The Europe White Spirits Market would witness market growth of 5.1% CAGR during the forecast period (2023-2030). In the year 2020, the Europe market's volume surged to 1329.0 Kilo Tonnes, showcasing a growth of 4.3% (2019-2022).

Within the market, certain grades of white spirits exhibit a high flash point, making them particularly suitable for applications requiring enhanced safety measures and reduced flammability risks. These high flash point grades are commonly utilized in industries such as paints and coatings, printing inks, and cleaning solvents, where stringent safety standards and regulations govern the handling and storage of flammable liquids. Therefore, the Netherlands used 36.67 Kilo Tones of high flash point white spirits in 2022.

The Germany market dominated the Europe White Spirits Market by Country in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $672.5 million by 2030. The UK market is exhibiting a CAGR of 4.6% during (2023 - 2030). Additionally, The France market would experience a CAGR of 5.5% during (2023 - 2030).

In Europe, the European Union has established directives and regulations to control VOC emissions across member states. The EU's VOC Solvents Emissions Directive (SED) sets limits on VOC emissions from industrial activities such as surface coating, printing, and dry cleaning. Member states are required to implement these regulations and monitor VOC emissions to ensure compliance.

Furthermore, the implementation of VOC regulations has prompted changes in consumer behavior and preferences. Consumers, particularly those in environmentally conscious markets, are increasingly choosing products that are labeled as low-VOC or eco-friendly. This shift in consumer preferences further drives the demand for white spirits with lower VOC content as manufacturers strive to meet market demands and differentiate their products.

The manufacturing sector in various European nations is expanding significantly, fueled by factors driving growth and innovation. Developed nations such as France and Italy, renowned for their premium goods and services, are witnessing expansion in their manufacturing industries due to the increasing domestic and global demand for these items. Thus, the expansion of the manufacturing sector in various European nations, coupled with the growth in the UK construction industry and the focus on sustainability, is expected to positively impact the demand for white spirits in the region.

Free Valuable Insights: The Global White Spirits Market will Hit USD 11 Billion by 2030, at a CAGR of 5.5%

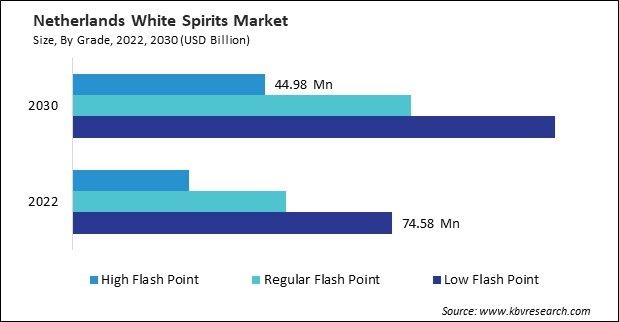

Based on Grade, the market is segmented into Low Flash Point, Regular Flash Point and High Flash Point. Based on Application, the market is segmented into Paint Thinner, Solvent Extraction, Cleaning Solvent, Degreasing Solvent and Others. Based on Product Type, the market is segmented into Type 1, Type 2, Type 3, and Type 0. Based on countries, the market is segmented into Germany, UK, France, Russia, Netherlands, Italy, and Rest of Europe.

By Grade (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Application (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Product Type (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Country (Volume, Kilo Tonnes, USD Billion, 2019-2030)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.