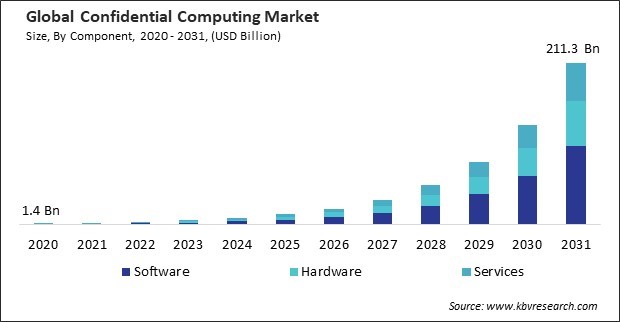

“Global Confidential Computing Market to reach a market value of USD 211.3 Billion by 2031 growing at a CAGR of 56.5%”

The Global Confidential Computing Market size is expected to reach $211.3 billion by 2031, rising at a market growth of 56.5% CAGR during the forecast period.

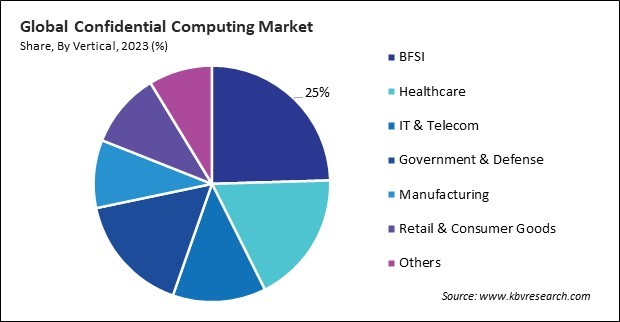

Healthcare professionals must share data but doing so with the wrong people who may learn about illnesses or DNA might have catastrophic consequences. Confidential computing may provide a solution by securing data even while healthcare workers utilize it, which is crucial for cybersecurity. Using confidential computing, data may now be used for purposes that were previously thought to be too dangerous. For instance, they are gathering data on individuals in severe conditions and using AI to look for trends and comprehend what they could be experiencing. Thus, the healthcare segment garnered 18% revenue share in the confidential computing market in 2023.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2024, Intel teamed up with Cohesity, specializes in data management solutions, helping organizations protect and manage their data efficiently, to introduce confidential computing technology to the Cohesity Data Cloud. By leveraging Intel® Software Guard Extensions (Intel® SGX) and Intel® Trust Authority, this collaboration aims to enhance hardware-enabled security for customer backup data across diverse environments, including enterprise databases, NAS systems, SaaS applications, virtual machines, and cloud infrastructures. Additionally, In May, 2024, Arm joined hands with HCLTech, an Indian multinational information technology consulting company to enhance custom silicon chips for AI-driven operations. This collaboration aims to help semiconductor manufacturers and cloud providers improve data center efficiency. Utilizing Arm's Neoverse Compute Subsystems, HCLTech will quickly deliver innovative solutions for AI workloads, advancing technology in the semiconductor industry.

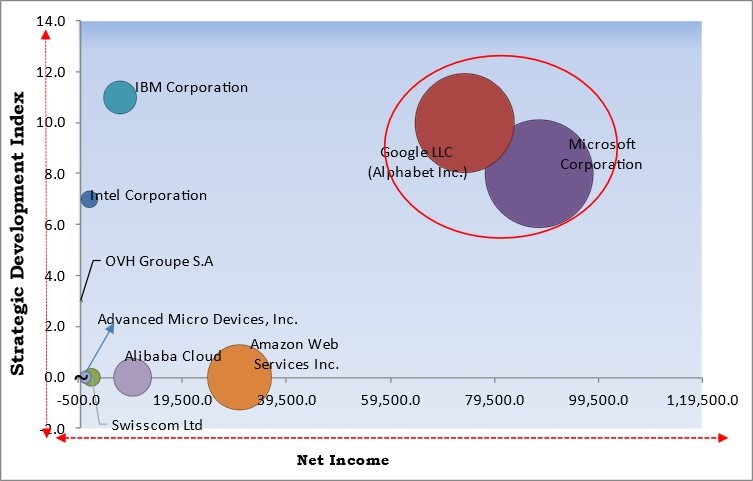

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Confidential Computing Market. In March, 2024, Microsoft Corporation partnered with NVIDIA, an American multinational corporation and technology company to leverage generative AI and advanced computing in healthcare. Combining Azure’s capabilities with NVIDIA DGX Cloud and Clara, they aim to accelerate clinical research, and drug discovery, and improve patient care, ultimately making healthcare more precise, accessible, and effective globally. Companies such as Amazon Web Services Inc., Alibaba Cloud, IBM Corporation are some of the key innovators in Confidential Computing Market.

Organizations may safeguard their intellectual property with the use of confidential computing. For instance, firms must take reasonable precautions to secure trade secrets since they are legally protected. Confidential computing offers a safe processing environment to prevent unauthorized users from accessing or compromising an organization's trade secrets. Hence, these requirements are driving the growth of the market.

Additionally, AI models that predict customer preferences improve user experiences, and create personalized recommendations often require access to sensitive behavioral data. Confidential computing allows analyzing customer data without compromising privacy, enabling organizations to extract valuable insights while maintaining compliance with data protection regulations. Thus, the increasing adoption of AI is supporting the expansion of the market.

Continuous monitoring, upgrades, and troubleshooting are necessary for maintaining confidential computer systems. This may be expensive and time-consuming, mainly if the solutions are complicated or include many different parts. Hence, the high cost of deploying and maintaining these solutions is one of the significant obstacles in the market for confidential computing.

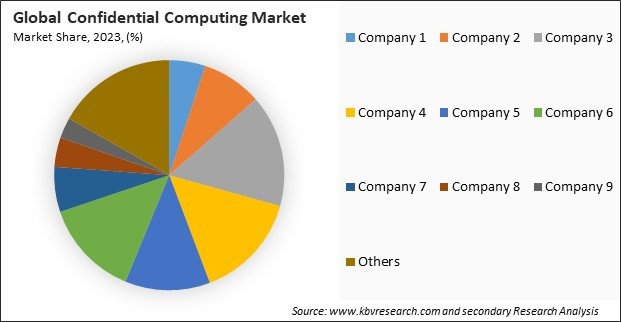

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on the vertical, the market is segmented into BFSI, government & defense, healthcare, IT & telecom, manufacturing, retail & consumer goods, and others. The BFSI segment projected 25% revenue share in the market in 2023. Banks and other financial institutions have long been the focus of cyber assaults, which might cause losses of hundreds of millions of dollars.

Based on component, the market is divided into hardware, software, and services. The services segment acquired 23% revenue share in the market in 2023. Services are crucial to developing, deploying, and administrating confidential computing systems.

By deployment mode, the market is segmented into on-premise and cloud. The on-premise segment covered 46% revenue share in the market in 2023. If a user has direct authority over the hardware, they could have to set up their attestation services, a reason because on-premise adoption has increased recently.

On the basis of application, the market is fragmented into data security, secure enclaves, pellucidity between users, and others. The data security segment witnessed 46% revenue share in the market in 2023. Secure and isolated environments are provided for data processing via confidential computing through specialized hardware infrastructure.

Based on the vertical, the market is segmented into BFSI, government & defense, healthcare, IT & telecom, manufacturing, retail & consumer goods, and others. The BFSI segment projected 25% revenue share in the market in 2023. Banks and other financial institutions have long been the focus of cyber assaults, which might cause losses of hundreds of millions of dollars.

Free Valuable Insights: Global Confidential Computing Market size to reach USD 211.3 Billion by 2031

The market is highly competitive, with numerous players focusing on enhancing secure environments for sensitive data processing. Key attributes include encryption, privacy-preserving technologies, and compliance with strict data protection regulations. As demand for secure cloud computing grows across industries like finance and healthcare, competition intensifies. Innovation centers on improving performance, scalability, and trust in secure data handling, as companies strive to offer solutions that protect sensitive data while maintaining efficiency and reliability in cloud-based environments.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, Europe segment held 29% revenue share in the market. Europe has a wide range of business requirements, as seen by the need for reliable and scalable IT infrastructure from several major merchants and industrial firms.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 6.2 Billion |

| Market size forecast in 2031 | USD 211.3 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 56.5% from 2024 to 2031 |

| Number of Pages | 317 |

| Number of Tables | 483 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Application, Deployment Mode, Vertical, Region |

| Country scope |

|

| Companies Included | Swisscom Ltd., OVH Groupe S.A, Arm Limited (SoftBank Group Corp.), Microsoft Corporation, IBM Corporation. Intel Corporation, Google LLC (Alphabet Inc.), Amazon Web Services, Inc. (Amazon.com, Inc.), Advanced Micro Devices, Inc. and Alibaba Cloud (Alibaba Group Holding Limited) |

By Component

By Application

By Deployment Mode

By Vertical

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges