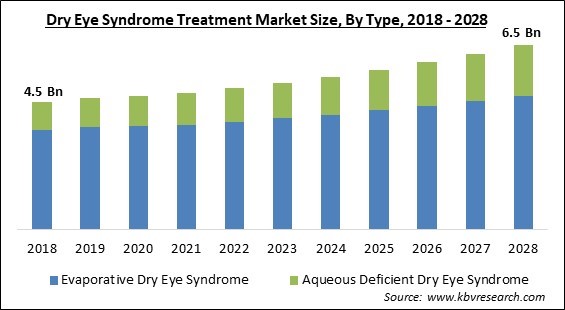

The Global Dry Eye Syndrome Treatment Market size is expected to reach $6.5 billion by 2028, rising at a market growth of 4.5% CAGR during the forecast period.

A dry eye is the absence of sufficient, high-quality tears to moisturize and feed the eye. Tears are essential for preserving the condition of the cornea and for maintaining vision clarity. Dry eye is a prevalent and frequently persistent condition, especially in elderly persons. Tears cover the cornea, which is the front layer of the eye, with every blink of the eyelids. Tears lubricate the eye surface, reduce the likelihood of eye infection, wipe away foreign objects from the eye, and maintain a clear, smooth surface. Extra tears from the eyes drain into tiny ducts inside the eyelids' inner corners and exit out from the back of the nose. When tear generation and drainage are out of balance, dry eyes can result.

For clear eyesight, the tear film is crucial. Three layers comprise the tear film: an oily layer, a watery layer, and a mucus layer with each layer having a specific function. The exterior of the tear film is the oily layer. It smoothens the tear's surface and slows down the rate of drying. The meibomian glands in the eye produce this layer. The center of the tear film is the watery layer. The majority of what is perceived as tears is made up of them. By removing foreign objects from the eye, this layer cleanses the eye. The lacrimal glands present in eyelids produce this layer.

The innermost layer of the film is called the mucus layer. This aids in distributing the watery layer and maintaining the eye's moisture. Tears would not adhere to the eye without mucus, which is produced by the conjunctiva. This is the transparent tissue that lines the interior of the eyelids and the surface of the eye. Normal tear production keeps eyes moist all the time. The eyes produce a lot of tears when they are inflamed or when someone cries.

Due to fewer ophthalmologist appointments, the COVID-19 pandemic had a negative effect on the dry eye syndrome treatment market in the initial stages of the pandemic. But as immediately as the eye care businesses started, the market started to recover. Additionally, the prevalence of dry eye complaints has grown throughout the pandemic due to increased screen use and sedentary lifestyles. The extrapolation of the results of these cases makes it evident that COVID-19 has a positive impact on the market.

In various age categories, the estimated concentration ranges from roughly 5% to over 35%. Dry eye (DE) is usually overlooked despite being very common. Dry Eye is a significant burden on the public healthcare system because of its detrimental effects on patients' visual function and life quality. Therefore, efforts to improve diagnostic procedures and develop suitable DE treatments are merited. Reproxalap (Alderya Therapeutics), tivanisiran (Sylentis), tanfanercept (HanAll BioPharma), timbetasin (Regenerx), loteprednol etabonate (Kala Pharma), and NOV03 (Bausch + Lomb) are few of the medications that were recently investigated in Phase 3 trials for the treatment of dry eyes. As these development continue to proceed, they aid in the expansion of the dry eye syndrome treatment market.

Burning, Itching, irritation, eye tiredness, and ocular inflammation are among the prominent symptoms of DED, which can vary from mild to serious and can potentially cause impairment to the cornea, conjunctiva, and even loss of eyesight. As a result, the treatment must be customized to each patient by focusing on the distinct mechanisms linked to their condition, depending on the various presentations and pathophysiology. The tailoring of the medical procedure allows patients to think about the pros and cons before going for treatment. This provides satisfaction and additional comfort to patients which tremendously helps in the success of treatment. This, in turn, will bolster the growth of the dry eye syndrome treatment market.

Drug approval entails several expensive regulatory approvals and research phases. About four steps of clinical trials are involved in the drug approval process, as well as different stages of screening by regulatory agencies like the FDA. Because clinical trial phases need significant investments, the costs of unsuccessful trials are also large. For instance, a Forbes article estimates that a drug manufacturer spends roughly $350 million on each treatment before it is introduced to the market. This demonstrates significant drug approval costs that are expected to have an impact on the market for dry eye medications. Additionally, long waiting times also add up to lost money for these manufacturers, and as such hampers the growth of the dry eye syndrome treatment market.

Based on type, the dry eye syndrome treatment market is bifurcated into evaporative dry eye syndrome and aqueous deficient dry eye syndrome. The aqueous dry eye syndrome segment witnessed a significant revenue share in the dry eye syndrome treatment market in 2021. The lack of tear production by the lacrimal glands leads to aqueous dry eye syndrome. Aqueous tear shortage and dry eye can be brought on by persistent inflammation, enlarged tear ducts, and a concentration of tears inside the lacrimal gland.

On the basis of drug, the dry eye syndrome treatment market is divided into Restasis, Xiidra, Cequa, Eysuvis, Tyrvaya, and others. The restasis drug segment dominated the dry eye syndrome treatment market with the largest revenue share in 2021. Symptoms of chronic dry eye are treated with it. Allergan markets the medication, which has a very low incidence of side effects and is widely used by the general public. Despite taking between three and six months to begin treating the illness, the medication is widely used as a prescribed drug with excellent therapeutic outcomes.

Based on product, the dry eye syndrome treatment market is categorized into cyclosporine, topical corticosteroids, artificial tears, punctal plugs, oral omega supplements, and others. The cyclosporine segment acquired the maximum revenue share in the dry eye syndrome treatment market in 2021. This is a result of cyclosporine-based drugs being used for a long time. Research has shown its usefulness for treating the signs and symptoms of dry eye illness. Cyclosporine has been reported to decrease T-cell proliferation, an inflammatory response that contributes to disease.

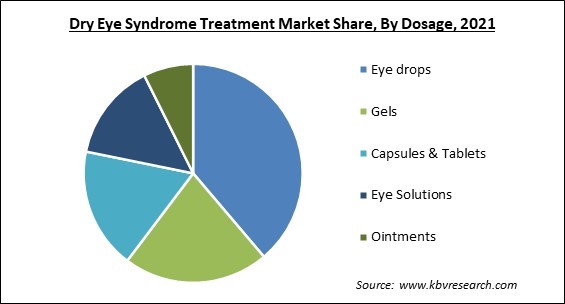

On the basis of dosage, the dry eye syndrome treatment market is segmented into gels, eye solutions, capsules & tablets, eye drops, and ointments. The gels segment acquired a significant revenue share in the dry eye syndrome treatment market in 2021. Gel eye drops tend to remain in the eye longer than other forms of eye drops because of their thicker consistency. Gel drops are frequently used overnight to soothe discomfort and restore moisture to the eyes. They might also give them a shot after trying other, unsuccessful dry eye treatments.

Based on sales channel, the dry eye syndrome treatment market is fragmented into prescription and OTC. The prescription segment witnessed a substantial revenue share in the dry eye syndrome treatment market in 2021. The rising incidence of dry eye in the general population is blamed for the market's expansion. Additionally, prescription eye drops could contain drugs that assist manage ongoing vision issues. A pharmaceutical eye drop called Restasis contains cyclosporine, which relieves the inflammation that leads to dry eyes.

On the basis of distribution channel, the dry eye syndrome treatment market is classified into hospital pharmacies, retail pharmacies, and online pharmacies. The online pharmacies segment acquired a promising revenue share in the dry eye syndrome treatment market in 2021. This is a result of an increase in consumers purchasing goods for convenience. Additionally, due to limits on human migration brought on by the pandemic, online pharmacies have become increasingly popular. Also, many internet retailers' improved pricing options encourage repeat purchasing.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.8 Billion |

| Market size forecast in 2028 | USD 6.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.5% from 2022 to 2028 |

| Number of Pages | 392 |

| Number of Tables | 674 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Drug, Dosage, Distribution Channel, Sales Channel, Product, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the dry eye syndrome treatment market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North American region acquired the maximum revenue share in the dry eye syndrome treatment market in 2021. The market in this region is expected to be driven by the presence of a large target population, increased access to healthcare treatments, and a higher incidence of treatment uptake. Additionally, the market's lucrativeness draws players to this area. For instance, Sun Pharmaceutical Industries Ltd. introduced Cequa in the area in October 2019.

Free Valuable Insights: Global Dry Eye Syndrome Treatment Market size to reach USD 6.5 Billion by 2028

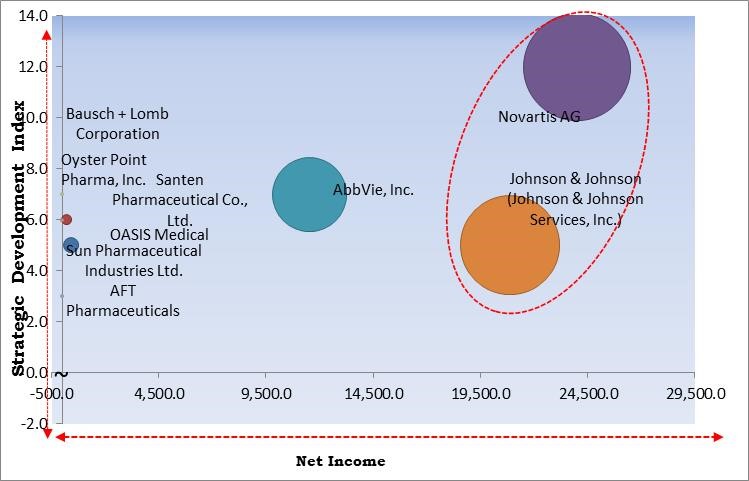

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Novartis AG and Johnson & Johnson (Johnson & Johnson Services, Inc.) are the forerunners in the Dry Eye Syndrome Treatment Market. Companies such as AbbVie, Inc., Bausch + Lomb Corporation, Sun Pharmaceutical Industries Ltd. are some of the key innovators in Dry Eye Syndrome Treatment Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Johnson & Johnson (Johnson & Johnson Services, Inc.), AbbVie, Inc., Bausch + Lomb Corporation (Bausch Health Companies, Inc.), Novartis AG, Sun Pharmaceuticals Industries Ltd., AFT Pharmaceuticals, Santen Pharmaceutical Co., Ltd., Oyster Point Pharma, Inc., OASIS Medical, Inc., and Otsuka Pharmaceutical Co., Ltd.

By Type

By Drug

By Dosage

By Distribution Channel

By Sales Channel

By Product

By Geography

The global Dry Eye Syndrome Treatment Market size is expected to reach $6.5 billion by 2028.

Development of promising drugs to manage Dry Eye Diseases are driving the market in coming years, however, Drug approval takes a longer time restraints the growth of the market.

Johnson & Johnson (Johnson & Johnson Services, Inc.), AbbVie, Inc., Bausch + Lomb Corporation (Bausch Health Companies, Inc.), Novartis AG, Sun Pharmaceuticals Industries Ltd., AFT Pharmaceuticals, Santen Pharmaceutical Co., Ltd., Oyster Point Pharma, Inc., OASIS Medical, Inc., and Otsuka Pharmaceutical Co., Ltd.

The Evaporative Dry Eye Syndrome market acquired the high revenue share in the Global Dry Eye Syndrome Treatment Market by Type in 2021, thereby, achieving a market value of $4.7 billion by 2028.

The OTC market is leading the Global Dry Eye Syndrome Treatment Market by Sales Channel in 2021, thereby, achieving a market value of $4.1 billion by 2028.

The North America market dominated the Global Dry Eye Syndrome Treatment Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.