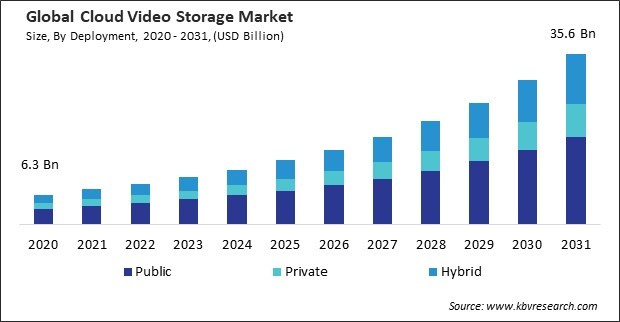

The Global Cloud Video Storage Market size is expected to reach $35.6 billion by 2031, rising at a market growth of 17.5% CAGR during the forecast period.

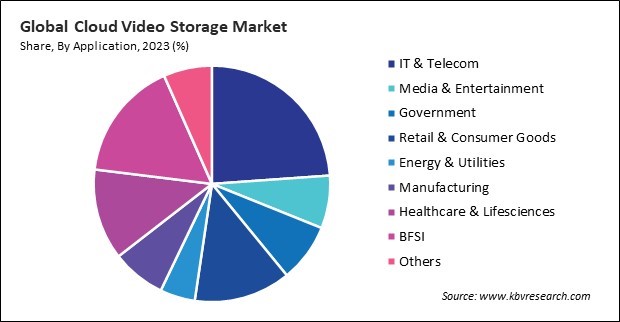

The demand for cloud video storage in the IT & telecom sector is propelled by the sector's increasing reliance on remote work, data security compliance requirements, scalability and flexibility needs, innovation, and the pursuit of competitive advantage. Thus, the IT & telecom segment captured 23.8% revenue share in the market 2023. Cloud video storage provides the scalability and flexibility needed to accommodate the sector's evolving storage needs without significant upfront investment in hardware.

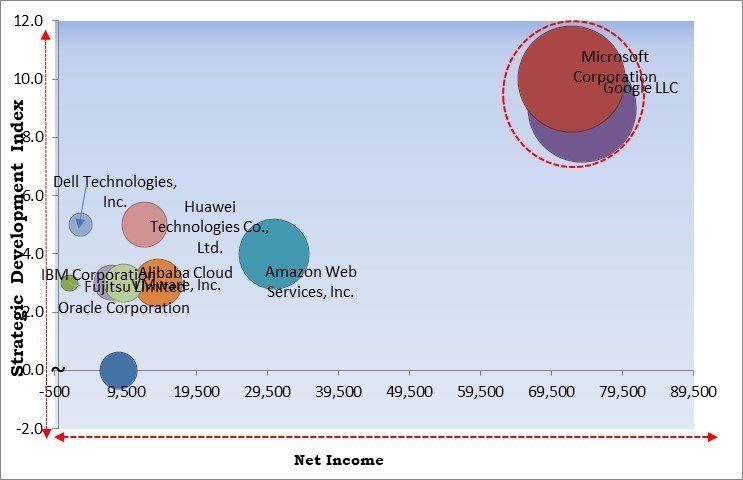

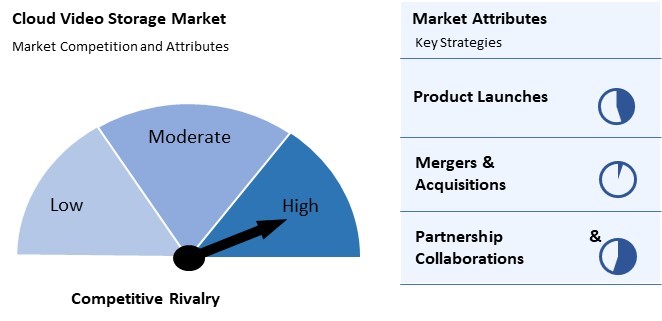

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Google LLC came into partnership with Salesforce Inc., an American cloud-based software company. Through this partnership, Google LLC aims to provide customers with enhanced bidirectional integrations, enabling them to combine context from both Salesforce and Google Workspace seamlessly. Additionally, this integration will encompass various Google Workspace tools such as Google Calendar, Docs, Meet, Gmail, and more. In February 2024, Dell Technologies, Inc. came into partnership with Nokia Corporation, a Finnish multinational telecommunication, information technology, and consumer electronics corporation. Through this partnership, Dell would develop open network architectures within the telecommunications ecosystem and explore private 5G applications for businesses.

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC and Microsoft Corporation are the forerunners in the Cloud Video Storage. In September, 2023, Amazon Web Services, Inc. came into partnership with Anthropic, an American artificial intelligence startup company. Through this partnership, Amazon Web Services, Inc. would combine their industry-leading technology and expertise in secure generative artificial intelligence (AI) to expedite the advancement of Anthropic's forthcoming foundational models, ensuring broad accessibility to AWS customers. Companies such as Amazon Web Services, Inc. VMware, Inc., and Huawei Technologies Co., Ltd. are some of the key innovators in Cloud Video Storage Market.

Businesses and organizations increasingly use video surveillance systems to enhance security and monitor their premises, assets, and operations. With increasing security threats, businesses and organizations seek ways to enhance security measures.

Additionally, the marketing industry has experienced a significant shift towards video content, with half the marketing professionals worldwide using videos on Facebook for marketing purposes. Additionally, TikTok and YouTube are well-known platforms for marketing videos. Thus, the rise in video content creation across various platforms has significantly increased the demand for cloud video storage solutions.

Organizations, especially those dealing with sensitive video content, often hesitate to adopt it due to fears of data breaches and unauthorized access. This reluctance stems from the fact that once data is stored in the cloud, it is no longer physically under the organization's control, raising concerns about the security and privacy of their data.

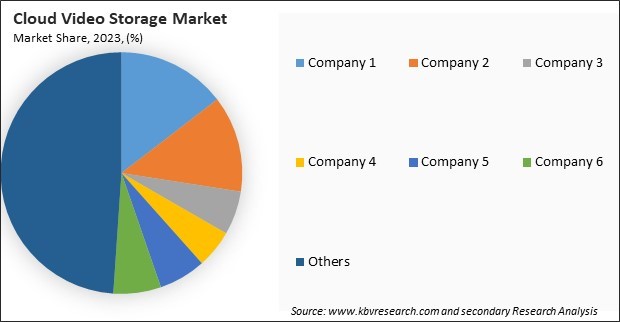

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges On the basis of application, the market is classified into BFSI, IT & telecom, government, manufacturing, energy & utilities, healthcare & life sciences, retail & consumer goods, media & entertainment, and others. The BFSI segment recorded 16.4% revenue share in the cloud video storage market in 2023. BFSI institutions increasingly use video content to engage customers, provide personalized services, and deliver financial education.

Based on deployment, the market is characterized into public, private, and hybrid. The hybrid segment procured 28.2% growth rate in the market in 2023. Organizations can store their video content across public cloud services and private, on-premises infrastructure in a hybrid cloud video storage setup.

Free Valuable Insights: Global Cloud Video Storage Market size to reach USD 35.6 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired 27.9% revenue share in the market in 2023. Rapid digital transformation is occurring in a number of Asia-Pacific nations, resulting in a surge in the implementation of cloud technologies.

The market for cloud video storage is fiercely competitive, with key players such as Amazon Web Services (AWS), Google LLC, Microsoft Corporation, IBM Corporation, for market share. These providers offer a range of solutions tailored to the needs of consumers and businesses, competing on attributes such as scalability, reliability, cost-effectiveness, security, performance, and integration.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 10 Billion |

| Market size forecast in 2031 | USD 35.6 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 17.5% from 2024 to 2031 |

| Number of Pages | 236 |

| Number of Tables | 323 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Deployment, Application, Region |

| Country scope |

|

| Companies Included | Google LLC (Alphabet Inc.), Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, Microsoft Corporation, Dell Technologies, Inc., VMware, Inc. (Broadcom Inc.), IBM Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Fujitsu Limited, Alibaba Cloud (Alibaba Group Holding Limited) |

By Deployment

By Application

By Geography

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.