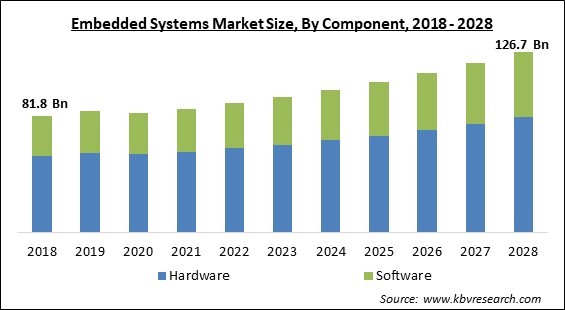

The Global Embedded Systems Market size is expected to reach $126.7 billion by 2028, rising at a market growth of 5.7% CAGR during the forecast period.

A combination of hardware and software makes up an embedded system, which includes processors, input-output devices, controllers, external peripheral devices, timers, and a host of other components created to process and regulate the system's unique mission. It is included in the wider electrical or mechanical system and aids in the facilitation of the specific function.

By providing real-time system limitations, it firmly controls the system's physical operation. Field-programmable gate arrays (FPGA), gate arrays, GPU technology, application-specific integrated circuits (ASIC), and microcontrollers or digital signal processors (DSP) are used to control embedded devices. These processing systems also include components for dealing with electrical and/or mechanical interfaces.

Embedded systems' primary characteristic is that they are task-specific. Within a bigger system, they finish a single duty. For instance, a cell phone is not an embedded system because it combines several embedded systems to execute a variety of general-purpose functions. Hardware for embedded systems is often based on microprocessors or microcontrollers.

In comparison to the typical enterprise desktop computer, an industrial microcontroller is less sophisticated and typically relies on a less complex, memory-intensive programming environment. The system is highly appropriate for a wide range of applications, including those involving electrical gadgets, home appliances, wearable technology, medical monitoring equipment, and others.

Due to a major impact on key companies in the supply chain, the COVID-19 pandemic has had a considerable negative influence on the growth of the worldwide embedded systems market. However, one of the key factors that drove the market expansion during the COVID-19 pandemic was the increase in ADAS in EV and hybrid vehicles, as well as the rise in the number of embedded systems-related R&D initiatives globally. Contrarily, the COVID-19 pandemic primarily caused various challenges for the market, including a shortage of skilled labor and project delays or cancellations as a result of a partial or total lockdown around the world. Additionally, the development of embedded devices based on 5G is anticipated to continue to expand for a considerable amount of time.

Embedded technology is a key factor in the restructuring of the automotive industry. The ADAS technology used in hybrid and electric cars makes use of these systems. Because of the increase in demand for electric and hybrid automobiles brought on by increased public awareness of the state of the environment, the market for embedded systems has grown. The market for embedded systems is expanding significantly as a result of this aspect.

The predicted period will likely see an increase in demand for products like smart power meters, which will likely drive the global market. This is because the precise and required functionality of these devices is ensured by embedded systems. The smart meter tracks energy usage, uploads the information to a cloud server, and can be utilized to operate appliances remotely via a control relay. The smart meter functions as a sensing node in a mesh network using Internet of Things (IoT) technology.

The IoT microcontroller industry is tremendously rising due to a variety of factors and an increasing number of applications. However, there are certain barriers that are hindering the demand for IoT microcontrollers. One of the major drawbacks of IoT controllers is the complications in the design and development of these devices. Design complexity in high-speed as well as power-critical applications can majorly impede the production of IoT microcontrollers. As a result, manufacturers are spending significant amounts in R&D to develop cutting-edge microcontrollers.

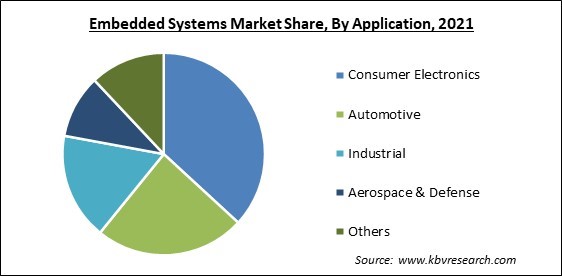

Based on application, the market for embedded systems is classified into automotive, consumer electronics, industrial, aerospace & defense, and others. In the projection term, the industrial segment is showing a strong growth rate. Infrastructure, energy, and process control are examples of industrial uses. Smart metering systems are anticipated to have an impact on the global market for industrial applications, as well as data gathering and feedback control systems for automation.

Based on components, the Embedded Systems Market is classified into Hardware and Software. The software industry is representing the market in 2021. The fundamental building components of embedded systems are software components. For device drivers, operating systems, error handling, application software, and debugging software, embedded software (also known as firmware) is produced.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 87 Billion |

| Market size forecast in 2028 | USD 126.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.7% from 2022 to 2028 |

| Number of Pages | 240 |

| Number of Tables | 383 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on geography, the Embedded Systems Market is categorized into North America, Europe, Asia Pacific, and LAMEA. In 2021, Asia Pacific generated the highest revenue share in the market. The Asia Pacific market is expanding as a result of factors like rising per capita income, ongoing widespread industrialization, and urbanization. Additionally, it is projected that the availability of inexpensive electronic products in APAC would contribute to a rise in the adoption of microprocessors and microcontrollers in the area.

Free Valuable Insights: Global Embedded Systems Market size to reach USD 126.7 Billion by 2028

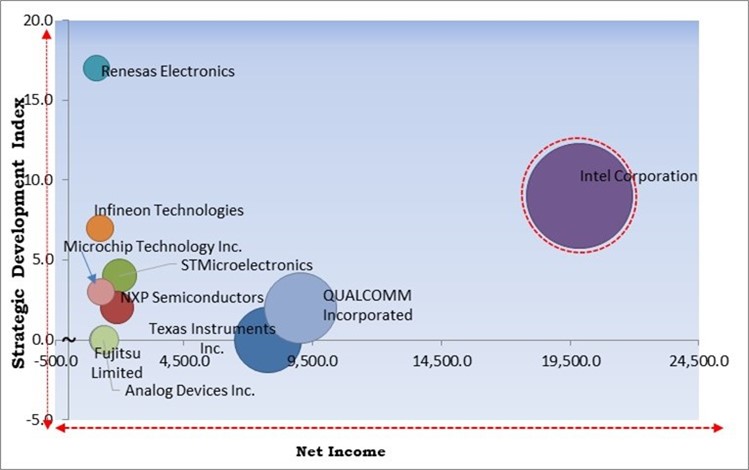

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Intel Corporation is the forerunner in the Embedded Systems Market. Companies such as QUALCOMM Incorporated, Texas Instruments, Inc. and Renesas Electronics Corporation are some of the key innovators in Embedded Systems Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Intel Corporation, Renesas Electronics Corporation, Texas Instruments, Inc., NXP Semiconductors N.V., QUALCOMM Incorporated (Qualcomm Technologies, Inc.), Fujitsu Limited, Infineon Technologies AG, Analog Devices, Inc., Microchip Technology, Inc., and STMicroelectronics N.V.

By Application

By Component

By Geography

The global Embedded Systems Market size is expected to reach $126.7 billion by 2028.

Power electronics are being used more frequently in the market for electric vehicles are driving the market in coming years, however, Complexities In Designing Cutting-Edge Iot Microcontrollers restraints the growth of the market.

Intel Corporation, Renesas Electronics Corporation, Texas Instruments, Inc., NXP Semiconductors N.V., QUALCOMM Incorporated (Qualcomm Technologies, Inc.), Fujitsu Limited, Infineon Technologies AG, Analog Devices, Inc., Microchip Technology, Inc., and STMicroelectronics N.V.

The expected CAGR of the Embedded Systems Market is 5.7% from 2022 to 2028.

The Hardware segment acquired maximum revenue share in the Global Embedded Systems Market by Component in 2021 thereby, achieving a market value of $80.1 billion by 2028.

The Asia Pacific market dominated the Global Embedded Systems Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $47.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.