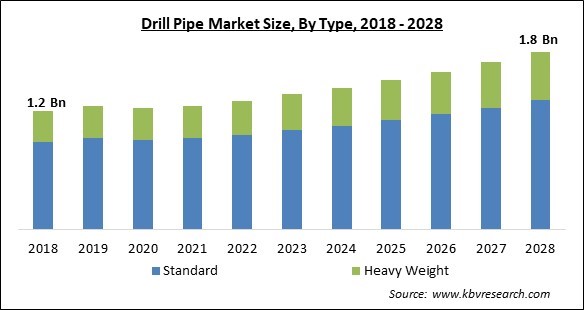

The Global Drill Pipe Market size is expected to reach $1.8 billion by 2028, rising at a market growth of 5.5% CAGR during the forecast period.

A drill pipe is a hollow, thick-walled conduit used during rig drilling operations to transmit drilling fluid from the wellbore to the drill bit. Drill pipes are steel pipes that are seamless and are included in the assembling of the drill string. These pipes are designed to withstand the tremendous external and internal pressures that fluids during drilling produce. It is produced, examined, and tested in accordance with the requirements established by the American Petroleum Institute (API).

According to their API grade, drill pipes are categorized as X-95, E grade, G-105, and S-135. With a total yield strength lesser than 80,000 psi, Grade E drill pipe, sometimes known as mild steel, per unit area has the lowest yield strength. Compared to drill pipe grades with higher strengths, it may withstand more stretch or strain before breaking. Additionally, it is less prone to cracking and corrosion. In wells of medium depth between 10,000 and 15,000 feet, Grade E is used. The grades S-135, X-95, and G-105 are regarded as being of high strength. They have higher yield strengths, which are necessary to serve deeper wells.

Private grades frequently go above what is required by API SPEC 5DP. They were developed for critical service, sour service, as well as other user-defined requirements because of their improved performance characteristics. Sulfide stress corrosion is resistant to sour service grades (SSC). When hydrogen sulfide is present, SSC may happen. Ingress of hydrogen reduces the ductility of steel grades, making them more vulnerable to crack growth and failure along with higher stresses, low pH, lower temperatures, and high chloride content.

In the beginning, the pandemic severely damaged the drill pipe market. The coronavirus (COVID-19) spread quickly across many nations and regions, having a significant negative effect on both individual lives and the community as a whole. It became a serious threat to international trade, the economy, and the financial system. Due to lockdowns brought on by the COVID-19 pandemic, several products in the making were put on hold. The reduced crude oil prices brought on by the COVID-19 pandemic hindered upstream activities such that they were temporarily postponed or stopped, which had a negative impact on various upstream players.

Oil and natural gas automation, often known as oilfield mechanization or automation, is a developing set of procedures, many of which make use of digitalization that could also help energy companies compete more successfully on the world market. Top prospects for automation in the oil and gas sector include drilling, manufacturing activities and process monitoring, transportation, supply chain, safety, and retail operations. Some sectors of the economy are more amenable to automation than others.

Since the first petroleum well was drilled, the resource has become a vital component of daily life. It has served as fuel for vehicles, a source of electricity for power companies and equipment. It is also an important commodity to make fertilizer to boost food production, and a source of plastic to make a variety of items that are used every day. Additionally, petrochemical chemicals are utilized in a variety of industries, including automotive, agribusiness, textile, electrical and electronics, construction, household goods, medical devices, packaging, and pharmaceutical.

A major concern with drill pipes is their lack of interoperability. While standards are available by API, they are only necessary to an extent. Manufacturers can still produce pipes with respect to a customer's priorities. This restricts their usage beyond a certain operation and machine. Additionally, the recessive interoperability actually magnifies the dearth of management in the pipes' after use or its premium nature. This factor has the potential to stifle expansion by these ringing interoperability problems in a number of nations.

Based on type, the drill pipe market is bifurcated into standard drill pipe and heavy weight drill pipe (HWDP). The heavy-weight drill pipe segment garnered a significant revenue share in the drill pipe market in 2021. Heavy weight drill pipe (HWDP) is a tube that functions as a transitional piece or to add weight to the drill string. It serves as a connecting segment of the drill pipe in between the drill collar and the regular drill pipe to lessen fatigue failures. The HWDP is employed in other applications as an extra weight to slow down the drill pipe.

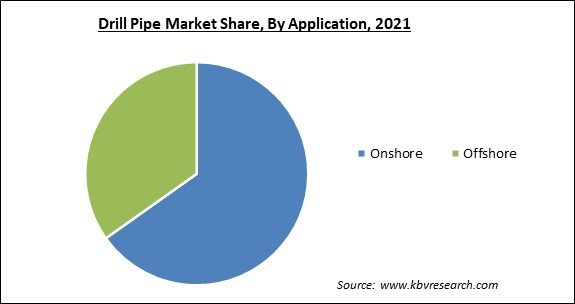

Based on the application, the drill pipe is categorized into offshore and onshore. The onshore segment garnered the maximum revenue share in the drill pipe market in 2021. This is because onshore wells are more readily available and very simple to dig, which facilitates the extraction process. Onshore wells are used to extract a lot of oil and gas. These are easier to extract than offshore wells since they are more readily available and relatively simple to drill.

On the basis of grade, the drill pipe market is divided into API and premium. The premium segment recorded a substantial revenue share in the drill pipe market in 2021. The Premium Class designation applies only to the used normal-weight drill pipe. The tube's remaining wall thickness (WT) shall not be less than 80% of the new nominal wall thickness. These pipes have become the norm throughout the industry. Since they are used, they are cost-effective and easily available as well.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 5.5 Billion |

| Market size forecast in 2028 | USD 1.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.5% from 2022 to 2028 |

| Number of Pages | 166 |

| Number of Tables | 320 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, Grade, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the drill pipe is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America dominated the drill pipe market with the highest revenue share in 2021. It is owing to the emergence of modern drilling techniques like hydraulic fracturing and horizontal drilling. Due to improvements in unconventional drilling technology that have attracted significant expenditures for oil and gas drilling projects, the US currently owns the greatest part of the regional market.

Free Valuable Insights: Global Drill Pipe Market size to reach USD 1.8 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hilong Group of Companies, Drill Pipes International LLC (Jindal Saw Ltd.). NOV, Inc., Oil Country Tubular Ltd., PetroMaterials Corporation, Tejas Tubular Products, Inc., Tenaris S.A., TEXAS STEEL CONVERSION, INC., PAO TMK and WEATHEROCK GROUP HOLDING LIMITED.

By Type

By Application

By Grade

By Geography

The global Drill Pipe Market size is expected to reach $1.8 billion by 2028.

Increasing Automation of Oil and Gas Industry are driving the market in coming years, however, Fluctuating Raw Material Prices and Lack of Interoperability restraints the growth of the market.

Hilong Group of Companies, Drill Pipes International LLC (Jindal Saw Ltd.). NOV, Inc., Oil Country Tubular Ltd., PetroMaterials Corporation, Tejas Tubular Products, Inc., Tenaris S.A., TEXAS STEEL CONVERSION, INC., PAO TMK and WEATHEROCK GROUP HOLDING LIMITED.

The API market has acquired maximum revenue in Global Drill Pipe Market by Grade in 2021; thereby, achieving a market value of $1.2 billion by 2028.

The Standard market is leading the Global Drill Pipe Market by Type in 2021; thereby, achieving a market value of $1.3 billion by 2028.

The North America market dominated the Global Drill Pipe Market by Region in 2021; thereby, achieving a market value of $622.3 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.