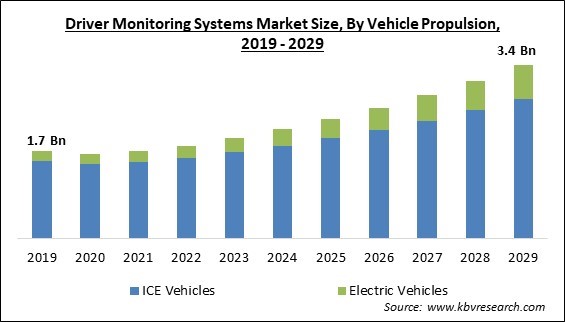

The Global Driver Monitoring Systems Market size is expected to reach $3.4 billion by 2029, rising at a market growth of 9.6% CAGR during the forecast period.

A safety feature in cars called the Driver Monitoring System (DMS), often referred to as the Driver State Sensing (DSS) system, aids in preventing accidents brought on by driver weariness. The DMS system employs multiple cameras to monitor the driver's eyes and alert the driver if their attention level is diminished. This product incorporates a driver-facing camera that is equipped with infrared LEDs to detect the driver's face and eyes, even in low-light conditions or if the driver is wearing sunglasses. In addition, the DMS system can detect driver attentiveness by monitoring engagement in different activities such as drinking, eating, using a cell phone, and more.

The demand for safety features, including driver monitoring systems, parking assistance, lane departure warnings, collision avoidance systems, traction control, tire pressure monitors, electronic stability control, airbags, and telematics, is growing due to the rise in road accidents globally. Additionally, it has been noted that there has been a significant rise in fatalities resulting from traffic accidents.

Teenagers have a higher incidence of fatal road traffic injuries. The growing need for safety features in automobiles is driven by these factors. Automotive manufacturers are innovating and implementing safety features to fulfill customer demands. The growth of the driver monitoring system market is driven by the high demand for safety features.

Governments globally have mandated the installation of safety systems in vehicles within specified timeframes. For example, governments mandate the installation of technologies such as drowsiness monitoring systems, lane departure systems, and driver monitoring systems in vehicles. Additionally, airbags, seat belts, child safety systems, pedestrian safety systems, and other safety features are required to be present in vehicles.

The driver monitoring system market has been adversely affected by the COVID-19 pandemic due to limitations on commuting, which is anticipated to have a detrimental effect on the financial performance of market participants. The economic impact has led market participants to develop strategic cost-saving plans. These factors are expected to contribute to the market's growth within the forecast timeframe. Thus, the market is expected to experience growth as restrictions ease and demand for these systems increases due to a rise in road accidents. This growth is expected to help the market recover from initial losses.

Automotive safety systems are essential devices that aim to reduce the likelihood of injuries, prevent accidents, and lessen the effects of collisions. The systems are engineered to function automatically or require drivers to activate them per their requirements. Electric vehicle manufacturers must implement driver monitoring systems that can work with autopilot mode to ensure safety. The automotive safety systems industry is witnessing a surge in the popularity of technological advancements as a prominent trend. The automotive sector emphasizes incorporating intelligent and secure safety systems in automobiles to enhance safety across various terrains and environments.

The increasing applications of driver monitoring systems have been driven by the growth of the industrial sectors, logistics, and transportation sectors. Fleet management solutions can gather, store, monitor, analyze, report, and export data through the implementation of driver monitoring systems. The driver's performance can be monitored to ensure compliance with safety regulations and legal requirements, including measures to prevent distracted driving, promote driver health, and reduce the risk of drunk driving incidents.

The complexity of Driver Monitoring Systems is increasing due to the growing number of monitoring parameters and the need for precise driver state detection. Minimizing the occurrence of false positives and false negatives is a crucial objective in business. The primary technical challenge associated with implementing vision based DMS technology is its ability to perform consistently in varying lighting conditions, which can result in overexposed or underexposed images. The validation and development of DMS in the automotive industry pose significant challenges for stakeholders due to heightened complexity. Moreover, the Driver Monitoring System is a new concept; hence, the awareness of this system among the general public is quite limited.

By vehicle propulsion, the driver monitoring systems market is classified into ICE vehicles and electric vehicles. The ICE vehicles segment witnessed the largest revenue share in the driver monitoring systems market in 2022. This is due to the fact that driver-monitoring systems can identify signs of drowsiness or lack of attention. As these systems continue to develop, they will integrate into a comprehensive interior sensing platform that offers personalized features, enhanced safety measures, entertainment options, and the ability to connect with smart home systems. The Driver Monitoring System (DMS) can recognize the driver and customize the temperature, seat, side mirror, and other settings according to their preferences.

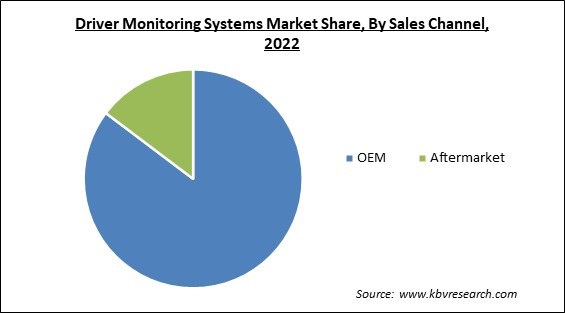

On the basis of sales channel, the driver monitoring systems market is segmented into OEM and aftermarket. The aftermarket segment acquired a prominent revenue share in the driver monitoring systems market in 2022. This is because the market for automotive-grade DMS software has grown due to the high number of trucks and buses on the roads globally. These solutions are available as plug-and-play options. The installation process is simple, and the product enables the vehicle to detect driver fatigue, lack of focus, and other factors that enhance road safety for each installation providing growth opportunities for the segment.

Based on the component, the driver monitoring systems market is bifurcated into cameras, sensors and others. The sensors segment registered the highest revenue share in the driver monitoring systems market in 2022. This is due to the increased demand for DMS systems, which serve as crucial support systems for human-machine interactions (HMI) concerning active safety (ADAS) and autonomous driving. Additionally, there is a growing need for user interface improvements to create intelligent dashboards and related HMI in vehicle settings, which are becoming overwhelmed with information.

On the basis of type of monitoring, the driver monitoring systems market is divided into driver state monitoring and driver health monitoring. The driver health monitoring segment procured a substantial revenue share in the driver monitoring systems market in 2022. This is because these systems aim to reduce the occurrence of road accidents through the use of smart glasses and user-friendly IOT devices. The IOT-based health monitoring system ensures that the driver's blood pressure, glucose, and pulse rate are constantly monitored. If any issues are detected, the system will promptly send an alert message to the appropriate hospital.

Based on vehicle type, the driver monitoring systems market is segmented into passenger cars, light commercial vehicles and heavy commercial vehicles. The passenger cars segment dominated the driver monitoring systems market with maximum revenue share in 2022. This is due to the rise in government regulations regarding driver safety, and the growing consumer demand for convenient and luxurious vehicle features has contributed to this trend. Driver monitoring systems are an essential component in passenger vehicles. The implementation of driver monitoring systems in passenger vehicles can significantly reduce the occurrence of accidents.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.8 Billion |

| Market size forecast in 2029 | USD 3.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 9.6% from 2023 to 2029 |

| Number of Pages | 304 |

| Number of Table | 505 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Vehicle Propulsion, Sales Channel, Component, Type of Monitoring, Vehicle Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the driver monitoring systems market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region generated the highest revenue share in the driver monitoring systems market in 2022. Europe has prioritized road safety and is a leader in this area. The government in the region are working to achieve zero traffic accidents in the region. As a crucial safety component, a driver Monitoring Solution has been recognized. Distracted driving accidents have been a persistent issue in Europe. Road accidents result in significant loss of life, making DMS a crucial solution for enhancing driver attentiveness. In addition, the DMS stakeholders will have the chance to work in an established market and capitalize on significant opportunities, which will surge the market growth in the region.

Free Valuable Insights: Global Driver Monitoring Systems Market size to reach USD 3.4 Billion by 2029

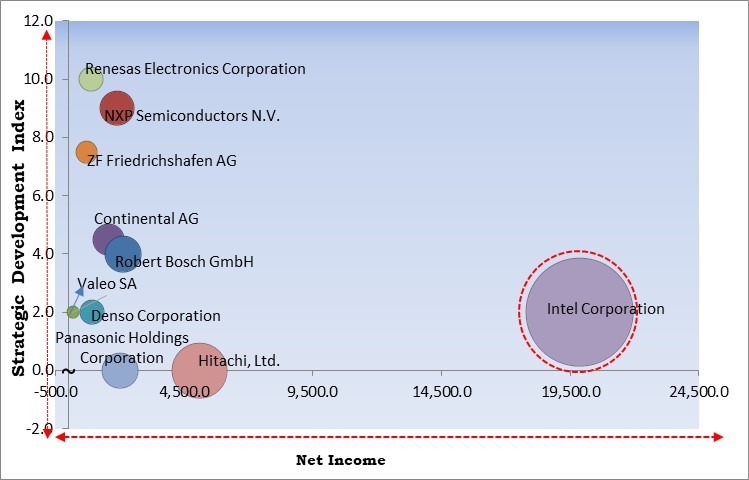

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Intel Corporation is the forerunner in the Driver Monitoring Systems Market. Companies such as Renesas Electronics Corporation, NXP Semiconductors N.V., and ZF Friedrichshafen AG are some of the key innovators in Driver Monitoring Systems Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Continental AG, Denso Corporation, Robert Bosch GmbH, NXP Semiconductors N.V., Panasonic Holdings Corporation, ZF Friedrichshafen AG, Intel Corporation, Hitachi, Ltd., Valeo SA and Renesas Electronics Corporation

By Vehicle Propulsion

By Sales Channel

By Component

By Type of Monitoring

By Vehicle Type

By Geography

The Market size is projected to reach USD 3.4 billion by 2029.

Increase in surveillance in transportation and logistics industries are driving the Market in coming years, however, A highly complex system restraints the growth of the Market.

Continental AG, Denso Corporation, Robert Bosch GmbH, NXP Semiconductors N.V., Panasonic Holdings Corporation, ZF Friedrichshafen AG, Intel Corporation, Hitachi, Ltd., Valeo SA and Renesas Electronics Corporation

The Driver State Monitoring market is generating high revenue in the Global Driver Monitoring Systems Market by Type of Monitoring in 2022; thereby, achieving a market value of $2.9 billion by 2029.

The OEM market is leading the segment in the Global Driver Monitoring Systems Market by Sales Channel in 2022; thereby, achieving a market value of $2.8 billion by 2029.

The Europe market dominated the Market by Region in 2022; thereby, achieving a market value of $1.1 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.