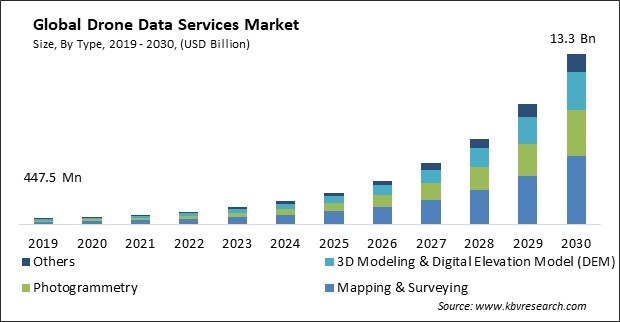

The Global Drone Data Services Market size is expected to reach $13.3 billion by 2030, rising at a market growth of 38.9% CAGR during the forecast period.

Drones are used for geological surveys, mineral exploration, and prospecting. Thus, the mining segment acquired $131.3 million in End-use segment in 2022. Drones are employed to inspect mines for safety compliance. They can access hard-to-reach and potentially hazardous areas, reducing the risk to human workers. Drones assist in conducting environmental impact assessments before and during mining operations. Accurate volume estimates are essential for inventory management and cost control. Drones provide data for monitoring tailings dams, ensuring their stability and safety. This is crucial for preventing environmental disasters. The mining segment has witnessed significant growth in the use of drone data services. Some of the factors impacting the market are rising government regulatory support for drone use, increasing technological advancements, and growing concerns about privacy issues.

Government bodies and aviation authorities have recognized the potential benefits of drones and have established regulatory frameworks that provide clarity, safety, and confidence to organizations and individuals looking to harness the power of drone data. The regulations safeguard the environment and wildlife while allowing researchers to collect essential data using drones. As a result, environmental organizations can leverage drone data to gain insights into climate change, wildlife populations, and ecosystem health. Additionally, ongoing advancements in drone hardware, sensors, and software have improved the capabilities and efficiency of drones for data collection and analysis. Integrating LiDAR technology into drones has enabled highly accurate 3D mapping and modelling, making drones valuable for surveying, construction, and infrastructure inspection applications. This is essential for accurate mapping, surveying, and navigation. As technology continues to evolve, drones are expected to become even more capable and integrated into everyday operations, further driving the growth of the market.

However, drones can capture images and videos from vantage points that are not previously accessible. This can lead to concerns about the invasion of personal privacy, especially when drones are used for aerial photography in residential areas. The data collected by drones, including images and videos, can inadvertently capture sensitive or private information. Drone use in commercial and residential neighbourhoods can raise concerns about the privacy of property owners, tenants, and customers of businesses. Thus, privacy concerns are a significant obstacle in the market for drone data services.

On the basis of end-use, the market is divided into real estate & construction, agriculture, mining, oil & gas, renewables, and others. The agriculture segment projected a prominent revenue share in the market in 2022. Drones provide high-resolution imagery and data for precision agriculture, enabling farmers to optimize resource allocation based on specific crop needs, such as water, fertilizers, and pesticides. This leads to increased yields and reduced costs. Drones can identify and locate weed infestations in fields, enabling targeted and more efficient weed control strategies. The advantages of drone data services in agriculture have revolutionized the industry, making it more efficient, sustainable, and profitable. As data analysis becomes more sophisticated and technology advances, the use of drones in agriculture is expected to increase.

By type, the market is categorized into mapping & surveying, photogrammetry, 3D modeling & digital elevation model (DEM), and others. In 2022, the mapping and surveying segment held the highest revenue share in the market. Drones produce land surveys and extremely accurate topographic maps. They can cover extensive areas rapidly, reducing the time and costs associated with traditional surveying methods. For example, drones perform surveys of construction sites to monitor progress, assess earthwork, and verify that construction aligns with plans and specifications. Drones capture high-resolution aerial imagery, crucial for urban planning, infrastructure development, and environmental assessments. Mapping and surveying services in the market have brought efficiency, cost savings, and data accuracy to various industries.

Based on platform, the market is classified into cloud-based and operator software. The operator software segment acquired the largest revenue share in the market in 2022. Operator software provides precise control over drone flight, enabling safer and more accurate data collection. This promotes confidence in drone technology for a wider range of applications. Operator software typically includes features for automated flight planning, route optimization, and waypoint management. This reduces human error and improves the efficiency of data collection missions. it also enables remote drone operations, allowing users to control drones from a distance. This is particularly beneficial for applications in remote or hazardous environments. The availability of user-friendly interfaces makes it easier for individuals with varying technical expertise to operate drones effectively.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 992.9 Million |

| Market size forecast in 2030 | USD 13.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 38.9% from 2023 to 2030 |

| Number of Pages | 239 |

| Number of Table | 380 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Platform, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America is a hub for technological innovation. The region has seen the development of cutting-edge drone technology, including advanced sensors, automation, and artificial intelligence, which enhance the capabilities of drones for data collection and analysis. Businesses and government organizations in North America are becoming more aware of the potential benefits of drone technology. This has led to greater adoption as organizations become more educated about the advantages of drone data services. Precision agriculture is a major driver in North America, where large-scale farming operations use drones for crop monitoring, yield estimation, and resource optimization.

Free Valuable Insights: Global Drone Data Services Market size to reach USD 13.3 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 4DMapper, Dronecloud, DroneDeploy, Inc., Pix4D SA, PrecisionHawk, Inc. (Field Group AS), Sentera, Inc., Skycatch, Inc., Terra Drone Corporation (Terra Motors Corporation), Cyberhawk Innovations Ltd., Australian UAV Pty Ltd.

By Type

By End-use

By Platform

By Geography

This Market size is expected to reach $13.3 billion by 2030.

Rising government regulatory support for drone use are driving the Market in coming years, however, Growing concerns about privacy issues restraints the growth of the Market.

4DMapper, Dronecloud, DroneDeploy, Inc., Pix4D SA, PrecisionHawk, Inc. (Field Group AS), Sentera, Inc., Skycatch, Inc., Terra Drone Corporation (Terra Motors Corporation), Cyberhawk Innovations Ltd., Australian UAV Pty Ltd.

The expected CAGR of this Market is 38.9% from 2023 to 2030.

The Real Estate & Construction segment is generating the highest revenue in the Market, by End-use in 2022; thereby, achieving a market value of $3.8 billion by 2030.

The North America region dominated the Market, by Region in 2022; and would continue to be a dominant market till 2030, thereby, achieving a market value of $5.1 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.