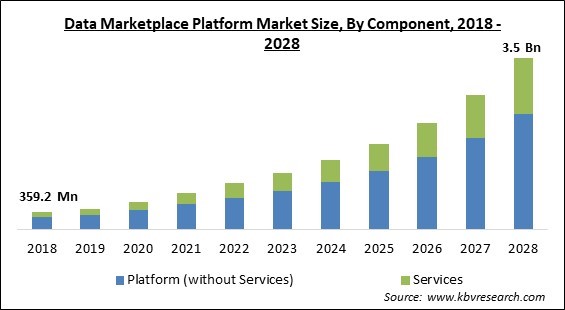

The Global Data Marketplace Platform Market size is expected to reach $3.5 billion by 2028, rising at a market growth of 24.3% CAGR during the forecast period.

A data marketplace platform offers a distinctive user experience while facilitating the purchase and trading of various data kinds. It includes cloud services that allow people or companies to upload data and information to the cloud. A data marketplace platform makes a wide range of data categories, including demographic, business intelligence, firmographics, and personal data, available. Self-service data access is made possible by the platform, which upholds consistency, excellent data quality, and security for all parties.

Organizations and businesses are starting to add external data to their internal data sets, which is boosting market expansion. It is a method of facilitating data exchange that is secure and effective, supports many data sharing models, and satisfies the needs of various data sets and customers. It also makes it possible for businesses to share data via data marketplace platforms, spurring data-driven innovation and incorporating third-party providers into these marketplaces. They are also in charge of enhancing small and medium-sized businesses' competitiveness.

For most businesses, data and information are their most valuable assets. Organizations can utilize their data to enhance their operations, but their data also has substantial value outside of operations. Data marketplaces allow sellers to make money from their data while buyers can buy datasets to improve analytics and provide new services to customers. The majority of data marketplaces are cloud services where people or companies submit data to the cloud.

These solutions allow for self-service data access while maintaining both parties' security, and consistency, as well as good data quality. The development of Big Data is associated with the advent of data marketplaces. Organizations are beginning to view data as a valuable asset. Business organizations are producing more data, either internally or by web scraping and other means. Some of this information is useful to other businesses as well. Data markets help businesses make money out of their data.

The COVID-19 pandemic had a severe impact on the economy all over the world. A number of large as well as small and medium-sized businesses were demolished as a result of the outbreak. However, the pandemic had a positive impact on the data marketplace platform market due to an increase in the usage of smart devices all over the world. Due to the growing use of data services, growing use of IoT and web scraping, and developing usage of blockchain, with remote access data services in sectors, like IT, retail & e-commerce, BFSI, hotel, and media & entertainment, the COVID-19 pandemic had a positive impact on data services.

With the increasing penetration of technologies all over the world, data volumes are constantly growing. The size of the data sets that a business has gathered for analysis and processing is referred to as the volume of data. These data sets are regularly observed in technology today pushing on the higher size of bytes, like terabytes and petabytes. In contrast to traditional storage and processing capabilities, the increased volume of data typically necessitates distinct and diverse processing technologies. Moreover, the magnitude of the data sets inside big data makes it impossible to compute them using a standard laptop or desktop CPU. Hence, this factor is majorly boosting the growth of the data marketplace platform market.

It is becoming increasingly clear how important external data is for both companies trying to buy and sell data. Data Capital refers to external data, an asset that has the capacity to change strategy and performance at several organizations and enterprises, much to how human and financial capital help firms to flourish. The requirement for external data capital is growing as a significant number of businesses concur that they must use external data sourcing more frequently. Businesses can make better-informed judgments, improve their predictive models, increase efficiency, and maximize ROI by enhancing private data with outside ideas. This factor is augmenting the growth of the data marketplace platform market.

Data markets frequently fall short because they lack a method for adequately resolving crucial trust issues. They chose to ignore the particularities of data in favor of sticking with the traditional market paradigm. Certainly, a traditional marketplace is not the best model for facilitating transactions between data sources and customers. Any market must also deal with problems that are intrinsic to the marketplace paradigm, such as commoditization, disintermediation, governance of inappropriate behavior, and the cold-start issue, all of which are potentially far more important when the asset is data. This factor is impeding the growth of the data marketplace platform market.

Based on Component, the Data Marketplace Platform Market is bifurcated into Platform (without services) and Services. In 2021, the platform (without services) segment acquired the largest revenue share of the data marketplace platform market. The development of cloud platforms, as well as the growing use of IoT, ML, AI, and big data for data management, are credited with the increase in the growth of the segment. Data sharing, distribution, and administration are now easier because of technology improvements that do not require expensive hardware and rigid business processes.

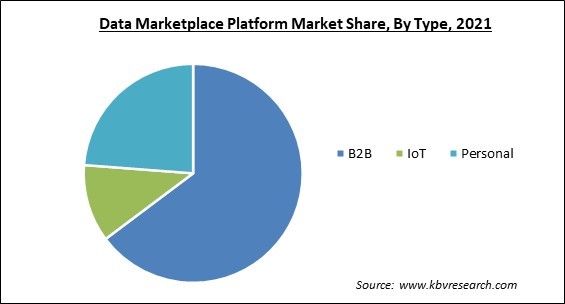

On the basis of Type, the Data Marketplace Platform Market is segmented into Personal Data Marketplace Platforms, B2B Data Marketplace Platforms, and IoT Data Marketplace Platforms. In 2021, the IoT data marketplace platforms segment recorded a substantial revenue share of the data marketplace platform market. The simplicity of data integration and expanding network of connected devices are two factors that have contributed to the growth of this market. A platform that creates real-time data gathered from connected devices and makes it available for purchasing and selling is known as an IoT data marketplace.

On the basis of Enterprise Size, the Data Marketplace Platform Market is divided into Large Enterprises and SMEs. In 2021, the large enterprise segment acquired the largest revenue share of the data marketplace platform market. The expansion of the segment is being driven by an increase in the demand for corporate as well as IoT data marketplace platforms to suit end-user needs. In order to build a solid platform for exchanging data and information and enable direct and indirect monetization from revenue streams, SaaS vendors and major data service providers are investing in research and development operations.

By Revenue Model, the Data Marketplace Platform Market is segregated into Subscription, Commission, Paid features, and Others. In 2021, the commission segment registered a significant revenue share of the data marketplace platform market. The increase in the growth of the segment is due to the high tendency for a higher profit rate over the sold data. Under this type of revenue model, the seller receives a commission on the data they sold. Income security is another major factor that is boosting the growth of this segment of the market.

By End-User, the Data Marketplace Platform Market is categorized into Financial Services, Advertising, Media & Entertainment, Retail & CPG, Healthcare & Life Sciences, Technology, Public Sector, Manufacturing, and Other. In 2021, the financial services segment acquired the largest revenue share of the data marketplace platform market. Cloud platforms enable the utilization of big data for financial use cases by financial companies, including the provision of personalized recommendations, the creation of new income streams through data-driven proposals, and the development of effective services to gain a competitive edge.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 736.1 Million |

| Market size forecast in 2028 | USD 3.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 24.3% from 2022 to 2028 |

| Number of Pages | 337 |

| Number of Tables | 574 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, Deployment, Enterprise Size, Revenue Model, End-user, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the Data Marketplace Platform Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the highest revenue share of the data marketplace platform market. The expansion is linked to the region's developments in machine-to-machine (M2M) communications networks, the growing use of IoT solutions, and the implementation of cutting-edge technologies like AI, AR/VR management and orchestration capabilities, and machine learning. In addition, significant businesses, including Acxiom LLC, Snowflake, AWS, and Quandl, among others, are among the primary growth factors that have fueled the industry's expansion.

Free Valuable Insights: Global Data Marketplace Platform Market size to reach USD 3.5 Billion by 2028

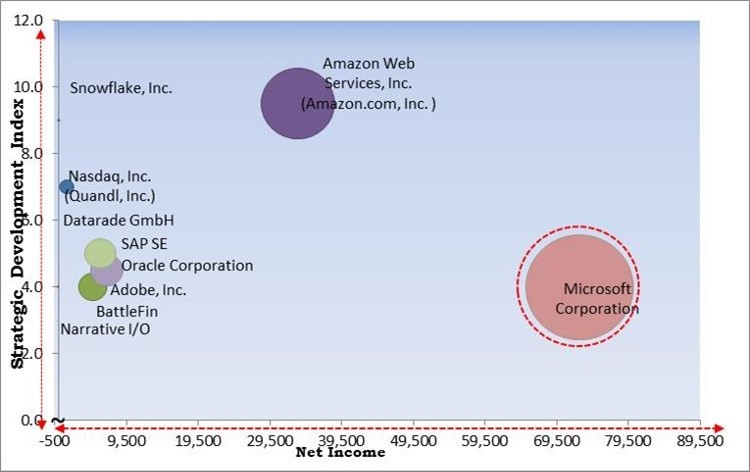

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation are the forerunners in the Data Marketplace Platform Market. Companies such as Amazon.com, Inc., Oracle Corporation and SAP SE are some of the key innovators in Data Marketplace Platform Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, SAP SE, Microsoft Corporation, Adobe, Inc., Snowflake, Inc., Nasdaq, Inc. (Quandl, Inc.), BattleFin, Narrative I/O, Inc., and Datarade GmbH.

By Component

By Type

By Enterprise size

By Revenue Model

By End-user

By Geography

The global Data Marketplace Market size is expected to reach $3.5 billion by 2028.

Rapidly rising data volumes due to increasing penetration of technologies are driving the market in coming years, however, Lack Of Development And Advancements In This Sector restraints the growth of the market.

Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, SAP SE, Microsoft Corporation, Adobe, Inc., Snowflake, Inc., Nasdaq, Inc. (Quandl, Inc.), BattleFin, Narrative I/O, Inc., and Datarade GmbH.

The expected CAGR of the Data Marketplace Market is 24.3% from 2022 to 2028.

The B2B market has acquired the maximum revenue share in the Global Data Marketplace Platform Market by Type in 2021, thereby, achieving a market value of $2.2 billion by 2028.

The North America market dominated the Global Data Marketplace Platform Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $1.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.