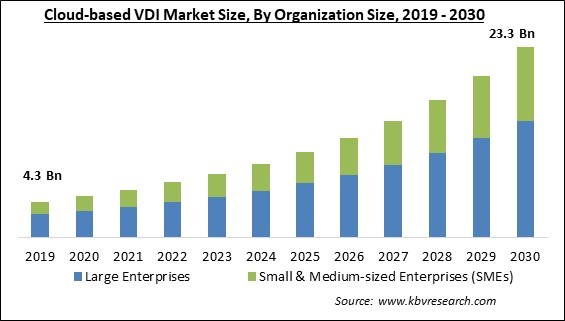

The Global Cloud-based VDI Market size is expected to reach $23.3 billion by 2030, rising at a market growth of 17.0% CAGR during the forecast period.

Asia-Pacific's growth has been driven by a rapid shift towards digital empowerment and the dominance of ICT in the region's landscape, with mobile communication and internet penetration yielding particularly lucrative returns. Consequently, Asia Pacific region registered $1,912.5 million revenue in the market in 2022. Government-implemented initiatives and programs also aid in the growth of cloud adoption. Asia-Pacific nations such as India and Japan are flourishing in cloud technology as the region endeavors for cloud competency with increasing businesses. Some of the factors impacting the market are rapid adoption of remote work and mobility, acceleration in the development of cloud computing, and infrastructure constraints.

The increasing trend of employees working from remote locations after COVID and the requirement for seamless access to the workplace from any device has driven up the demand for cloud-based VDI solutions. Due to the pandemic, more than half of the American workforce now works remotely. Cloud-based VDI solutions are widely adopted to boost the use of IT and control systems between virtual desktop administrators, especially IoT and other digital technologies. Cloud-based VDI allows employees to connect to virtual desktops, applications, and data from anywhere with internet access. Cloud computing provides the fundamental framework and resources necessary for supplying virtual desktops to end-users, which makes it an indispensable enabling technology for cloud-based VDI solutions. This is because many end-users are committing to implement cloud-based virtual desktop solutions as part of a digital transformation initiative. As a result of the factors above, the market will likely experience substantial growth during the forecast period.

However, most of an enterprise's key business processes are now controlled through the cloud, website server downtime is a significant problem for businesses. Website server downtime is defined as the absence of, inability to access, or sluggish access to a website. Among the problems, businesses are having include delayed online access, cyberattacks, website traffic saturation, etc. The development of the market throughout the projection period may be hampered by these infrastructure problems.

Based on organization size, the market is divided into small & medium-sized enterprises (SMEs) and large enterprises. In 2022, the large enterprises segment dominated the market with the maximum revenue share. This is due to the increased adoption of cloud computing by large organizations to take advantage of its scalability. Additionally, complex IT infrastructure and the requirement for efficient remote workforce administration contribute to expanding the large enterprise segment's growth outlook.

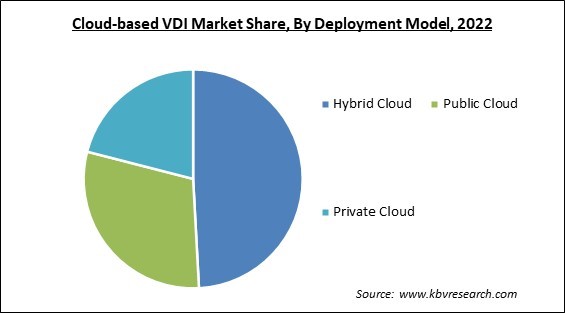

On the basis of deployment model, the market is segmented into private, public, and hybrid clouds. The public cloud segment garnered a significant revenue share in the market in 2022. This allows businesses to utilize greater scalability, flexibility, and cost-effectiveness. Additionally, the public cloud enables businesses to set up virtual desktops in the cloud and remotely access them. Due to these benefits, the market is estimated to expand in this segment.

By end-user, the market is segmented into BFSI, government, healthcare, IT & telecom, education, and others. In 2022, the BFSI segment registered the highest revenue share in the market. Due to rising security concerns, cybersecurity is essential in the BFSI industry in order to safeguard valuable consumer assets and data. Cloud-based VDI offers centralized data management and control, lowering the risk of data breaches and assuring regulatory compliance.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6.7 Billion |

| Market size forecast in 2030 | USD 23.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 17% from 2023 to 2030 |

| Number of Pages | 242 |

| Number of Table | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Organization Size, Deployment Model, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed in North America, Europe, Asia-Pacific, and LAMEA. In 2022, the North America region witnessed the largest revenue share in the market. This results from the region's rapid economic expansion and increasing investments in digitalization and internet access. The increasing demand for a flexible work environment and the widespread adoption of cloud technologies in the region are factors in the market's growth. In addition, the development of the regional industry is supported by the prominent market participant's steady enhancements to VDI solutions.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hewlett Packard Enterprise Company, Citrix Systems, Inc. (Cloud Software Group, Inc.), Cisco Systems, Inc., Microsoft Corporation, Dell Technologies, Inc., Rackspace Technology, Inc., Amazon.com, Inc., VMware, Inc., NComputing Co., Ltd., IBM Corporation

Free Valuable Insights: Global Cloud-based VDI Market size to reach USD 23.3 Billion by 2030

By Organization Size

By Deployment Model

By End User

By Geography

The Market size is projected to reach USD 23.3 billion by 2030.

Acceleration in the Development of Cloud Computing are driving the Market in coming years, however, Infrastructure Constraints restraints the growth of the Market.

Hewlett Packard Enterprise Company, Citrix Systems, Inc. (Cloud Software Group, Inc.), Cisco Systems, Inc., Microsoft Corporation, Dell Technologies, Inc., Rackspace Technology, Inc., Amazon.com, Inc., VMware, Inc., NComputing Co., Ltd., IBM Corporation

The Hybrid Cloud segment is leading the Market by Deployment Model in 2022; thereby, achieving a market value of $11.0 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $7.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.