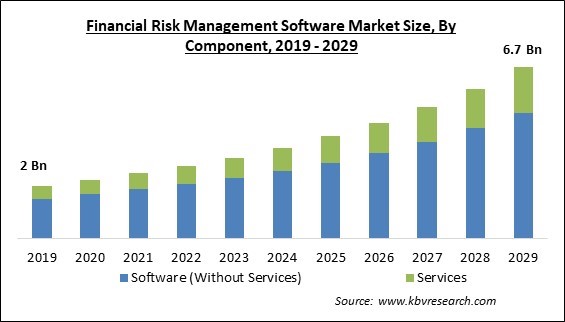

The Global Financial Risk Management Software Market size is expected to reach $6.7 billion by 2029, rising at a market growth of 13.4% CAGR during the forecast period.

The major end user of financial risk management software is insurance companies. Due to the restrictive circumstances, many banks now operate business online. Businesses are implementing risk management software to secure the online platform for their customer database. Thereby, contributing more than 25% revenue of the market share. Some of the factors impacting the market are the increasing complexity of financial instruments, Increased instability in the financial sector, and the difficulty of installing and configuring software.

Financial institutions are adopting sophisticated financial instruments, including derivatives and structured products, to mitigate risks and optimize returns. The increasing intricacy of financial instruments has resulted in a surge in need for financial risk management software as institutions strive to manage their risks and adhere to regulatory mandates effectively, thereby boosting market growth. In recent years, the volatility of the financial sector has heightened, resulting in a rise in the potential for financial losses for institutions. As a result, the current trends demand efficient credit risk software in the banking industry.

However, the market has difficulty due to software installation and configuration complexity. Installing and deploying new software solutions can be challenging and time-consuming in financial institutions because they frequently have complex IT infrastructures with several legacy systems. Thereby, a key factor limiting the market could be the complexity involved with software installation and configuration.

Based on component, the market is segmented into software (without services) and services. The software (without services) segment dominated the market with maximum revenue share in 2022. This is because such software addresses the challenges faced by businesses today, including heightened regulatory scrutiny, compliance with industry standards and regulations, the rapid expansion of financial data, the need for advanced fraud detection & prevention tools, and the growing threat of cyber-attacks.

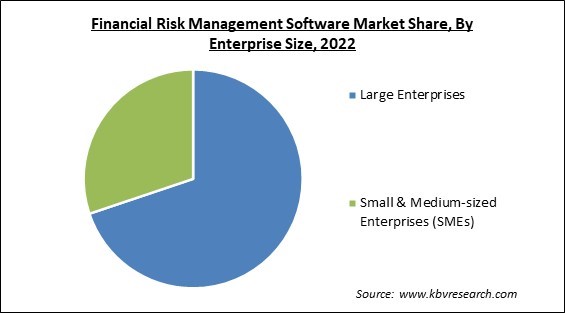

By enterprise size, the market is classified into large enterprises and small & medium-sized enterprises (SMEs). The large enterprises segment witnessed the largest revenue share in the market in 2022. This is because the prominence of financial risk management has grown, and numerous large corporations have initiated enterprise risk management programs that span their entire organization. In addition, numerous large corporations have enough budget to effectively implement these solutions to detect potential risks and implement appropriate measures to safeguard the organization.

On the basis of deployment mode, the market is divided into on-premise and cloud. The cloud segment procured a substantial revenue share in the market in 2022. This is due to the fact that cloud-based financial risk management software is a cutting-edge solution that is managed and operated remotely from a secure location. Cloud solutions are easily accessible through the internet from any location globally, as they are hosted on secure servers. In addition, cloud solutions offer cost-effective advantages over on-premise alternatives as they eliminate the need for hardware or software installation.

Based on the end-user, the market is bifurcated into banks, insurance companies, NBFCS and credit unions. The insurance companies segment recorded a significant revenue share in the market in 2022. This is due to the fact that insurance companies must comply with cybersecurity regulations at both the state and national levels, in addition to meeting the rigorous security standards set forth by their banking partners. Incorporating additional complexities, it should be noted that state-level security regulations may exhibit a high degree of similarity but may not be entirely uniform across all jurisdictions.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.8 Billion |

| Market size forecast in 2029 | USD 6.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 13.4% from 2023 to 2029 |

| Number of Pages | 248 |

| Number of Table | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Enterprise Size, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the market by generating the maximum revenue share in 2022. In North America, the market is being propelled by the surge in the adoption of cloud-based solutions, heightened recognition of risk management's significance, and the mounting need for comprehensive risk management solutions that enable enterprises to manage risks with greater effectiveness and efficiency. Moreover, businesses in North America are progressively implementing cloud-based risk management software solutions because of their scalability, cost-efficiency, and user-friendliness.

Free Valuable Insights: Global Financial Risk Management Software Market size to reach USD 6.7 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Oracle Corporation, SAP SE, SAS Institute, Inc., Experian PLC, Fiserv, Inc., Pegasystems Inc., CreditPoint Software, Optial UK Limited, Resolver Inc. (Kroll, LLC) and Lumivero, LLC.

By Component

By Deployment Mode

By Enterprise Size

By End User

By Geography

The Market size is projected to reach USD 6.7 billion by 2029.

Increased instability in the financial sector are driving the Market in coming years, however, The difficulty of installing and configuring software restraints the growth of the Market.

Oracle Corporation, SAP SE, SAS Institute, Inc., Experian PLC, Fiserv, Inc., Pegasystems Inc., CreditPoint Software, Optial UK Limited, Resolver Inc. (Kroll, LLC) and Lumivero, LLC.

The On-premise segment acquired maximum revenue share in the Market by Deployment Mode in 2022 thereby, achieving a market value of $4 billion by 2029.

The Banks segment is leading the Market by End User in 2022 thereby, achieving a market value of $3.1 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $2.3 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.