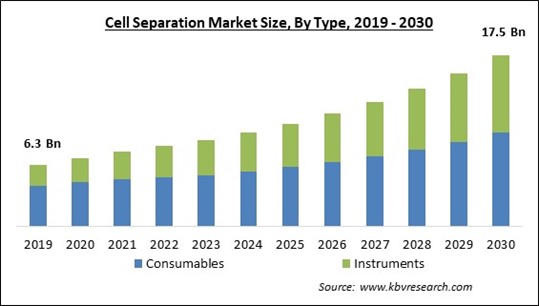

The Global Cell Separation Market size is expected to reach $17.5 billion by 2030, rising at a market growth of 10.2% CAGR during the forecast period.

Several stem cell & gene therapy research projects are ongoing in Japan, China, and South Korea. Hence, the Asia Pacific region captured $2,143.9 million revenue in 2022. Cell separation is a crucial stage in the development of cell-based therapies. Government agencies from all over the world have provided funding for cell-based research because it is essential for many applications. A rise in healthcare expenditure and an increase in the market penetration of major global participants in crucial Asia Pacific countries drives the growth of the market.

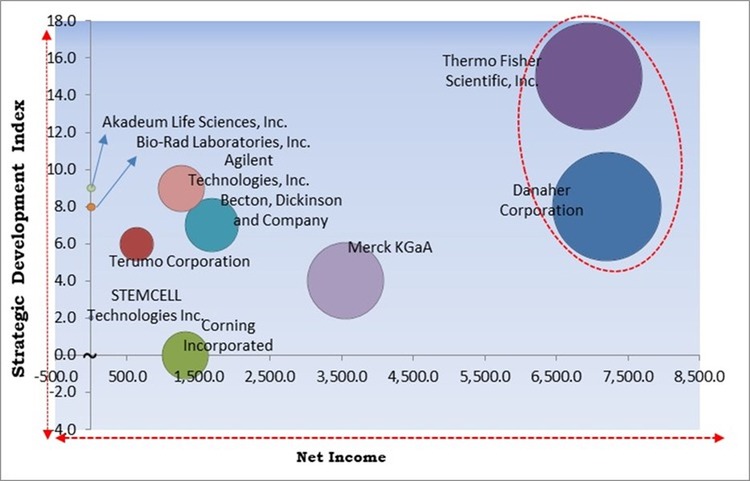

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In March, 2023, Agilent Technologies Inc. enhanced capabilities of Cell Analysis Workflow Automation by integrating xCELLigence RTCA HT, to enables researchers to analyze up to eight 384-well E-Plates, enhancing throughput and decreasing sample sizes. Additionally, In May, 2023, Akadeum Life Sciences introduced Human T Cell Activation & Expansion Positive Selection Kit, Microbubble Leukopak Human T Cell Isolation Kit, and Microbubble Leukopak Human PBMC Isolation Kit, the series of products for cell therapy research and development.

Based on the Analysis presented in the KBV Cardinal matrix; Thermo Fisher Scientific, Inc. and Danaher Corporation are the forerunners in the Market. In October, 2022, Thermo Fisher Scientific Inc. introduced Gibco CTS DynaCellect Magnetic Separation System, the advanced cell isolation, cell activation, cell depletion, and Dynabeads magnetic beads removal instrument, to help cell therapy developers simply move from process and clinical development to commercial manufacturing. Companies such as Merck KGaA, Becton, Dickinson and Company and Agilent Technologies, Inc. are some of the key innovators in the Market.

The pandemic caused global supply chains to become disrupted, which had an impact on the manufacturing and delivery of lab supplies, reagents, and consumables used in cell separation processes. Delays or shortages of crucial materials may have hampered applications in science and medicine. Lockdowns, social segregation policies, and capacity limitations hampered regular operations in research institutions and laboratories. Numerous researchers had difficulties getting to their labs or running experiments, which may have impacted their work utilizing cell separation technology. Future in creating cutting-edge cell-based medicines and ongoing innovation in the market are estimated to support the market’s growth.

Chronic diseases like diabetes, obesity, arthritis, heart conditions, and cancer are on the rise due to increased sedentary lifestyles, aging of the world population, increased cigarette & alcohol use, and other causes. The Imperial College London in 2020 estimated that the chronic illnesses will account for about 41 million deaths yearly or seven out of ten fatalities globally. Nearly 17 million deaths are considered premature, with the average person passing away younger than anticipated. Owing to this, as the burden of chronic diseases increases, so does the need for cellular therapies. As a result of the rising prevalence of chronic diseases, the market is estimated to grow significantly during the projection period.

The prevalence of chronic diseases, including cancer and neurological problems, is higher among the elderly than the younger population. In addition, the elderly population is expanding swiftly compared to younger people. As the population over 65 grows, it is expected that diseases like Alzheimer's, dementia, cancer, and immunological disorders will become increasingly common. According to the United Nations, the population of people over 60 is predicted to double by 2050 and triple by 2100, going from 962 million in 2017 to 2.1 billion in 2050 and 3.1 billion in 2100. As a result, the need for cell separation will grow as result of the rising aging population.

The market faces a significant obstacle in developing cell therapies, necessitating isolation and manipulation of specific therapeutic cell types. It is challenging to separate and purify particular cell populations because different cell types have varied properties and roles. A diverse population of cells may be produced as a result, which may lessen the efficacy of the therapy. To be employed in therapies, isolated cells must be functioning and viable. Additionally, the cost of equipment and devices required for cell separation techniques is considerably high, decreasing their use in facilities with less financial aid. These barriers to the development of cell treatments represent significant market challenges overall. In light of this, the market may witness slow growth in the upcoming years.

By product type, the market is classified into consumables and instruments. The instruments segment covered a considerable revenue share in the market in 2022. Companies have started developing sustainable technologies to acquire a competitive edge in the market which is supporting segment’s growth. For instance, Element Biosciences revealed information about future Aviti DNA sequences in March 2022. The product is anticipated to be a new benchtop instrument since the manufacturer claims it can reduce reagent consumption and cut costs significantly.

Under consumables, the market is categorized into reagents, kits, media, & sera, beads, and disposables. In 2022, reagents, kits, media, & sera witnessed the largest revenue share in the market. Targeting certain cell types or markers, reagents and kits made for cell separation are very specialized. The quality of the isolated population is improved and contamination from other cell types is reduced thanks to this specificity, which also ensures that the required cells are accurately isolated. Companies that create medium, sera, kits, and reagents for cell separation often have specific knowledge in the industry. Their expertise and assistance can help researchers troubleshoot problems and improve their cell separation techniques.

Under instruments, the market is segmented into centrifuges, flow cytometers, filtration systems, and magnetic-activated cell separator systems. In 2022 the centrifuges segment dominated the with maximum revenue share. One of the most significant procedures is centrifugation. The most popular cell separation techniques are differential centrifugation and density gradient centrifugation. Many scientific and biochemical research require the ability to isolate subcellular components, such as organelles (such as mitochondria, nuclei), and cellular macromolecules (such as proteins, RNA, and DNA). This is made possible by centrifugation.

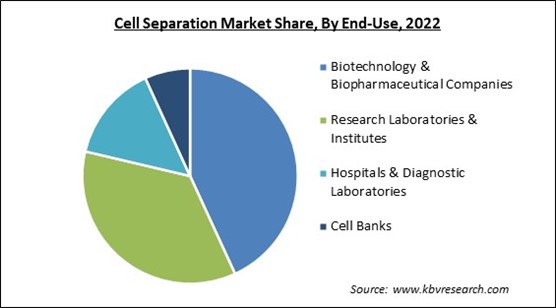

Based on end-use, the market is segmented into research laboratories & institutes, hospitals & diagnostic laboratories, cell banks, and biotechnology & biopharmaceutical companies. In 2022, the research laboratories and institutes segment covered a considerable revenue share in market. This can be ascribed to the growing R&D efforts by research institutions to develop novel oncology and neuroscience therapies. The expansion of research facilities and labs around the world is also projected to be a critical factor in the segment's growth.

Based on cells type, the market is divided into human cell and animal cell. In 2022, the human cell segment projected a prominent revenue share in the market. One of the main drivers driving its highest share is the growing emphasis on human and cancer research and the various uses of isolated human cells in biopharmaceutical development, clinical trials, and research. In addition, favorable reimbursement policies for personalized medicine in developed nations increase the demand for human cell isolation.

On the basis of technique, the market is bifurcated into centrifugation, surface marker, and filtration. The surface maker segment acquired a substantial revenue share in the market in 2022. Surface markers separation is dividing cells or tissues according to their surface markers. The molecules unique to a particular cell or tissue type can be proteins, carbohydrates, lipids, or others. This procedure allows scientists to distinguish and isolate specific cell or tissue types from a mixture.

By application, the market is fragmented into biomolecule isolation, cancer research, stem cell research, tissue regeneration, in vitro diagnostics, and therapeutics. The cancer research segment acquired a substantial revenue share in the market in 2022. Growing investment in cell-based research by businesses and academic institutions is a major factor behind the segment's expansion. Due to the rising global incidence of cancer, numerous public-private organizations are investing significantly in cancer research, thereby driving the demand for innovative cell separation solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 8.2 Billion |

| Market size forecast in 2030 | USD 17.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.2% from 2023 to 2030 |

| Number of Pages | 444 |

| Number of Table | 743 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Cells Type, Technique, Application, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. This can be attributed to the fact that the pharmaceutical and biotech industries are well-established in the United States. Also, the country has a high acceptance rate for cutting-edge technologies. Substantial demand for cell separation technologies has also been generated by the extensive research activities conducted by research universities in cell treatments across the region.

Free Valuable Insights: Global Cell Separation Market size to reach USD 17.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, Merck KGaA, Danaher Corporation, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Corning Incorporated, Terumo Corporation, STEMCELL Technologies, Inc. and Akadeum Life Sciences, Inc.

By Product Type

By End-Use

By Cells Type

By Technique

By Application

By Geography

The Market size is projected to reach USD 17.5 billion by 2030.

The aging population is driving up demand for clinical trials & research are driving the Market in coming years, however, Challenges in developing cell-therapies restraints the growth of the Market.

Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, Merck KGaA, Danaher Corporation, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Corning Incorporated, Terumo Corporation, STEMCELL Technologies, Inc. and Akadeum Life Sciences, Inc.

The Biotechnology & Biopharmaceutical Companies segment is leading the Market by End-Use in 2022; thereby, achieving a market value of $7.2 Billion by 2030.

The Centrifugation segment acquired highest revenue in the Market by Technique in 2022; thereby, achieving a market value of $8.7 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $6.7 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.