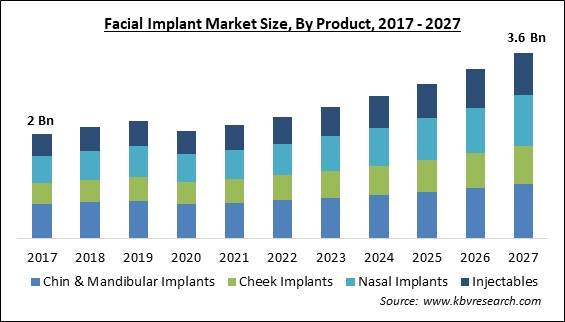

The Global Facial Implant Market size is expected to reach $3.6 billion by 2027, rising at a market growth of 8.6% CAGR during the forecast period.

A facial implant is defined as the medical procedure that is utilized to repair the facial structure or provide more defined facial traits such as the chin, cheekbones, and jawline. Increased virtual representation on social media is expected to fuel the demand for facial implants in the upcoming years. Moreover, the growing concern about personal appearance among the local population in both advanced and developing countries is likely to raise the number of cosmetic procedures.

As per the Association for Safe International Road Travel (ASIRT), 1.3 million people die in road accidents each year, with another 20-30 million becoming crippled or injured. Road traffic injuries are the eighth largest cause of death for individuals of all ages, according to the World Health Organization (WHO). Therefore, some of the major growth catalysts for the industry are the rising incidence of accidents, the growing incidences of acquired or congenital malformations of the face, and technical developments in plastic surgical treatments.

The number of facial implant procedures has increased dramatically during the previous several years all around the world. In addition, these cosmetic procedures are used to alter people's facial shapes or to give their faces more balance and stability. Moreover, they have evolved into necessary procedures for restoring the form and dimensions of the face following trauma or serious sickness.

People are increasingly opting for facial cosmetic treatments such as chin augmentation, paranasal procedures, cheekbone surgery, and forehead surgery to change their facial features, such as their chin, cheeks, lips, and jaws. Additionally, facial implants are put into the face during these surgeries. These facial implants provide individuals with long-lasting and permanent effects, as well as a considerable boost in confidence. According to the International Society of Aesthetic Plastic Surgery (ISAPS), roughly 3,913,679 cosmetic procedures on the face and head were performed worldwide in 2020.

The outbreak of the COVID-19 pandemic has created major disruptions in the medical device industry's supply chain. As a result of the outbreak, the number of procedures conducted each year has decreased, resulting in sluggish growth of the industry during the pandemic period. In addition, the coronavirus outbreak has had a detrimental influence on the market, with fewer surgeries performed in 2020 and 2021 as a result of global limitations. The COVID-19 pandemic caused a 15% drop in the total number of cosmetic treatments in 2020, according to the American Society for Aesthetic Plastic Surgeons.

In the near future, rising healthcare spending and awareness are projected to help the facial implant industry to expand further. In addition, different types of procedures and implants are utilized to improve the appearance of the face in the event of trauma or injury. Moreover, the growing number of sports-related facial injuries is expected to generate higher demand for cosmetic surgeries. Additionally, because the majority of young people consider facial injuries to be ugly, they are more likely to choose a facial implant. Face implants have also grown in popularity as a result of their use in high-fashion modeling. Many top models have benefited from chin implants, which have given them a more defined profile that is ideal for high-fashion photo sessions.

The use of social media by millennials is widespread around the world. On social networking and dating sites, people want to appear appealing. In addition, many people have been influenced by social media to have cosmetic surgery. Moreover, numerous single and divorced men and women have been opting for cosmetic surgery for the last couple of years. There is a desire among women to look beautiful, particularly among those who belong to elite circles, as well as their willingness to spend. Also, people are sometimes drawn to the luxurious lifestyles of celebrities and wish to emulate them. In many nations, such as Japan and China, women's desire for a star appearance is driving up the number of aesthetic surgeries.

Despite a robust and long-term increase in demand for aesthetic operations such as facial implants and botulinum toxin injections, there are concerns among people about the possible side effects. Pain, swelling at the injection site, infection, redness, bruising, and the formation of bumps and lumps are all possible side effects of these operations. In addition, if the facial implants are delivered into a blood vessel, major side effects like vision loss, blurred vision, scarring, and blindness have happened in certain rare cases. This is especially true in poor countries, where inexperienced surgeons or assistants may inadvertently inflict substantial harm to customers.

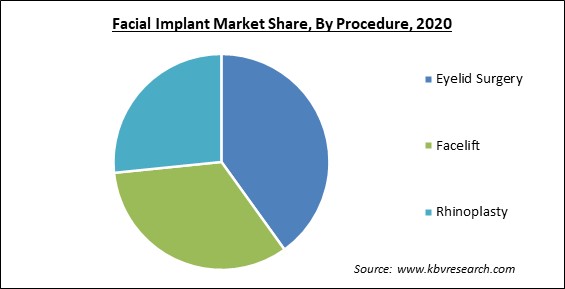

Based on Procedure, the market is segmented into Eyelid Surgery, Facelift, and Rhinoplasty. The Facelift segment procured a significant revenue share of the Facial Implant Market in 2020. This is because Facelift surgery is expected to rise in popularity in the next years as people become more conscious about their appearance, particularly among baby boomers. According to the American Society of Plastic Surgeons, 234,374 facelift treatments were conducted in the United States in 2020, and this number is likely to rise throughout the forecast year. According to the American Society of Plastic Surgeons (ASPS), nose reshaping, facelifts, and eyelid surgery were the most popular cosmetic procedures in the United States in 2020.

Based on Product, the market is segmented into Chin & Mandibular Implants, Cheek Implants, Nasal Implants, and Injectables. The Fillers & Injectables segment obtained a significant revenue share of the Facial Implant Market in 2020. This is because of the rising demand for cost-effectiveness, nonsurgical facial rejuvenation operations, and increased awareness about the use of fillers for augmentation surgery. In addition, Females were the most interested in facial injectables like hyaluronic acid and botulinum toxin. Factors such as increased usage of facial fillers for aesthetic operations like wrinkles on the face, lip lines, facial lines, and other procedures, are anticipated to fuel the growth of the segment during the forecasting period.

Based on Material, the market is segmented into Polymers, Metal, Biologicals, and Ceramic. In 2020, the Polymers segment collected the biggest revenue share of the Facial Implant Market. This is because of the rising use of deformity correction procedures. In addition, Polymeric materials are ideal for facial implants because of their high tensile strength. Other advantages associated with it, such as flexibility, stiff support, and biocompatibility, are also expected to drive the growth of the segment. Solid silicone implants, which are utilized for augmentation surgery, are the most commonly used implants.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 2.1 Billion |

| Market size forecast in 2027 | USD 3.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 8.6% from 2021 to 2027 |

| Number of Pages | 204 |

| Number of Tables | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Procedure, Product, Material, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The APAC is expected to showcase a rapid growth rate in the Facial Implant Market during the forecasting period. The Asia Pacific market is being driven by a number of major factors, including significant untapped opportunities, economic growth, increased patient awareness, and constantly expanding healthcare infrastructure. In addition, the growing economies of India and China are predicted to fuel industry expansion by growing medical tourism activities supported by cheap procedural costs.

Free Valuable Insights: Global Facial Implant Market size to reach USD 3.6 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Matrix Surgical USA, Eurosurgical Ltd., Implantech Associates, Inc., Hanson Medical Inc., Zimmer Biomet Holdings, Inc., Johnson & Johnson, Integra LifeSciences Holdings Corporation, Sientra, Inc., Stryker Corporation, and Medartis AG.

By Procedure

By Product

By Material

By Geography

The global facial implant market size is expected to reach $3.6 billion by 2027.

Rising consumer preference towards aesthetic appeal are on the rise are driving the market in coming years, however, growing concerns about the possible side-effects limited the growth of the market.

Matrix Surgical USA, Eurosurgical Ltd., Implantech Associates, Inc., Hanson Medical Inc., Zimmer Biomet Holdings, Inc., Johnson & Johnson, Integra LifeSciences Holdings Corporation, Sientra, Inc., Stryker Corporation, and Medartis AG.

Yes, COVID-19 pandemic caused a 15% drop in the total number of cosmetic treatments in 2020, according to the American Society for Aesthetic Plastic Surgeons.

The Chin & Mandibular Implants segment acquired the maximum revenue share in the Global Facial Implant Market by Product in 2020, thereby, achieving a market value of $1.0 billion by 2027.

The North America market dominated the Global Facial Implant Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.