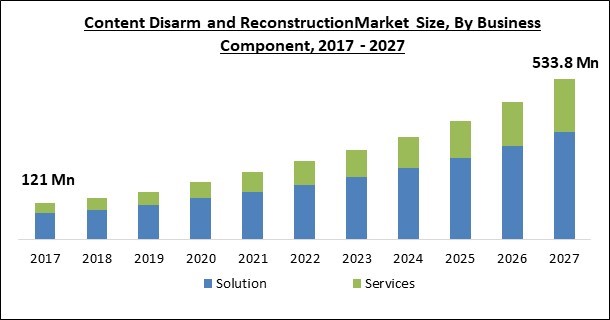

The Global Content Disarm and Reconstruction Market size is expected to reach $533.8 million by 2027, rising at a market growth of 15.6% CAGR during the forecast period.

CDR (Content Disarm and Reconstruction) is a computer security solution that removes potentially dangerous code from files. CDR technology, unlike malware analysis, does not determine or detect malicious capability, but instead excludes any file components which are not supported by the system's rules and policies. CDR is used to prevent cybersecurity threats from breaching the perimeter of a business network. Website traffic and email are two channels that CDR may be used to defend.

A phishing email is the source of the vast majority of malware infections. A considerable number of them employ a malicious document as the distribution mechanism. Over than 70% of phishing emails attachments or links and over 30% of fraudulent online downloads in 2020 were supplied via documents like PDF, Excel, Microsoft Office Word, and PowerPoint. Nevertheless, just because a document has been weaponized does not mean it is attempting to destroy.

Microsoft Office files are organised as ZIP files that contain folders holding a variety of different files. This indicates that the malicious script included within an Office file is merely one of numerous files contained within it. PDFs are similar in that they are likewise constructed from many elements. A malicious PDF file is made up of a number of components that work together to form the file which the receiver sees. Just one or a few such objects, however, contain the dangerous script code that is concealed within the page.

The COVID-19 pandemic has had a favourable influence on the market for content disarmament and reconstruction. CDR has acquired market traction in the midst of the continuing COVID-19 pandemic in order to cater to the escalating cyber-attacks and the growing use of remote working practises. The COVID-19 pandemic has posed a significant difficulty for businesses all over the world in maintaining operations despite the large closure of offices and other infrastructure. The increased usage of technologies, particularly in pandemic situations, to stay connected and run enterprises efficiently raises the risk of cyber-attacks.

As a result, the need for modern digital infrastructures has skyrocketed. These technologies have also grown in popularity and value as a target for hackers. During a pandemic, systems are more vulnerable to cyber-attacks. Enterprises are looking for ways to provide their staff with the resources and infrastructure they need to work remotely while maintaining company continuity.

With the rise in file-sharing amongst coworkers working remotely and clients, partners, and suppliers – companies confront increased risks, threats, and exposures from file-borne malware, many of which are undetected by standard network security solutions. Malware assaults have serious repercussions. Companies incur data loss, service interruption, enterprise reputation harm, downtime, and revenue loss.

As a result, data breaches have a direct impact on the company's total market position. According to the Accenture Annual Cost of Cybersecurity research, the estimated average cost of a malware attack on a firm is USD 2.6 million, with these attacks losing the organisation an average of 50 days in lost time.

The cybersecurity mesh is a modern structured methodology to security structures. It enables dispersed enterprises to supply and improve security where it is most needed. It's a decentralised concept that attempts to safeguard the identities of people or machines, and it's one of the trendiest strategies right now. The purpose, whether in cloud or on-premises, is to limit access to a company's network to authorised users (or systems). In principle, the cybersecurity mesh assists IT workers in maintaining security out of each access point even while blocking hackers from gaining access to the devices.

The shortage of expertise among security specialists is a key issue that affects all big security firms. According to the conclusions of ISACA's State of Cybersecurity 2021 Part 1 survey study, the cyber security sector continues to face hiring and retention issues. India has a 9 percent greater deficit of cyber security workers than the worldwide norm. To resist cyberattacks, security professionals must have up-to-date knowledge and sophisticated abilities in forensic investigations, analytics, and cloud computing security.

The growing number of cyber security risks and file-based assaults has resulted in a scarcity of suitable IT security skills and personnel. Companies should take a proactive approach to deploying IT security infrastructure and training employees to forecast attacks by regularly monitoring data and conducting investigations. Preplanning assists businesses in picking the best CDR solution with all of the necessary capabilities and technology. As a result, a lack of competence and preparation is a stumbling block in the content disarms and rebuilding market.

Based on Component, the market is segmented into Solution and Services. The segment of Content Disarm and Reconstruction Solutions is predicted to provide the most market share. The content disarm and reconstruction technique ensures that the file's content is preserved while the potentially dangerous threat is eliminated. It eliminates the need to remove the file altogether, saving time and costs. Rising regulatory and compliance pressures, as well as an increase in cyber-attacks via different channels like attachments, USB transfers, emails, and file transfer protocol (FTP) transfers, have prompted the solution segment to generate greater revenue during the projection period.

Based on Deployment Mode, the market is segmented into On-premise and Cloud. During the projected period, the cloud deployment option is predicted to increase at a fast growth rate. CDR solutions are shifting to the cloud from on-premises deployment models because the former provides benefits such as lower operational costs and enabling technology available to companies and departments who lack funding and strong equipment to enable the on-premises deployment model. ECDR software can be put in the cloud, allowing numerous users to access information via the internet. Cloud services have no upfront costs and are paid for on an as-needed basis.

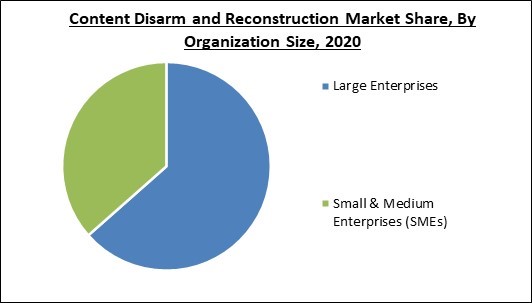

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). By 2026, the large businesses segment is predicted to have a larger market share. The increasing digitization of numerous industrial verticals is increasing the susceptibility of businesses to cyber-attacks. Furthermore, the sophistication and complexity of cyber-attacks are increasing. In general, the majority of large-scale cyber-attacks targeted large organisations, and cyber thieves exploited user executions and detect phishing file attachments to attack these enterprises' networks. The frequency of zero-day cyberattacks is also rapidly increasing, and cyber criminals are exploiting the bulk of organisations' less competent security technologies and devices.

Based on Vertical, the market is segmented into Government & Defense, BFSI, IT & Telecom, Manufacturing, Healthcare, Energy & Utilities and Others. The government and defence sector dominated the market, accounting for the lion's share. Cyberattacks are anticipated to attack personal data about the country's residents as well as military tactics. Untrustworthy hackers are constantly on the hunt for such information. The massive volumes of data processed and stored on-premises and in the cloud necessitate the development and deployment of secure systems capable of repelling any potential hacking attempts.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 191.5 Million |

| Market size forecast in 2027 | USD 533.8 Million |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 15.6% from 2021 to 2027 |

| Number of Pages | 260 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. During the predicted period, APAC will increase at a faster CAGR. China, Australia, Japan, and the rest of Asia Pacific are examples of developing economies in the Asia Pacific area. It is very concerned about the rise in security costs as a result of the ever-changing danger situation. There are some well-established SMEs in the region. To meet the demands of their enormous client base, SMEs in this region are expanding at an exponential rate. In this region, innovative approaches such as IoT, machine learning, AI, and big data analytics are being used. Organizations are shifting their operations to the cloud in order to improve productivity and business success. The definition of cyber-attacks is always evolving and growing more complex.

Free Valuable Insights: Global Content Disarm and Reconstruction Market size to reach USD 533.8 Million by 2027

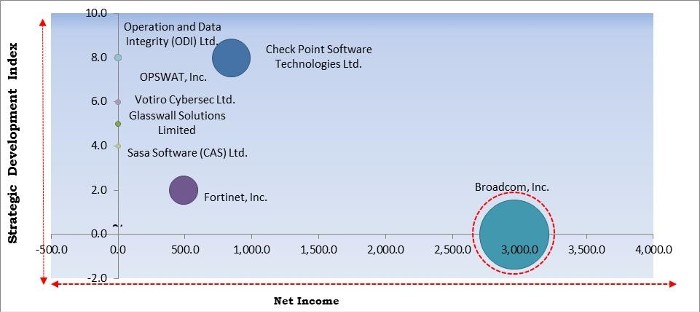

The major strategies followed by the market participants are Product Launches and Partnerships. Based on the Analysis presented in the Cardinal matrix; Broadcom, Inc. is the major forerunner in the Content Disarm and Reconstruction Market. Companies such as Fortinet, Inc., Sasa Software (CAS) Ltd. and Glasswall Solutions Limited are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Fortinet, Inc., Broadcom, Inc. (Symentec Corporation), Check Point Software Technologies Ltd., OPSWAT, Inc., Peraton, Inc. (Veritas Capital Fund Management, L.L.C.), Deep-Secure Ltd. (Forcepoint LLC.), Votiro Cybersec Ltd., Operation and Data Integrity (ODI) Ltd., Glasswall Solutions Limited, and Sasa Software (CAS) Ltd.

By Component

By Deployment Mode

By Organization Size

By Vertical

By Geography

The global content disarm and reconstruction market size is expected to reach $533.8 million by 2027.

Increasing Demand for Cybersecurity Networks are driving the market in coming years, however, inadequate necessary skills and strategic management limited the growth of the market.

Fortinet, Inc., Broadcom, Inc. (Symentec Corporation), Check Point Software Technologies Ltd., OPSWAT, Inc., Peraton, Inc. (Veritas Capital Fund Management, L.L.C.), Deep-Secure Ltd. (Forcepoint LLC.), Votiro Cybersec Ltd., Operation and Data Integrity (ODI) Ltd., Glasswall Solutions Limited, and Sasa Software (CAS) Ltd.

The On-premise segment is leading the Global Content Disarm and Reconstruction Market by Deployment Mode 2020, and would continue to be a dominant market till 2027.

The North America is fastest region in the Global Content Disarm and Reconstruction Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.