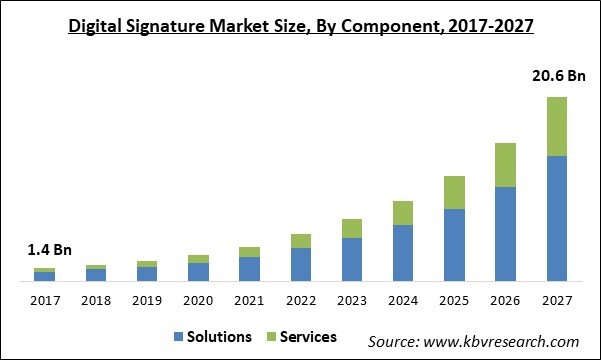

The Global Digital Signature Market size is expected to reach $20.62 billion by 2027, rising at a market growth of 32.2% CAGR during the forecast period.

A digital signature refers to a modern method with the electronic and encrypted stamp of verification on different digital documents like word files, PDF files, and online legal contract papers. Additionally, it is beneficial in addressing the problems of impression and tempering in digital communication. As it comprises all the information of digital document, it allows users to identify the source rapidly and easily, recognize the status of an electronic document.

By using a digital signature, the sender becomes empowered to verify the reliability of a digital document. During the financial transactions or document distribution globally, the chances of risks such as tampering or fraud of documents are very high, thereby fuelling the requirement for digital signatures.

The outbreak of the COVID-19 pandemic has impacted the companies globally, majorly in a severe manner. With the adoption of digital signatures, companies are striving to streamline the process of signing the crucial documents with minimized or no delay or constraints. Thus, the digital signature market has been significantly driven because of the rising use cases from current and new customers owing to a global pandemic.

Moreover, the adoption of digital verification and signatures has been increased due to the recent outbreak of the COVID-19 pandemic. In addition, the industries are compelled to embrace digital technology in order to continue their business due to the rising obligations related to online and remote work. The government is supporting the digital modes of signature and verification like smart ID/card readers, smooth pass, electronic signatures, biometric signatures, and others.

The demand for cloud-based security technologies and solutions is rising due to the high availability of the Internet and higher utilization of mobile & internet-connected devices. In addition, many companies are transitioning towards digital and advanced solutions for dealing with customers. Hence, digital signature becomes the medium for secured and enhanced experience between customers and the companies. Moreover, SMEs and startups are increasingly installing these cloud-based digital signature solutions because of the growing adoption rate of the eCommerce model.

Several industry workflows systems are expected to witness transformation due to the increasing digitalization. In addition, majority of the organizations are adopting the concept of dematerialization, which may increase the acceptance of digital signature. Also, digital signature helps many companies to reduce their spending on the stationary. In a similar manner, it lowers down the possibility of misplacing a crucial document and maintains its security for a long time period.

The digital signature technology is constantly upgrading, while there is no appropriate legislation to regulate these signatures. In addition, there is still not a widespread awareness among many countries about the legal status of digital signatures. Also, legal bodies should make provisions in order to increase awareness associated with the legal acceptance and advantages of digital signature in comparison to the classic signature.

Based on Component, the market is segmented into (Software and Hardware) and Services (Professional and Managed). The services segment, is further divided into the professional services segment obtained the highest revenue share of the market and would unfold the same kind of trend even during the forecasting period. This is credited to the growing demand of the companies for the superior security of their operations and cost savings.

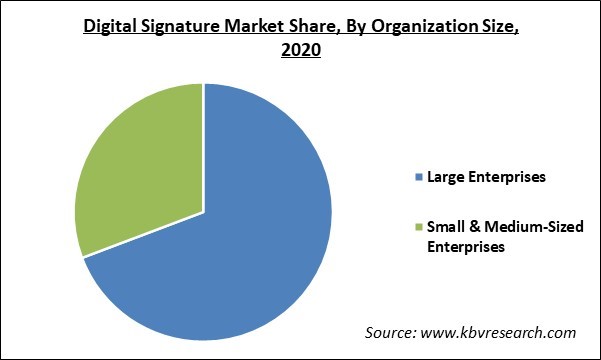

Based on organization size, the market is segmented into large enterprise and Small & medium enterprise. Small and medium enterprises would showcase the highest growth rate throughout the forecasting period. This is credited to the rise in the adoption of digitalization to enhance efficiency in the business process.

Based on Deployment Mode the market is segmented into On premises and Cloud. The cloud-based deployment segment is expected to display a promising growth rate over the forecasting years. In addition, companies and several verticals globally are embracing eSignature solutions in the cloud to achieve cost optimization, flexibility, and scalability.

Based on End User, the market is segmented into BFSI, Healthcare & Life Sciences, Energy & Utilities, Education and Legal, Telecom & IT, Government & Public Sector, and Hardware. The legal segment would display the highest growth rate during the forecasting period. By adopting digital signatures, the legal firms can accelerate and completely automate the sluggish, complicated and costly conventional paper-based signing process and gain higher productivity, maintained eRecord, decreased manual processing, enhanced compliance, decreased turnaround time of the document, streamlined reporting, and digital transformation.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 2.8 Billion |

| Market size forecast in 2027 | USD 20.62 billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 32.2% from 2021 to 2027 |

| Number of Pages | 318 |

| Number of Tables | 612 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Organization Size, Deployment Mode, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. . North America would emerge as the dominating region in the overall digital signature market throughout the forecast years. The region remains at the forefront regarding the adoption of IT technologies. In addition, the region is home to a majority of multinational companies and various small-scale enterprises.

Free Valuable Insights: Global Digital Signature Market size to reach USD 20.62 billion by 2027

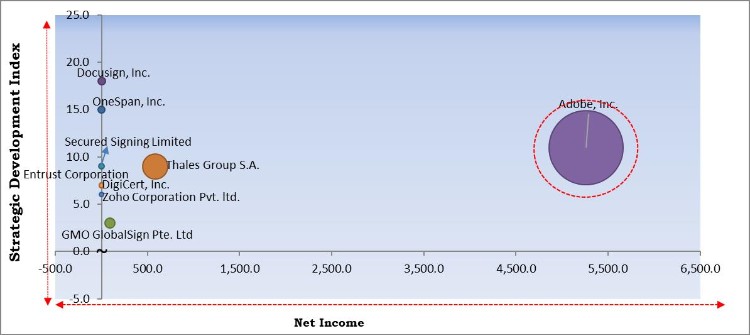

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Adobe, Inc. is the major forerunners in the Digital Signature Market. Companies such as Docusign, Inc., Thales Group S.A., and Zoho Corporation Pvt. ltd. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Docusign, Inc., Secured Signing Limited, OneSpan, Inc., DigiCert, Inc., Zoho Corporation Pvt. ltd., Thales Group S.A., Adobe, Inc., Entrust Corporation, and GMO GlobalSign Pte. Ltd. (GMO Internet, Inc.)

By Component

By Organization Size

By Deployment Mode

By End User

By Geography

The global digital signature market size is expected to reach $20.62 billion by 2027.

The rapid adoption of cloud-based security solutions are driving the market in coming years, however, low Level of Awareness Regarding the Legality of Digital Signatures limited the growth of the market.

Docusign, Inc., Secured Signing Limited, OneSpan, Inc., DigiCert, Inc., Zoho Corporation Pvt. ltd., Thales Group S.A., Adobe, Inc., Entrust Corporation, and GMO GlobalSign Pte. Ltd. (GMO Internet, Inc.)

Yes, the adoption of digital verification and signatures has been increased due to the recent outbreak of the COVID-19 pandemic. In addition, the industries are compelled to embrace digital technology in order to continue their business due to the rising obligations related to online and remote work.

The Solutions market dominated the Global Digital Signature Market by Component 2020 thereby, growing at a CAGR of 31.1% during the forecast period.

The North America market dominated the Global Digital Signature Market by Region 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $7,590.5 million by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.