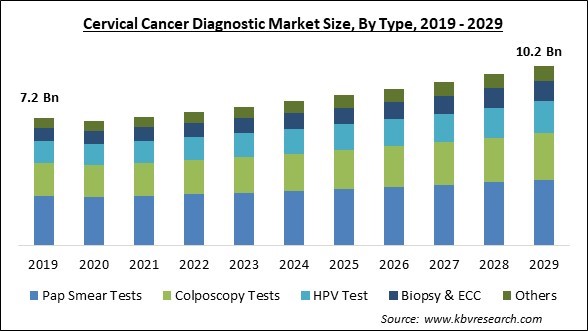

The Global Cervical Cancer Diagnostic Market size is expected to reach $10.2 billion by 2029, rising at a market growth of 4.4% CAGR during the forecast period.

Asia Pacific is the promising region for cervical cancer diagnostic because rise in the prevalence of obesity among women, an increase in instances of hazardous sexual behavior, particularly among adolescents, and an increase in the number of diverse strategies and trends adopted by market participants. Hence, APAC generated $1,929.4 million revenue in the market in 2022. Numerous public-private partnerships, rising R&D efforts, and strategic initiatives by market participants are creating opportunities for the market in the region.

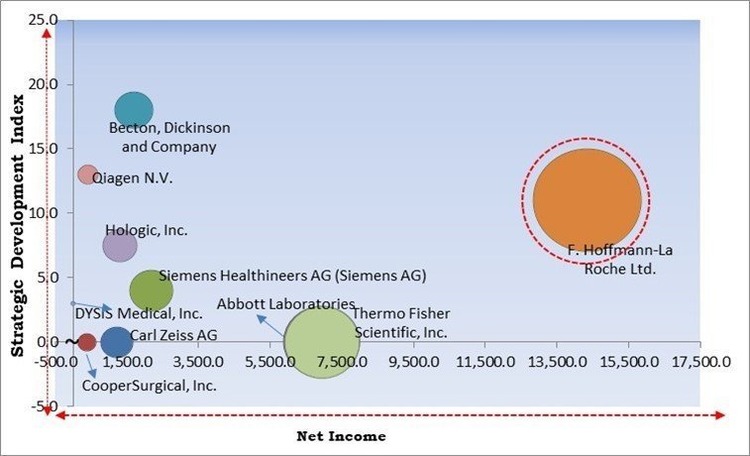

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance,In July 2021, QIAGEN partnered with Sysmex Corporation for developing cancer companion diagnostics by utilizing Qiagen's expertise and Sysmex’s Plasma-Safe-SeqS technology. The partnership provides the company with NGS capabilities and would allow the company to serve its partners in a better way. Additionally, In August 2022, Becton, Dickinson, and Company announced a partnership with LabCorp for developing and selling flow cytometry-based companion diagnostics (CDx). The partnership allows BD to serve its customers in a better way by providing solutions for cancer diagnostics.

Based on the Analysis presented in the KBV Cardinal matrix; F. Hoffmann-La Roche Ltd. is the forerunner in the Market. In May 2023, Roche Diagnostics signed an agreement with Cancer Awareness Prevention and Early Detection Trust (CAPED) for improving the situation of cervical cancer in India. The partnership is part of Roche's efforts to enhance cancer care around the world. Companies such as Abbott Laboratories, Thermo Fisher Scientific, Inc., Becton, Dickinson and Company are some of the key innovators in Market.

Healthcare expenditures have increased globally as disposable income has risen in various countries. In addition, government bodies and healthcare organizations are accelerating healthcare expenditures to meet population requirements. As cervical cancer has become increasingly prevalent in recent years, the increase in healthcare expenditures enables healthcare institutions to enhance their diagnostic and therapeutic facilities for the disease. In addition, key market participants' strategic initiatives will provide structural integrity and future growth opportunities for the market.

If detected early and managed effectively, cervical cancer is one of the most successfully treatable forms once diagnosed. Late-stage cancers can also be controlled with the correct treatment and palliative care. Cervical cancer can be eliminated within a single generation if enough measures are taken in prevention, screening, and treatment. Several advanced laboratory tests, instruments, and procedures that evaluate abnormal cells and strains of the human papillomavirus (HPV) are used to diagnose cervical cancer. Consequently, the growing incidence of cervical cancer and its treatability following early diagnosis will increase the demand.

By 2035, there will likely be a shortage of 12.9 million healthcare workers, an increase from the 7.2 million that exist today. According to recent WHO research, the lack of healthcare workers might have a catastrophic impact on the health of billions of people worldwide if prompt actions are not taken. One reason contributing to this situation is the aging of the workforce, which causes retirements or leaves for higher-paying employment without comparable replacements. Additionally, the sector lacks fresh hires and offers inadequate training. The identification and treatment of illnesses like cervical cancer would be significantly impacted by a global scarcity of healthcare experts, which would impede the market growth.

Based on type, the market is segmented into pap smear tests, HPV test, biopsy & ECC, colposcopy tests and others. The pap smear tests segment dominated the market with maximum revenue share in 2022. This is because more people are using Pap smear tests to diagnose cervical cancer. The Pap test aids in identifying abnormal cervix cells that may later progress to cancer. Due to this test's great efficiency, it makes up the majority of the shares. Additionally, this segment is growing as early diagnosis is becoming increasingly popular.

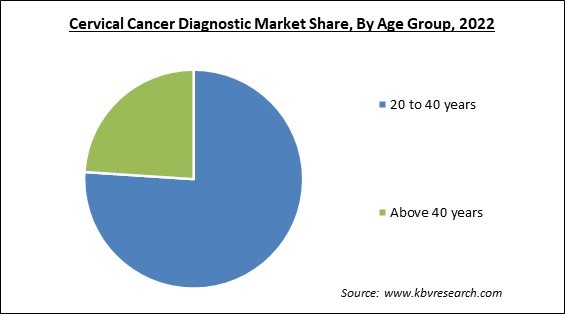

On the basis of age group, the market is divided into 20 to 40 years and above 40 years. The above 40 years segment procured a substantial revenue share in the market in 2022. This is owing to the increased government support for cervical cancer diagnosis. Many elderly women are unaware that the risk of developing cervical cancer persists with age, increasing the demand and importance of diagnosis. In addition, approximately one-fifth of cervical cancer cases are diagnosed in women aged 65 and older, propelling the segment's expansion.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 7.6 Billion |

| Market size forecast in 2029 | USD 10.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 4.4% from 2023 to 2029 |

| Number of Pages | 182 |

| Number of Table | 275 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Age Group, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed the largest revenue share in the market in 2022. This is due to the increasing number of patients utilizing cervical cancer diagnosis services in hospitals, an increase in the number of market participants, joined with the rising availability of products in the region. In addition, the large market share is attributable to the high level of disease prevention awareness among women in the region, as well as the numerous initiatives introduced to prevent cervical cancer, which has expanded insurance coverage for cervical screening tests, particularly for low-income women, which is aiding the market growth in the region.

Free Valuable Insights: Global Cervical Cancer Diagnostic Market size to reach USD 10.2 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Becton, Dickinson and Company, Carl Zeiss AG, CooperSurgical, Inc. (The Cooper Companies, Inc.), DYSIS Medical, Inc., F. Hoffmann-La Roche Ltd., Hologic, Inc., Qiagen N.V., Siemens Healthineers AG (Siemens AG) and Thermo Fisher Scientific, Inc.

By Type

By Age Group

By Geography

The Market size is projected to reach USD 10.2 billion by 2029.

Rising cases of cervical cancer are driving the Market in coming years, however, A lack of qualified medical personnel restraints the growth of the Market.

Abbott Laboratories, Becton, Dickinson and Company, Carl Zeiss AG, CooperSurgical, Inc. (The Cooper Companies, Inc.), DYSIS Medical, Inc., F. Hoffmann-La Roche Ltd., Hologic, Inc., Qiagen N.V., Siemens Healthineers AG (Siemens AG) and Thermo Fisher Scientific, Inc.

The expected CAGR of this Market is 4.4% from 2023 to 2029.

The 20 to 40 years segment acquired maximum revenue share in the Market by Age Group in 2022 thereby, achieving a market value of $7.6 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $3.9 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.