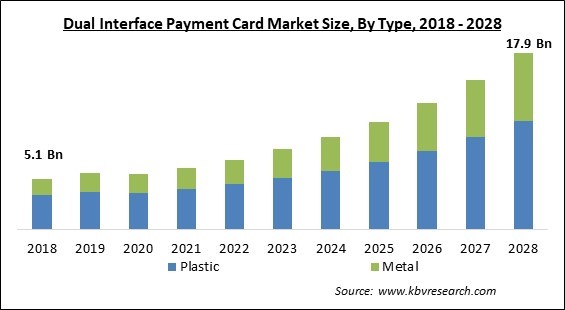

The Global Dual Interface Payment Card Market size is expected to reach $17.9 billion by 2028, rising at a market growth of 16.8% CAGR during the forecast period.

A contactless payment card with both NFC and a magnetic stripe is known as a dual interface payment card. This enables the user to utilize their smartphone, watch, tablet, or other connected device to swipe or tap at point-of-sale terminals and to perform in-app payments. For example, in 2009, Mastercard launched its PayPass/PayWave product line, which features two kinds of product lines: contactless (RFID) for usages with mobile devices as well as conventional magstripe for usages at POS terminals without wireless communication capacity.

This was the first time a payment card had two interfaces. Due to its ability to offer smooth connectivity across older technology platforms like smartphones and legacy systems, dual interface cards have indeed been widely utilized throughout sectors. Microcontroller chips as well as memory chips are the other two types of chips included in these cards. A memory chip is comparable to a tiny floppy disc with added protection.

Despite being less affordable than microcontrollers, memory chips have less security for data handling. Memory chip cards rely on the card reader's safety for processing which are the best option for circumstances requiring low or medium security. A microcontroller chip has the ability to modify its memory via adding, deleting, and other means. A microcontroller resembles a tiny computer since it has an operating system, hard drive, and input/output interface.

Smart cards with integrated microcontrollers have the special capacity to store a lot of data, perform on-card tasks (such as encryption and digital signatures), and communicate with smart card readers in a thoughtful way. A contactless transaction is one in which the point-of-sale (POS) terminal and the customer's payment device do not make direct physical touch. In close proximity to a terminal, the customer is holding a payment device (like a contactless or dual-interface chip card or mobile device), and payment account information is sent instantly through radio frequency (RF).

The commercial introduction of the Dual Interface Payment Card Market industry may also be significantly delayed as a result of the economic crisis that followed the pandemic. The base of technology providers, small and medium-sized businesses, have seen a sharp decline in revenue that since pandemic's debut in 2020. As a result of the supply chain disruptions, market participants faced several difficulties. But, as more supplies come back online in the second half of 2022, things should get better. Over the course of the projection period, the COVID-19 pandemic significantly influenced the growth of the dual interface payment card market.

The number of scams is rising daily, and this is happening at the same time that bank customers are getting older. Payment cards with a dual-interface based on biometrics are becoming more popular as a solution to this issue. Banks are now implementing cutting-edge technologies to address security issues with important data. In order to make it more challenging for fraudsters to access bank accounts, banks are also utilizing fingerprint or iris monitoring as an authentication measure for current passwords. Customers can instantly access their bank details with these new cards.

The market for dual interface payment cards is growing faster due to increased card life. Better cards with decreased magnetic stripe performance are now being offered by service providers, helping to shield them against data loss. Among some of the best instances of these cards' innovation are contactless smart cards with Wi-Fi module transactions permitted. Customers tend to use their cards for a lengthier period of time because the cards get a longer lifespan before they expire.

In the event that a contactless card is lost or stolen, there is concern about unauthorized purchases because the transaction does not require a PIN to be authorized. It is often a smart option to inform the issuing bank about this situation. Several banks offer a 100% fraud guarantee, absolving customers of all liability as long as they utilize it responsibly. Devices for mobile contactless payments might not function abroad. Certain mobile wallets utilized for contactless payments are not accepted abroad, although similar technology. A separate overseas transaction fee can also apply.

On the basis of type, the dual interface payment card market is bifurcated into Plastic and Metal. The plastic segment procured the highest revenue share in the dual interface payment card market in 2021. The industry's continuing technical development in both developed and developing economies around the world is what is causing the segment to grow. To diversify their product options, a number of vendors have begun to provide environmentally friendly plastic cards produced from recycled plastic.

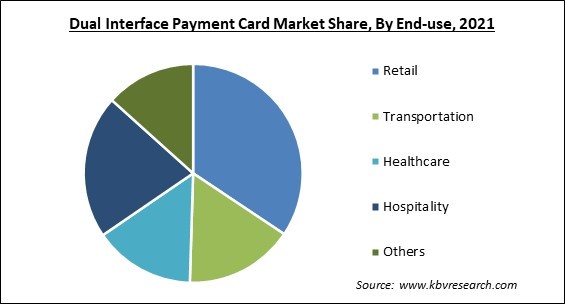

Based on end-use, the dual interface payment card market is segmented into Retail, Transportation, Healthcare, Hospitality and Others. The transportation segment registered a substantial revenue share in the dual interface payment card market in 2021. The segment expansion is predicted to be fueled by the growing preference for a contactless transportation payment solution in smart cities. Additionally, due to reasons like availability and convenience, contactless payment transactions have increased in comparison to cash payments throughout the transportation sector.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 6.2 Billion |

| Market size forecast in 2028 | USD 17.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 16.8% from 2022 to 2028 |

| Number of Pages | 151 |

| Number of Tables | 269 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the dual interface payment card market is analyzed across North America, Europe, Asia Pacific and LAMEA. North America emerged as the leading region in the dual interface payment card market with the largest revenue share in 2021. This supremacy is due to the presence of numerous notable players, including MasterCard and American Express. Additionally, market participants in North America are working to introduce dual-interface cards that will let customers use both credit & debit cards with contactless technology.

Free Valuable Insights: Global Dual Interface Payment Card Market size to reach USD 17.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thales Group S.A., IDEMIA SAS (Advent International, Inc.), CPI Card Group (Parallel49 Equity), Giesecke & Devrient GmbH, Watchdata Co., Ltd., Eastcompeace Technology Co., Ltd. (Potevio Group), Paragon Group Limited, Valid S.A., and Wuhan Tianyu Information Industry Co., Ltd.

By Type

By End Use

By Geography

The Dual Interface Payment Card Market size is projected to reach USD 17.9 billion by 2028.

Rising Demand For Biometric-Based Dual Interface Payment Card Among Banks are driving the market in coming years, however, Rise In The Security Concerns Among Individuals restraints the growth of the market.

Thales Group S.A., IDEMIA SAS (Advent International, Inc.), CPI Card Group (Parallel49 Equity), Giesecke & Devrient GmbH, Watchdata Co., Ltd., Eastcompeace Technology Co., Ltd. (Potevio Group), Paragon Group Limited, Valid S.A., and Wuhan Tianyu Information Industry Co., Ltd.

The expected CAGR of the Dual Interface Payment Card Market is 16.8% from 2022 to 2028.

The Retail segment acquired maximum revenue share in the Global Dual Interface Payment Card Market by End-use in 2021 thereby, achieving a market value of $5.6 billion by 2028.

The North America market dominated the Global Dual Interface Payment Card Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.