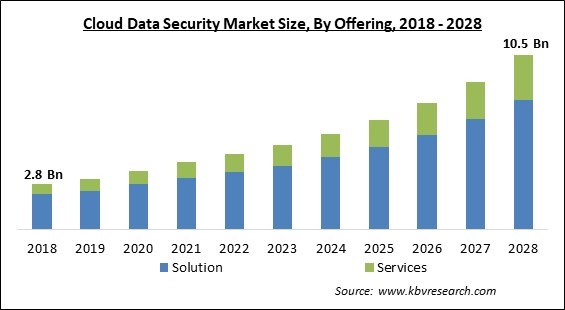

The Global Cloud Data Security Market size is expected to reach $10.5 billion by 2028, rising at a market growth of 15.1% CAGR during the forecast period.

Cloud data security refers to the policies, technology, services, and security controls that safeguard any cloud-stored data from loss, leakage, or misuse caused by breaches, exfiltration, and unauthorized access. A solid cloud data security plan must include assuring the security and confidentiality of data across networks and within apps, containers, workloads, and other cloud environments, regulating access to data for all users, devices, and software, and offering total visibility into all network data.

The protection and security policy for cloud data must also safeguard all forms of data. This consists of using the user access control and authentication to protect data utilized by an application or endpoint. Using encryption and other email and message security measures to ensure the secure transmission of sensitive, confidential, or proprietary data as it travels across a network. Protecting data on any network location, including the cloud, using access controls and user authentication.

To protect their data, enterprises must develop a comprehensive cybersecurity strategy that tackles cloud-specific data threats. Some of the key components of a robust cloud data security strategy are the utilization of sophisticated encryption techniques. Encryption is an excellent method for safeguarding data. Before entering the cloud, cloud encryption converts data from plain text to an unreadable format. It is advised that data should be encrypted during both transmission and storage. Cloud service providers offer varied out-of-the-box encryption features for data saved in object and block storage systems. HTTPS/TLS connections should be used to connect to cloud storage providers to maintain data security in transit.

The outbreak of COVID-19 is anticipated to result in a substantial expansion of this market. This is due to the significant acceleration in cloud data security solutions deployment, which is supported by the rise in cloud-based solution adoption. The SaaS model is anticipated to alter the operating model of the firm. As a result of the impact of COVID-19 on corporate operations, the use of containers is projected to rise, driving demand for robust security solutions. The increasing demand for a hybrid cloud can be ascribed to the cloud's scalability and seamless customer experience. In addition, serverless computing is likely to drive market expansion.

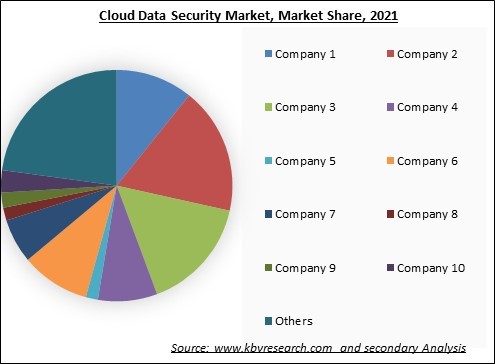

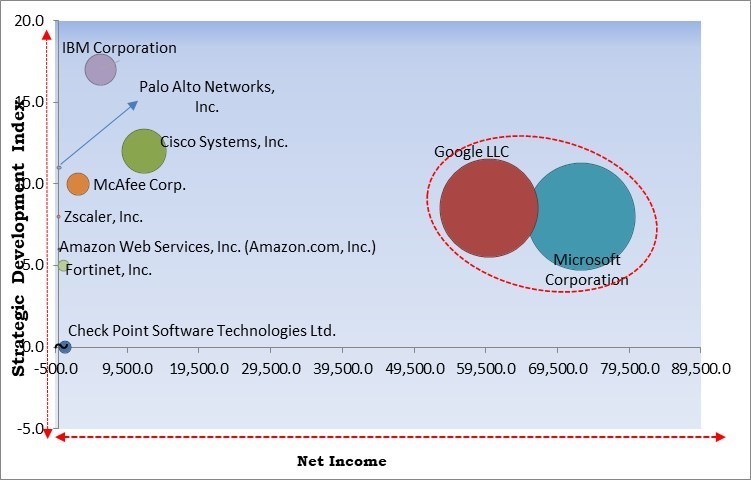

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

SMEs have been increasingly receptive to adopting cloud-based security solutions, and cloud-based security service providers can capitalize on this trend by offering organizations customized security services. As SMEs change their focus to cloud-based solutions, cloud-based data protection solutions and service providers are anticipated to encounter substantial growth prospects, such as protecting SMEs' data from security breaches and vulnerabilities. Hence with the broader adoption of cloud data security by SMEs due to the increasing cyber-attacks, the market's growth is expected to surge.

Businesses encourage employees to bring their own devices to work, reducing system investments. BYOD permits employees to work from any location. Since the devices are connected to the company's network, they can access the information. Additionally, the expanding BYOD policy has led businesses to provide cloud. In logistics, for instance, the employer shares data with various vendors. This element increases the likelihood of data breaches, making cloud data security even more crucial, as many businesses prefer cloud-based systems. Increased enterprise adoption of bring-your-own-device (BYOD) policies and the technological advancements will increase the chances of cyber-attacks, boosting the expansion of the cloud data security market over the forecast period.

Large and small businesses are getting cautious about shifting their operations to the cloud because they do not fully trust Cloud Service Providers (CSPs). This lack of trust results from unclear Service Level Agreements (SLAs) and security or privacy policies, conventional terms and conditions, the immaturity of cloud services, data breaches, and numerous other difficulties. This makes the infrastructure of a cloud service provider very susceptible to frequent and complicated assaults, which can discourage businesses from entrusting their sensitive data to these service providers.

Based on offering, the cloud data security market is segmented into solution and services. The solution segment dominated the cloud data security market with maximum revenue share in 2021. This is due to the increased demand for cloud security solutions as more enterprises are adopted these solutions to facilitate remote work. They provide enhanced flexibility, security, data integration, and scalability. A solid cloud security solution safeguards the entire data lifecycle, from creation to disposal.

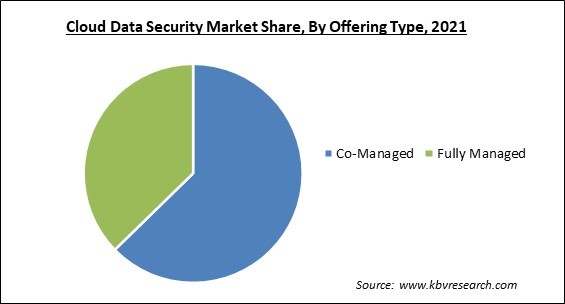

By offering type, the cloud data security market is classified into fully managed and co-managed. The fully managed segment procured a significant revenue share in the cloud data security market in 2021. This is because it provides all AI Cloud capabilities in a fully managed cloud environment that includes infrastructure provisioning, scalability, and software updates. They employ a multilayered approach to cyber security that provides numerous independent lines of defense against cyber threats. Also, fully managed services allow clients to focus on AI creation, expansion, and innovation. These features of the fully managed type are anticipated to boost the segment’s expansion.

Based on the organization size, the cloud data security market is bifurcated into large enterprises and SMEs. The large enterprises segment witnessed the largest revenue share in the cloud data security market in 2021. This is because large businesses are expanding their infrastructure to suit the requirements and new demands of their remote workforce. Businesses must provide infrastructure support for their services and products. Cybersecurity is crucial because it protects persons and companies from cyber threats. In addition, cybersecurity can aid in preventing data breaches, identity theft, and other cybercrimes.

On the basis of vertical, the cloud data security market is classified into BFSI, retail & ecommerce, government & defense, healthcare & life sciences, IT & telecom, manufacturing and others. The IT & telecom segment recorded a prominent revenue share in the cloud data security market in 2021. This is because IT firms are progressively prioritizing the usage of cloud data security services and solutions as BYOD and telecommuting become more prevalent. Also, object storage breaches, unauthorized traffic to a virtual server instance, unauthorized access to database services, IAM rights, user logins, and unauthorized API requests are on the rise due to cloud misconfiguration.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.1 Billion |

| Market size forecast in 2028 | USD 10.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.1% from 2022 to 2028 |

| Number of Pages | 281 |

| Number of Table | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Offering Type, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the cloud data security market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the cloud data security market by generating the maximum revenue share in 2021. This is due to the presence of a significant number of providers, resulting in the high adoption of cloud data security solutions in the region. Increasing security breaches, expanding adoption of cloud technology by businesses, and rising migration to the cloud are driving growth in this area's cloud data security market. In addition, the expansion of cloud data security solutions in the region results from the rise of digitization, growing security concerns, and the desire to protect assets.

Free Valuable Insights: Global Cloud Data Security Market size to reach USD 10.5 Billion by 2028

The major strategy followed by the market participants is Acquisition. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Cloud Data Security Market. Companies such as Cisco Systems, Inc., McAfee Corp., and IBM Corporation are some of the key innovators in Cloud Data Security Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC (Alphabet, Inc.), Cisco Systems, Inc., McAfee Corp., Microsoft Corporation, Palo Alto Networks, Inc., Zscaler, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., and IBM Corporation.

By Offering

By Offering Type

By Organization Size

By Vertical

By Geography

The global Cloud Data Security Market size is expected to reach $10.5 billion by 2028.

Increasing risk of cyber-attacks are driving the market in coming years, however, Low trust and awareness regarding cloud-based systems restraints the growth of the market.

Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC (Alphabet, Inc.), Cisco Systems, Inc., McAfee Corp., Microsoft Corporation, Palo Alto Networks, Inc., Zscaler, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., and IBM Corporation.

The Co-Managed segment acquired maximum revenue share in the Global Cloud Data Security Market by Offering Type in 2021 thereby, achieving a market value of $6.9 billion by 2028.

The BFSI segment is leading the Global Cloud Data Security Market by Vertical in 2021 thereby, achieving a market value of $2.8 billion by 2028.

The North America market dominated the Global Cloud Data Security Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.