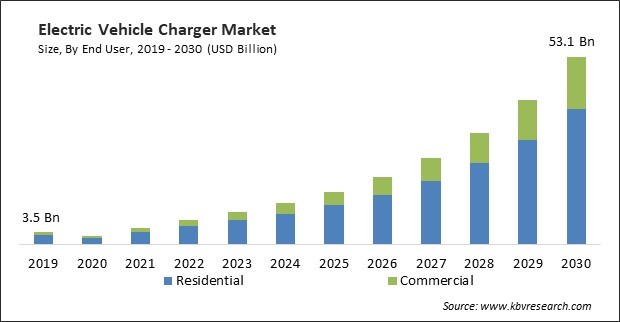

The Global Electric Vehicle Charger Market size is expected to reach $53.1 billion by 2030, rising at a market growth of 28.6% CAGR during the forecast period.

Many European automakers are working on initiatives to provide home charging solutions to EV buyers. These automaker-branded chargers are designed to be compatible with their vehicles. Thus, the European region registered $2,011.7 million revenue in the market in 2022. Efforts are underway to facilitate cross-border charging interoperability, which makes it easy for EV owners to travel between European countries without worrying about compatibility issues. European EV charger manufacturers continuously innovate to provide higher-power chargers, significantly reducing charging times. Fast-charging options are especially crucial for long trips. All these factors will give momentum to the segment’s expansion in the future.

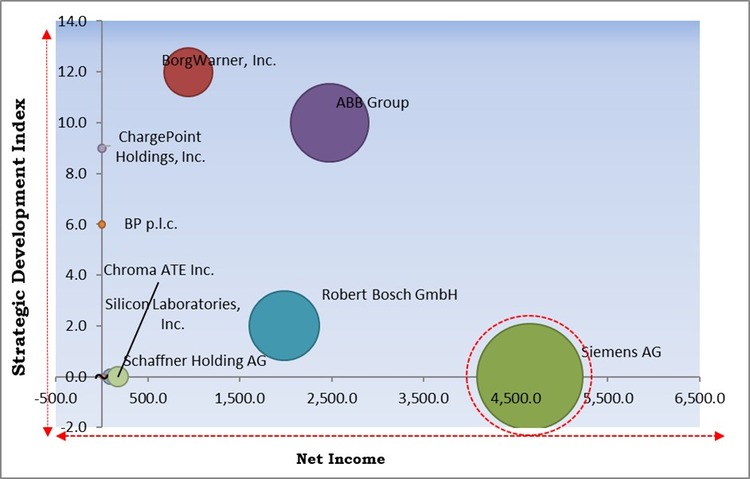

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy in order to keep pace with the changing demands of end users. For instance, In June, 2023, BorgWarner, Inc. came into an agreement to acquire the Electric Hybrid Systems (EHS) business segment of Eldor Corporation. Through this acquisition, the products included in the EHS segment of Eldor were added into BorgWarner’s product portfolio and supplemented its capabilities in the engineering of compact and efficient 400V and 800V on-board chargers. Additionally, In May, 2022, ABB Group acquired the E-mobility division of Numocity. Through this acquisition, ABB Group strengthened its position across India.

Based on the Analysis presented in the KBV Cardinal matrix, Siemens AG is the forerunner in the Market. Companies such as ABB Group, BorgWarner, Inc., Robert Bosch GmbH are some of the key innovators in the Market. In March, 2023, Robert Bosch GmbH teamed up with University of Cambridge. Through this collaboration, several innovative component designs based on silicon carbide were enhanced and new material systems like the ultra-wide bandgap semiconductor gallium oxide were explored. Additionally, designs and simulation models were invented to upgrade the performance of related components.

As more people purchase electric vehicles, the market naturally expands. The demand for home chargers, in particular, rises significantly as EV owners seek convenient and reliable options for charging their vehicles. This increased market size provides a robust and growing customer base for charger manufacturers. A thriving market encourages innovation and competition among charger manufacturers. Since they can be charged overnight at home, EV owners aren't concerned as much about the availability of public charging infrastructure. Increasing EV usage favors the environment, encouraging more people to consider driving an electric car. Consumers are more willing to invest in EVs and home chargers because they are contributing to reducing greenhouse gas emissions. These factors are expected to drive the expansion of the market in the coming years.

The demand for residential chargers results in increased sales and installation services. Charger manufacturers and installation professionals’ benefit from a growing demand for residential chargers, leading to greater revenue opportunities and job creation within the charger installation sector. Residential chargers have the potential to generate consistent, long-term revenue for charger manufacturers. Once installed, these chargers typically remain used for many years, contributing to a steady revenue stream as more households adopt electric vehicles. Residential chargers can integrate with smart home energy management systems, enabling homeowners to optimize their energy use. This integration can lead to cost savings and greater interest in residential chargers as part of a comprehensive home energy strategy. These factors will boost the demand for electric vehicle chargers in the upcoming years.

Chargers that support fewer common standards may become stranded or underutilized if the corresponding EV models are not widely adopted. This can result in a suboptimal utilization rate for some chargers, making them less financially viable for operators. The lack of standardization can deter investment in charging infrastructure by charger operators and network providers. They may wait for a dominant standard before committing significant resources to expansion efforts. Charger operators who offer multiple standards must invest in maintaining and upgrading various chargers. This complexity can increase operational costs and reduce profitability. As a result, these factors will hinder the expansion of the market in the coming years.

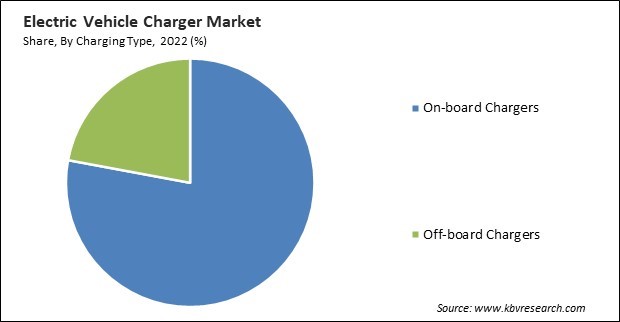

Based on charging type, the market is segmented into on-board chargers and off-board chargers. The on-board chargers segment held the largest revenue share in the market in 2022. On-board chargers are designed to cater to various types of electric vehicles, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). This diversity in vehicle types has led to various charger configurations and specifications. Advancements in battery technology have resulted in EVs with larger battery capacities and longer driving ranges. To accommodate these higher-capacity batteries, on-board chargers with greater power output are required, further boosting market demand. All these factors will increase the demand in the segment.

Based on vehicle type, the market is segmented into battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV). The battery electric vehicle (BEV) segment garnered a significant revenue share in the market in 2022. One of the primary drivers of BEV chargers’ growth is the increasing adoption of battery-electric vehicles. As BEVs become more affordable, with longer ranges and improved performance, consumers are choosing them as their preferred mode of electric transportation. Growing environmental awareness and stricter emissions regulations push automakers to invest heavily in BEVs.

On the basis of end user, the market is divided into residential and commercial. The residential segment recorded the maximum revenue share in the market in 2022. Advances in charger technology have led to faster home charging solutions. Level 2 chargers, which offer faster charging speeds than standard Level 1 chargers, have become increasingly popular for residential use. Many residential EV chargers now have smart features, allowing homeowners to monitor and control their charging sessions remotely through mobile apps. These chargers can also be integrated with home energy management systems. Therefore, the residential segment will witness increased growth in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6.9 Billion |

| Market size forecast in 2030 | USD 53.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 28.6% from 2023 to 2030 |

| Number of Pages | 253 |

| Number of Table | 333 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Vehicle Type, Charging Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Norway, Netherlands, China, Japan, India, South Korea, Taiwan, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the market is divided into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific segment witnessed the highest revenue share in the market. The Asia-Pacific region has witnessed rapid economic growth over the past few decades, resulting in a growing middle-class population. This expanding middle class has higher disposable income, leading to increased consumer spending on products like cameras, smartphones, and eyewear, all of which rely on optical lenses. The demand for eyewear, including prescription glasses and contact lenses, has been rising in Asia-Pacific due to increased awareness about eye health and vision correction. This has led to higher sales of optical lenses for eyewear. Therefore, the segment will witness increased demand in the coming years.

Free Valuable Insights: Global Electric Vehicle Charger Market size to reach USD 53.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Robert Bosch GmbH, AeroVironment, Inc, BorgWarner Inc, Silicon Laboratories, Inc., BP p.l.c., ChargePoint, Inc, Schaffner Holding AG, Siemens AG, and Chroma ATE Inc.

By End User

By Vehicle Type

By Charging Type

By Geography

This Market size is expected to reach $53.1 billion by 2030.

Rising adoption of electric vehicles worldwide are driving the Market in coming years, however, Rising confusion due to lack of charging standardization restraints the growth of the Market.

ABB Group, Robert Bosch GmbH, AeroVironment, Inc, BorgWarner Inc, Silicon Laboratories, Inc., BP p.l.c., ChargePoint, Inc, Schaffner Holding AG, Siemens AG, and Chroma ATE Inc.

The expected CAGR of this Market is 28.6% from 2023 to 2030.

The Plug-in Hybrid Electric Vehicle (PHEV) segment is leading the Market by Vehicle Type in 2022, thereby achieving a market value of $18.2 Billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $22.2 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.