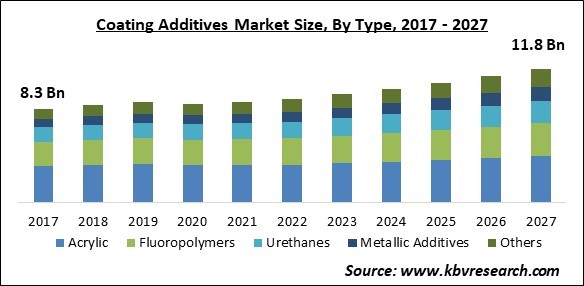

The Global Coating Additives Market size is expected to reach $11.8 billion by 2027, rising at a market growth of 4.8% CAGR during the forecast period.

Coating additives are some of the most significant ingredients in a coating's formulation since they help influence the coating's performance. These additives are used in a variety of applications, including furniture and construction, as well as automotive coatings. Coating additives are increasingly being employed to alter the rheology, wetting and dispersion capabilities, anti-fouling, and anti-foaming properties of coating compositions. With tighter environmental rules, the use of aqueous and powder coatings is becoming more popular.

Manufacturers are also devoting more resources to the development of environmentally friendly bio-based and water-borne coating additives, which are anticipated to expand market prospects in the near future. In the future years, the aforementioned factors are projected to have an impact on the global market for coating additives.

Coating additives are the type of solutions used to improve the quality and performance of paints. Coating additives are used to improve product qualities and remove or decrease difficulties that arise during the formulation and manufacturing of paint systems, attributed to improvements in coating additives technology. They are utilized in tiny quantities, but they have a significant impact on the size of the coating additives industry. Coating additives are becoming more and more essential to meet zero-VOC emission standards. Governments all across the world are stepping up their efforts to minimize carbon emissions from construction.

The World Health Organization declared COVID-19 a public health emergency on March 11, 2020, after it has spread to over 213 countries around the world. Germany, France, Italy, Spain, the United Kingdom, and Norway are among the major economies affected by the COVID-19 crisis. The majority of coating additives are used in the automotive, industrial, and architectural industries.

Due to a scarcity of resources in various regions of the world, the COVID-19 pandemic has had a detrimental influence on the manufacturing and industrial industries. Various techniques are being used by the companies to increase production volume, and they are attempting to develop innovative solutions at an affordable price that can meet customer requirements at a lower cost while also supporting the overall breakthrough required for increased product penetration and sustainability.

Architecture is the most common application of coating additives, which improve the quality of building structures for a longer period of time, reducing the need for periodic maintenance. The building industry is seeing an increase in the demand for wood coating additives. Economic growth in many regions would inevitably lead to increased industrial activity, which would benefit the architectural coatings additives market.

Coatings additives are a subset of chemically modified materials that are used in a variety of industries. Because of the performance benefits that these materials provide, their application in coating formulations is becoming increasingly common. They enhance the formulation's chemical properties, such as wettability, dispersion, rheology, UV protection, chemical resistance, and high-temperature stability. They are frequently employed in a variety of industrial industries that are subjected to harsh conditions.

The use of additives is restricted by the rigorous limitations imposed by many governments and associations on the use of solvent-based paints and coatings containing volatile organic compounds (VOCs). These rules apply to both manufacturers and consumers of paints and coatings. The National Volatile Organic Compound Emission Standards for Consumer and Commercial Products, for example, are set by the United States Environmental Protection Agency (EPA).

Based on the Type, the coating additives market is segmented into Acrylic, Fluoropolymers, Urethanes, Metallic Additives, and Others. In 2020, the Fluoropolymers segment accounted for a significant revenue share of the coating additives market. The expediting growth of this segment is attributed to the high performance of the fluoropolymers. In addition, these coatings comprise a superior dry film which also enhances the quality of the coating. Due to the requirement of a coating additive that offers excellent quality coating, the demand for this segment across the market is propelling.

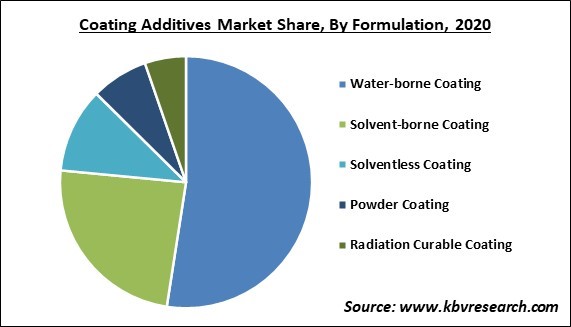

Based on the formulation, the coating additives market is divided into Water-borne Coating, Solvent-borne Coating, Solventless Coating, and Powder Coating. In 2020, the water-borne coating segment obtained the largest revenue share of the coating additives market. The growth of this segment is increasing due to the increasing utilization of water-borne coating. The utilization of water-borne coating is increasing due to the attribute that this technology comprises lesser odor, enhanced durability, stable color, and low availability of VOC.

Based on the End-user, the coating additives market is classified into Architectural, Industrial, Automotive, Wood & Furniture, and Others. In 2020, the automotive segment followed the architectural segment by holding the second largest revenue share of the coating additives market. The increasing utilization of coating additives across the automotive industry due to its property of preventing corrosion and offering a more tractive finish to the vehicle is majorly contributing to increasing the growth of this segment across the market.

Based on the Function, the Coating additives market is segregated into Anti-foaming, Wetting & Dispersion, Rheology modification, Biocides, and Impact Modification. In 2020, the anti-foaming segment accounted for a significant revenue share of the coating additives market. The rising growth of this segment of the market is a result of its property of eliminating the formation of foam in the solution. This feature allows the customer to eliminate the disruption that is caused by the occurrence of foam while preparing the solution.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 8.7 Billion |

| Market size forecast in 2027 | USD 11.8 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.8% from 2021 to 2027 |

| Number of Pages | 316 |

| Number of Tables | 534 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Formulation, Function, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the region, the coating additives market is analyzed across North America, Europe, APAC, and LAMEA. In 2020, the coating additives market was dominated by APAC as the region accounted for the largest revenue share of the market. The increase in the growth of the market across this region is owing to multiple factors viz. rising disposable income of people of countries across the region along with a stable economy as well as constantly rising living standards of the population of this region.

Free Valuable Insights: Global Coating Additives Market size to reach USD 11.8 Billion by 2027

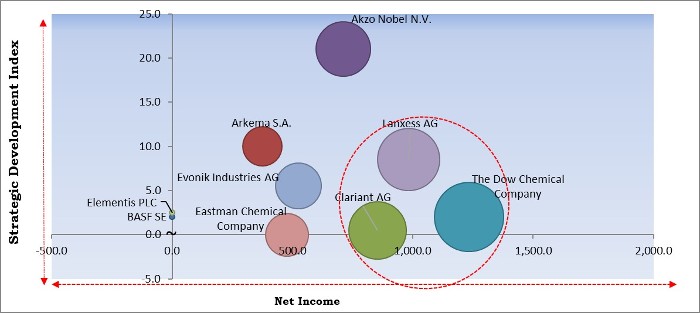

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; The Dow Chemical Company, Lanxess AG and Clariant AG are the forerunner in the Coating Additives Market. Companies such as BASF SE, Arkema S.A., Evonik Industries AG are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Akzo Nobel N.V., The Dow Chemical Company, BASF SE, Arkema S.A., Evonik Industries AG (RAG-Stiftung), Momentive Performance Materials, Inc., Lanxess AG, Eastman Chemical Company, Clariant AG, and Elementis PLC.

By Type

By Formulation

By End Use

By Geography

The coating additives market size is projected to reach USD 8.2 billion by 2027.

The increasing popularity of Architectural Application of Coating Additives are driving the market in coming years, however, Additives are restricted in solvent-based paints and coatings due to rigorous regulations have limited the growth of the market.

Akzo Nobel N.V., The Dow Chemical Company, BASF SE, Arkema S.A., Evonik Industries AG (RAG-Stiftung), Momentive Performance Materials, Inc., Lanxess AG, Eastman Chemical Company, Clariant AG, and Elementis PLC.

The Architectural market is generating high revenue in the Global Coating Additives Market by End Use 2020, thereby, achieving a market value of $4.2 billion by 2027.

The Solventless Coating market has high growth rate of 6% during (2021 - 2027).

The Asia Pacific market region is leading the market in the Global Coating Additives Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.