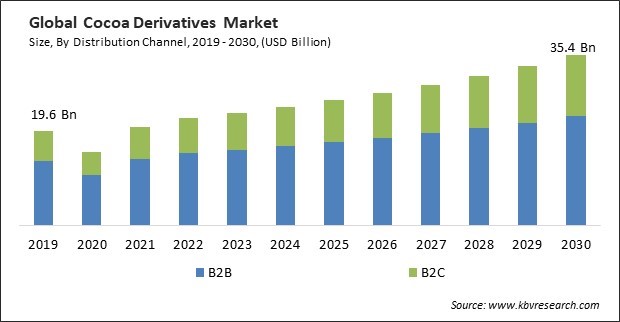

The Global Cocoa Derivatives Market size is expected to reach $35.4 billion by 2030, rising at a market growth of 6.1% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,731.1 kilo tonnes, experiencing a growth of 5.9% (2019-2022).

Hypermarkets and supermarkets provide extensive shelf space, displaying a broader range of cocoa derivatives. Thus, the hypermarkets/supermarkets segment acquired $2,951.3 million in 2022. This includes various chocolate products, cocoa powders, cocoa-based beverages, and other derivatives. Consumers have greater access to diverse cocoa-related products in these retail settings. These factors will help in the expansion of the segment. Some of the factors impacting the market are growing global chocolate consumption, expanding bakery and confectionery industry, and continuous fluctuations in the cocoa prices.

Cocoa derivatives, including cocoa powder, cocoa butter, and cocoa liquor, are fundamental components in the production of chocolate. These derivatives impart the characteristic flavor, texture, and aroma that define chocolate. As such, the demand for cocoa derivatives is directly proportional to the demand for chocolate products. Cocoa derivatives play a crucial role in enhancing the flavor profile of chocolate. The unique taste and aroma associated with cocoa contribute to consumers' sensory experience with high-quality chocolate. The better the quality of cocoa derivatives, the more appealing the chocolate product is to consumers. Additionally, the ongoing global trend of urbanization, accompanied by changing lifestyles, has increased demand for convenient and indulgent food products. Urban consumers, with busier schedules and higher disposable incomes, often seek ready-to-eat bakery and confectionery items. Cocoa derivatives, being key ingredients in these products, witness heightened demand. The enduring popularity of sweet indulgences, including pastries, cakes, cookies, and chocolates, has fueled the growth of the bakery and confectionery industry. Consumers across demographics indulge in these treats as comfort food or to celebrate special occasions, driving the demand for cocoa derivatives that contribute to these products' rich, flavorful profiles.

However, cocoa is a major input cost in the production of cocoa derivatives. The cost of cocoa beans represents a substantial portion of the overall production costs for manufacturers. Fluctuations in cocoa prices directly influence the cost of raw materials, subsequently affecting the cost of producing cocoa derivatives. The cocoa sector is subject to supply and demand dynamics influenced by weather conditions, geopolitical events, and changes in consumer preferences. When the supply of cocoa is affected by factors like unfavorable weather conditions or political instability in cocoa-producing regions, it can lead to price fluctuations due to changes in supply and demand. Sharp increases in cocoa prices can squeeze profit margins if manufacturers cannot pass on the increased costs to consumers. Conversely, decreases in cocoa prices may affect revenue if product prices are slow to adjust. Thus, these factors can limit the expansion of the cocoa derivatives market.

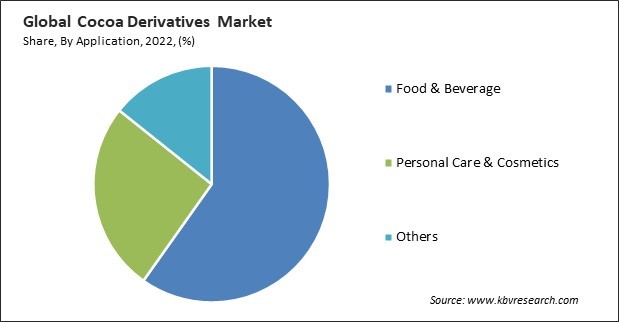

On the basis of application, the cocoa derivatives market is divided into food & beverage, personal care & cosmetics, and others. The food and beverage segment recorded the maximum revenue share in the cocoa derivatives market in 2022. Chocolate confectionery remains a major driver of the cocoa derivatives market within the food and beverage segment. The popularity of chocolate as a treat, snack, or gift contributes to a consistent demand for cocoa-derived products. Cocoa powder is a key ingredient in hot chocolate and cocoa-based beverages. The rise of specialty hot chocolate drinks and innovative cocoa-infused beverages contributes to the growing demand for cocoa derivatives. These aspects will help in the expansion of the segment.

Based on distribution channel, the cocoa derivatives market is divided into B2B and B2C. In 2022, the B2C segment witnessed a substantial revenue share in the cocoa derivatives market. B2C brands focus on flavor innovation, introducing unique and exotic flavor combinations to differentiate their products. This includes incorporating spices, herbs, fruits, and other ingredients to create distinctive cocoa-derived offerings. The B2C segment has witnessed the introduction of functional chocolates that go beyond traditional indulgence. Products infused with superfoods, adaptogens, or health-promoting ingredients cater to consumers seeking pleasure and functional benefits. Therefore, the segment will expand rapidly in the coming years.

The B2C segment is divided into online sales, hypermarkets/supermarkets, wholesale stores, and others. The online sales segment held a substantial revenue share in the cocoa derivatives market in 2022. Consumers are increasingly turning to online platforms for convenience shopping from the comfort of their homes. The ease of browsing and purchasing online has become a significant factor in the preference for e-commerce channels. Online sales allow cocoa derivative manufacturers and retailers to reach a broader and global market. Consumers from different regions can access a wide range of cocoa products, increasing market visibility and accessibility. These factors will pose lucrative growth prospects for the segment.

Based on product, the cocoa derivatives market is segmented into cocoa powder, cocoa butter, cocoa mass/liquor, and others. The cocoa powder segment held the largest revenue share in the cocoa derivatives market in 2022. Growing trends of health-conscious consumer behavior have led to an increased demand for cocoa products perceived as healthier. Cocoa powder, especially unsweetened and not heavily processed, is often considered a healthier alternative to chocolate bars and candies. These factors will lead to increased demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 22.3 Billion |

| Market size forecast in 2030 | USD 35.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.1% from 2023 to 2030 |

| Number of Pages | 418 |

| Number of Tables | 890 |

| Quantitative Data | Volume in Tonnes, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Distribution Channel, Application, Region |

| Country scope |

|

| Companies Included | Olam Group Limited (Temasek Capital), Cargill, Incorporated, JB Foods Limited, The Barry Callebaut Group, Indcre, S.A., Moner Cocoa, S.A., BASF SE, Buhler Group, Mondelez International, Inc., and Nestle S.A. |

| Growth Drivers |

|

| Restraints |

|

By region, the cocoa derivatives market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired the highest revenue share in the cocoa derivatives market. Europe has a rich history and cultural affinity for chocolate consumption. Chocolate is deeply ingrained in European culinary traditions and is often associated with indulgence, celebrations, and everyday enjoyment. European countries, including Switzerland, Belgium, and Germany, consistently rank globally among the highest per capita chocolate consumption. Therefore, the segment will grow rapidly in the upcoming years.

Free Valuable Insights: Global Cocoa Derivatives Market size to reach USD 35.4 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Olam Group Limited (Temasek Capital), Cargill, Incorporated, JB Foods Limited, The Barry Callebaut Group, Indcre, S.A., Moner Cocoa, S.A., BASF SE, Buhler Group, Mondelez International, Inc., and Nestle S.A.

By Application (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Product (Volume, Kilo Tonnes, USD Billion, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD Billion, 2019-2030)

The Market size is projected to reach USD $35.4 billion by 2030.

Expanding bakery and confectionery industry are driving the Market in coming years, however, Continuous fluctuations in the cocoa prices restraints the growth of the Market.

Olam Group Limited (Temasek Capital), Cargill, Incorporated, JB Foods Limited, The Barry Callebaut Group, Indcre, S.A., Moner Cocoa, S.A., BASF SE, Buhler Group, Mondelez International, Inc., and Nestle S.A.

The B2B segment is leading the Market by Distribution Channel in 2022; thereby, achieving a market value of $22.6 billion by 2030.

The Europe region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $11.8 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.