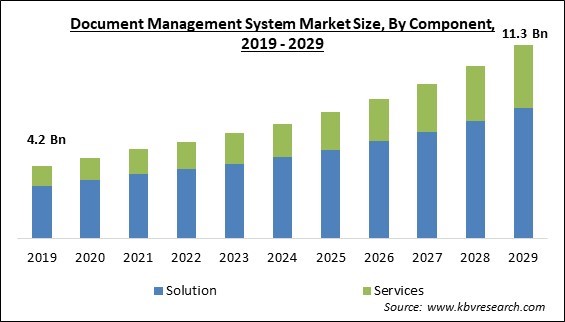

The Global Document Management System Market size is expected to reach $11.3 billion by 2029, rising at a market growth of 10.7% CAGR during the forecast period.

Cloud-based deployment mode is the most preferred mode because of the dramatic increase in the use of DMS solutions by micro, small, and medium-sized businesses all over the world. Hence, cloud-based deployment mode is anticipated to generate more than 40% share of the market by 2029. Businesses prefer vendors with features like cloud hostage and maintenance services. It becomes crucial for vendors to concentrate on these services and consumer needs. Vendors who offer these features and facilities alongside their software have a significant chance to expand their customer base as the need for document management systems rises. Some of the factors impacting the market are increasing productivity at work owing to a cutting-edge document management solution, the need for increased cybersecurity, and Increasing concerns regarding data privacy.

The market systems is expanding due to the growing adoption of cutting-edge technology like artificial intelligence (AI), cloud computing, real-time tracking systems, and other solutions. Utilizing document management solutions, employees and projects are handled remotely. In addition, the use of cutting-edge software has increased worker efficiency. Cyber risks include hacking, security flaws, and even secret information that is not encrypted. Exposure to these risks might harm a company's brand or hurt its customers. As a result, rules were established, compliance is now expected, and security is even more crucial. This tendency has enhanced the value of document management systems, particularly those with the strongest security features.

However, Document management services and systems based on current technology have given rise to several new problems around the privacy of information and other risks. A few factors that impede the expansion of the market are vulnerabilities. These include security and data breaches, invasions of data privacy, cyberattacks, and identity theft. The total damage caused by cyberattacks was estimated in trillions of dollars. Even though the market is providing cybersecurity solutions to decrease cyber risks, the advancement of technology has increased the risk of cyber security and data piracy, as data can be breached even with a small opening, decreasing the adoption of such solutions and hampering the market growth.

Based on component, the market is segmented into solution and services. The services segment acquired a significant revenue share in the market in 2022. This is because electronic documents like word processing files, PDFs, and digital photographs of paper-based content can be captured, tracked, and stored with its help. Utilizing document management can result in significant time and financial savings. It provides centralized storage, audit trails, access control, document protection, and the ability to search and retrieve information more quickly. In addition, the ability of a document management platform to mix different documents allows for more control, access, and overall efficiency of the process, which is anticipated to propel the segment's expansion.

On the basis of deployment mode, the market is divided into on-premise, cloud and hybrid. The cloud segment held the highest revenue share in the market in 2022. The most important industry participants are now offering cloud-based storage solutions to their customers to help them improve their data-holding capacity. The use of cloud services is accelerating rapidly, which can be attributed to prominent players' increased investments in cloud-based infrastructure. Utilizing a document management system that is hosted in the cloud for an organization can handle various problems and complexity associated with the working environment. This can be accomplished with minimal or no direct monitoring from a human being.

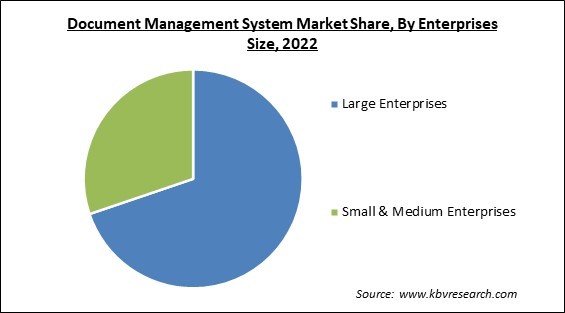

By enterprises size, the market is classified into small and medium enterprises and large enterprises. The small and medium enterprises segment garnered a prominent revenue share in the market in 2022. This is due to the fact that a faster pace of growth is anticipated for the SMEs. This is mostly a result of new market entrants' adoption of cutting-edge technologies like Social, Mobility, Analytics, and Cloud (SMAC), pressuring established firms to update their antiquated IT infrastructures to match shifting customer demands.

Based on the application, the market is bifurcated into BFSI, government, education, healthcare, corporate, industrial manufacturing, retail and other applications. The BFSI segment registered the highest revenue share in the market in 2022. This is due to the fact that DMS solutions enable banks to reduce their usage of paper and related costs. It also allows banks to easily evaluate numerous papers during audits and deliver effective customer service. In the BFSI industry, document management systems are crucial for collecting and maintaining all financial data, aiding the segment's growth in the projected period.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 5.6 Billion |

| Market size forecast in 2029 | USD 11.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 10.7% from 2023 to 2029 |

| Number of Pages | 283 |

| Number of Table | 470 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Application, Enterprises Size, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the market by generating the maximum revenue share in 2022. The growth is attributed to the prevalence of significant players in the region. These firms invest in and create cutting-edge DMS solutions to accommodate the rising need for data. In addition, due to the widespread acceptance of the technology in this region, North America is anticipated to account for the biggest percentage of mobile users, one of the biggest users of DMS solutions which will fuel the market growth.

Free Valuable Insights: Global Document Management System Market size to reach USD 11.3 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include OpenText Corporation, IBM Corporation, Canon, Inc., Oracle Corporation, Newgen Software Technologies Limited, Xerox Corporation, Hyland Software, Inc., Zoho Corporation Pvt. Ltd., MasterControl, Inc., and Ricoh Company, Ltd.

By Component

By Deployment Mode

By Enterprises Size

By Application

By Geography

This Market size is expected to reach $11.3 billion by 2029.

The need for increased cybersecurity are driving the Market in coming years, however, Increasing concerns regarding data privacy restraints the growth of the Market.

OpenText Corporation, IBM Corporation, Canon, Inc., Oracle Corporation, Newgen Software Technologies Limited, Xerox Corporation, Hyland Software, Inc., Zoho Corporation Pvt. Ltd., MasterControl, Inc., and Ricoh Company, Ltd.

The Solution market acquired the maximum revenue share in the Market by Component in 2022 thereby, achieving a market value of $7.6 billion by 2029.

The Healthcare market has shown the high growth rate of 11.3% during (2023 - 2029).

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $3.7 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.