The Embedded Multimedia Card (eMMC) Market size is expected to reach $11.8 billion by 2027, rising at a market growth of 3.5% CAGR during the forecast period. An embedded multimedia card (eMMC) is an advanced embedded and non-volatile memory system. It comprises both a flash memory controller and flash memory. It streamlines the application interface design and releases the host processor from low-level flash memory management.

Embedded multimedia card (eMMC) is promptly being adopted for various embedded applications like robotics, single board computers (SBC), medical devices, networking and building control devices, and automotive. It is due to its compact size, low power consumption, and various improved features. In the world of digitalization, there is rapid penetration of the internet of things (IoT), thus it is expected that the eMMC is also finding its way for many new applications.

The small footprint of eMMC, even smaller than a conventional postage stamp makes it ideal for many electronic gadgets. It is used in smartphones, smart TVs, small laptops, wearable technology, and smart home appliances. As storage is soldered directly onto the device’s motherboard so, the word “embedded” is added to its name. This is the reason why it is neither removable nor displaced from its place. eMMC storage comprises NAND flash, a technology that finds high applications in SD cards, USB drives, and solid-state drives but it is packaged differently.

Apart from its application in consumer products, eMMC is rapidly used in many other embedded applications like medical devices, automotive, Single Board Computers (SBC), robotics, networking, and building control devices. There are many advantageous features in eMMC such as its compact size, low power consumption, and enhanced features. The eMMC is finding its way to other applications with the massive growth of the IoT market.

The outbreak of the COVID-19 pandemic has a significant impact on the size of the global embedded multimedia card (eMMC) market. The COVID-19 pandemic has negatively impacted the manufacturing industry and thus, affected the global economy. Most of the electronic components and semiconductor devices are imported from China. With the short-term shutdown of manufacturing units, the expenses of semiconductor components have amplified by 2-3%, due to a shortage of supplies. Furthermore, reductions in numerous capital budgets and delays in planned projects in several end-use industries have hampered the global market of embedded multimedia cards (eMMC).

Based on Density, the market is segmented into 32GB-64GB, 128GB-256GB, 8GB-16GB and 2GB-4GB. The 32GB-64GB market dominated the Global Embedded Multimedia Card (eMMC) Market by Density 2020. The 128GB-256GB market is experiencing a CAGR of 3.7% during (2021 - 2027). Additionally, The 8GB-16GB market is showcasing prominent growth during the forecast period.

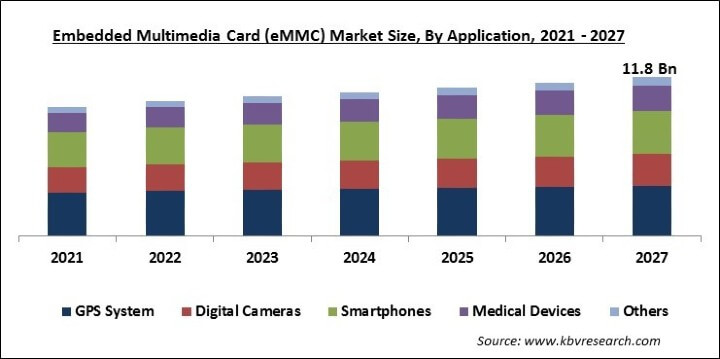

Based on Application, the market is segmented into GPS System, Digital Cameras, Medical Devices, Smartphones and Others. GPS System segment procured the largest revenue share of the market in 2020. It is attributed to the increasing use of location-based services & mobile applications. As there is an increasing number of smartphone users, thus the demand for automobile GPS software is also increasing. These are the major factors that are driving the demand for embedded multimedia cards (eMMC) in the GPS market.

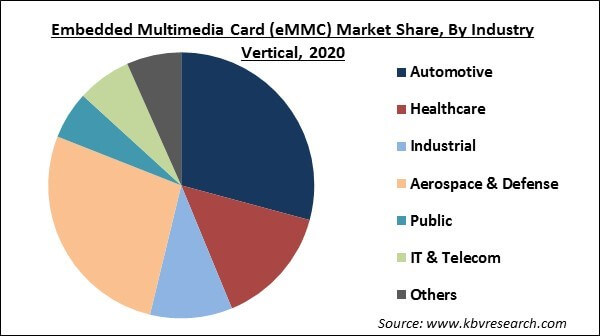

Based on Industry Vertical, the market is segmented into Automotive, Aerospace & Defense, Industrial, Healthcare, Public, IT & Telecom, and Others. The automotive segment garnered a significant revenue share in the market for the embedded multimedia cards (eMMC) in 2020. It would show the highest growth rate during the forecast period. The growing adoption of embedded multimedia cards (eMMCs) in the automotive industry and the surge in demand for the embedded multimedia cards (eMMC) in electronic devices are the major factors leading to the growth of this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 8.9 Billion |

| Market size forecast in 2027 | USD 11.8 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 3.5% from 2021 to 2027 |

| Number of Pages | 264 |

| Number of Tables | 420 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Density, Application, Industry Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia-Pacific obtained the highest revenue share in 2020. It is likely to grow at a considerable pace during the forecast period. Factors like the increasing adoption of digital cameras, and the rising consumer electronics industry are directly contributing factors for the market growth in Asia-Pacific. In the Asia-Pacific region, there is increasing use of smartphone penetration and the popularity of smart wearable devices is also high.

Free Valuable Insights: Global Embedded Multimedia Card (eMMC) Market size to reach USD 11.8 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Samsung Electronics Co., Ltd. (Samsung Group), Toshiba Corporation, Western Digital Corporation, Kingston Technology Company, Inc., Greenliant Systems, Inc., Micron Technology, Inc., Phison Electronics Corporation, Silicon Motion Technology Corporation, SK Hynix, Inc., and Transcend Information, Inc.

By Density

By Application

By Industry Vertical

By Geography

The global Embedded Multimedia Card (eMMC) market size is expected to reach $11.8 billion by 2027.

Increasing use of smartphone and the need for ultra-fast memory are driving the market in coming years, however, The development of new and advanced storage devices have limited the growth of the market.

Samsung Electronics Co., Ltd. (Samsung Group), Toshiba Corporation, Western Digital Corporation, Kingston Technology Company, Inc., Greenliant Systems, Inc., Micron Technology, Inc., Phison Electronics Corporation, Silicon Motion Technology Corporation, SK Hynix, Inc., and Transcend Information, Inc.

Yes, The COVID-19 pandemic has negatively impacted the manufacturing industry and thus, affected the global economy. Most of the electronic components and semiconductor devices are imported from China. With the short-term shutdown of manufacturing units, the expenses of semiconductor components have amplified by 2-3%, due to a shortage of supplies.

The 32GB–64GB market dominated the Global Embedded Multimedia Card (eMMC) Market by Density 2020, thereby, achieving a market value of $5,337.1 million by 2027.

The Asia Pacific market dominated the Global Embedded Multimedia Card (eMMC) Market by Region 2020, growing at a CAGR of 3.5 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.