The Global Enterprise Search Market size is expected to reach $6.9 billion by 2028, rising at a market growth of 8.3% CAGR during the forecast period.

The process of making content from various enterprise-type sources, like intranets and databases, searchable for a specific audience is known as enterprise search. The term enterprise search is specifically used to describe the information-searching software utilized by businesses. Enterprise search can be compared with desktop search, using searching technology to access data on a single computer, and web search, which uses search technology to access documents on the public web.

In addition to filing systems, document management systems, intranets, e-mail, and databases, enterprise search systems also index documents and data from various sources. Unstructured and structured information are frequently combined in the collections of enterprise search engines. Access restrictions are another tool used by enterprise search systems to make their users adhere to a security policy.

An organization's vertical search can be viewed as an enterprise search. Though enterprise search and web search are similar in certain aspects, they function very differently and have different goals. Employees are allowed to use enterprise search tools. They gather data from all forms of data that a company keeps, like structured data (found in databases) and unstructured data (found in media and documents like PDFs).

Enterprise search is evolving into something new, according to IT industry analysts. For instance, Gartner introduced the Insight Engines category of enterprise search in 2017. By absorbing, organizing, and analyzing data, these technologies assist businesses in synthesizing information interactively or even proactively. This new category is known as Cognitive Search.

Slack, Google Meet, Microsoft Teams, and Zoom are a few collaboration tools that gained popularity with companies. Companies thus needed to store more digital interactions, including challenging file types like sizable video files from numerous virtual meetings. In addition, the need for appropriate search drove businesses to invest in technology that allows cognitive data and analytics capabilities. Therefore, demand for search solutions increased during the pandemic owing to the higher dependence on technology, which aided in the expansion of the enterprise search market.

These tools enable the search for correct results, which reduces the likelihood of making duplicate attempts. It is simpler to maintain the source of data and archive out-of-date data when all the information is in one place. Large intranets with separate areas for each department are common in many businesses. Search engines can assist in making sense of the data and returning more pertinent results. Getting a phone number or email address is made simpler. In addition to looking up contact by name, looking up internal specialists by job description or expertise can be helpful. Therefore, as more companies realize the benefits of enterprise search tools, it is expanding the market.

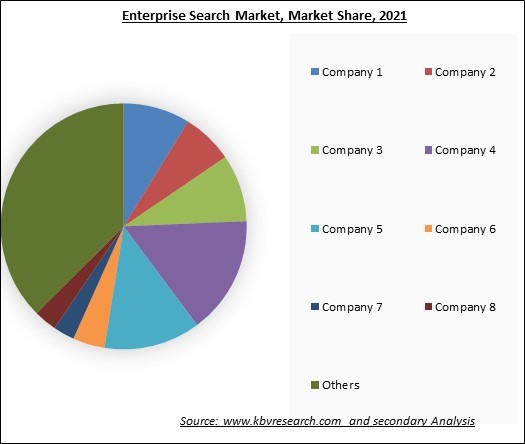

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Social media and business software remain the most accessed things. The IT infrastructure is getting more complex and can produce much data as more IoT connections, and diversified end-user devices are added. More storage space is required because the installation of such devices is developing and expanding quickly. Enterprise search solutions must therefore give companies the tools they need to quickly and securely search data, as well as to collect data from all devices and platforms. This is driving up demand for enterprise search tools and thus expediting the growth of the market.

The inability to search ambiguous keywords is still a major challenge for search solutions. Since most words have multiple meanings and are difficult to understand without context, this presents a significant difficulty. However, developments like offering linkages between websites so users may understand the intended meaning and web searches have solved this issue. Nevertheless, as linkages between papers on an intranet are few, this technique is ineffective for enterprise research. Moreover, the present enterprise search is both excessively slow and insufficiently accurate. Therefore, these inabilities of enterprise search systems are the major factor hampering the market's growth.

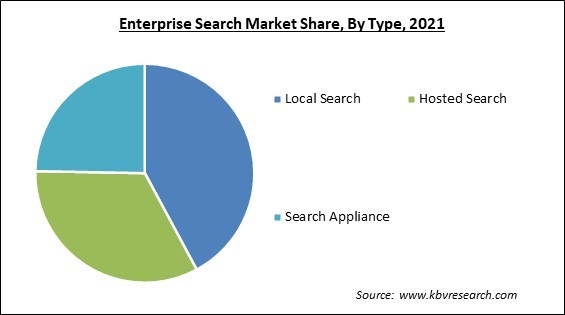

Based on type, the enterprise search market is categorized into local search, hosted search, and search appliance. The local search segment garnered the highest revenue share in the enterprise search market in 2021. Due to the extensive data hosting on regional business websites, the segment has more growth prospects. Since no third party can access any data, the issue of data security is alleviated by local data storage. Additionally, it is anticipated that the segment would be driven by the trend of data sorting by type and format.

On the basis of end-use, the enterprise search market is divided into government & commercial offices, BFSI, healthcare, retail & e-commerce, media, manufacturing, and others. The healthcare segment witnessed a promising growth rate in the enterprise search market in 2021. The growing need for enterprise search systems in this industry to efficiently utilize the massive volumes of unstructured data might be credited with the market share. The examination of clinical trial data and the entire development process are made possible by enterprise search tools. The category expansion in the upcoming years will be aided by the ongoing rise in data volume, which calls for sophisticated search tools.

Based on Organization size, the enterprise search market is segmented into large size enterprises and small & medium sized enterprises. The small and medium sized enterprises segment procured a remarkable growth rate in the enterprise search market in 2021. The segment's expansion is aided by the rising number of small businesses worldwide. More small enterprises are utilizing enterprise search solutions as they ease the process of gathering data, which otherwise tends to be more expensive. Furthermore, due to their accessibility and usefulness for business processes, enterprise search solutions are anticipated to be in high demand among small businesses as a result of technology advancements.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4 Billion |

| Market size forecast in 2028 | USD 6.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.3% from 2022 to 2028 |

| Number of Pages | 248 |

| Number of Table | 383 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Organization Size, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the enterprise search market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region acquired the highest revenue share in the enterprise search market in 2021. This can be ascribed to the region's strong involvement of several important industry players and the technological advancements they helped to start. In addition, the fusion of enterprise search solutions with security solutions as well as information technologies will further fuel regional market expansion. Also, the regional companies are facilitating quick technological development and acceptance of the solution.

Free Valuable Insights: Global Enterprise Search Market size to reach USD 6.9 Billion by 2028

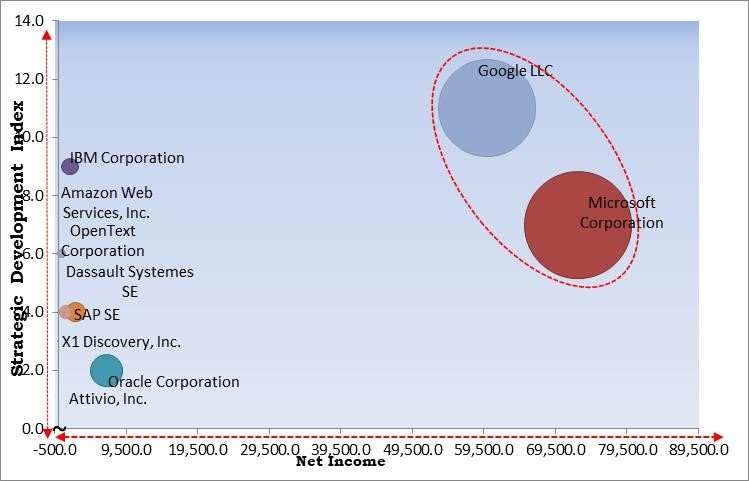

The major strategies followed by the market participants are partnerships. Based on the Analysis presented in the Cardinal matrix; Google LLC and Microsoft Corporation are the forerunners in the Enterprise Search Market. Companies such as SAP SE, IBM Corporation and Oracle Corporation are some of the key innovators in Enterprise Search Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, IBM Corporation, Google LLC (Alphabet, Inc.), Amazon Web Services, Inc. (Amazon.com, Inc.), OpenText Corporation, Oracle Corporation, X1 Discovery, Inc., Attivio, Inc., SAP SE, and Dassault Systemes SE.

By Type

By Organization Size

By End-use

By Geography

The global Enterprise Search Market size is expected to reach $6.9 billion by 2028.

Growing rate of production of data every year are driving the market in coming years, however, Lack of understanding of ambiguous search keywords restraints the growth of the market.

Microsoft Corporation, IBM Corporation, Google LLC (Alphabet, Inc.), Amazon Web Services, Inc. (Amazon.com, Inc.), OpenText Corporation, Oracle Corporation, X1 Discovery, Inc., Attivio, Inc., SAP SE, and Dassault Systemes SE.

The Large Size Organizations segment is leading the Global Enterprise Search Market by Organization Size in 2021 thereby, achieving a market value of $4.8 billion by 2028.

The North America market dominated the Global Enterprise Search Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.4 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.