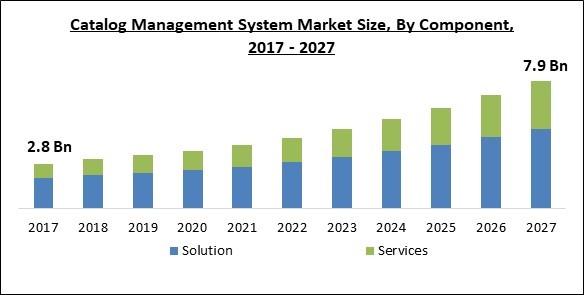

The Global Catalog Management System Market size is expected to reach $7.9 billion by 2027, rising at a market growth of 12.4% CAGR during the forecast period.

Over the projected period, a sharp rise in consumer demand for services and items such as fashion and clothing and electronic gadgets, as well as expanding internet penetration and growing smartphone use, are expected to fuel market expansion. Following the COVID-19 pandemic, demand for catalogue management systems is predicted to soar as large and small businesses alike transfer their IT infrastructure to cloud networks in order to boost and improve company operations.

Catalog management is described as the act of organizing items in the desired way in order to provide consistent and high-quality data throughout all sales channels. Catalog management entails defining different catalogues depending on a variety of criteria. These catalogues must be descriptive and consistent. Product names, hierarchy, descriptions, pricing, and other associated characteristics are all part of online catalogue administration. Color, pattern, style, and fit are all details that must be exact in order for shoppers to be guided to the proper product. A catalogue management system assists in the creation and modification of catalogues, as well as the pricing of items.

It is utilized to keep product information organized and structured, making it easier for consumers and channel partners to grasp the benefits of the product. Brands are currently delivering a plethora of new products which are both short-lived and reliant on several channels. It's challenging for brands to ensure the integrity of their product data throughout all platforms and channels. Catalogs are a vital part of every business since they provide a list of items for sale as well as information on shipping and availability.

Rising consumer demand for items, expanding internet access, and increasing smartphone prevalence are likely to fuel market expansion, acting as a stimulus for catalogue management solutions from the e-commerce businesses. The catalogue management systems market is highly fragmented since a big number of firms competes in it.

COVID-19's widespread adoption has resulted in digital revolution in a variety of sectors, including media and entertainment, telecommunications, retail, and e-commerce. The onset of the COVID-19 pandemic has pushed the usage of catalogue management systems to new heights. These systems provide a fast picture of a channel's services and products, uploading and recording data and organizing it to satisfy client requirements. They also aid in the real-time augmenting, enriching, and validating of data, as well as automating the creation of catalogues utilizing data from diverse sources like e-commerce websites in order to extend product assortment and achieve quicker dissemination of product data over channels. Due to the digitization, shifting customer tastes, and more screen time, the COVID-19 pandemic has had a favorable influence on total industry growth.

Because of expanding consumer demand for items, more internet access, and increased smartphone penetration, the eCommerce business has been developing at a breakneck speed. The amount of money spent on the internet has surged over the world. The eCommerce business is quickly expanding in nations including Philippines, India, Mexico, and China. Catalog management aids in the reduction of service delivery costs, the enhancement of customer experience, staff efficiency, and the general operation of enterprises. Customers have a better shopping experience with catalogue management system solutions since they provide extensive information on every product. These advantages assist firms in saving time and automating the updating of product information on eCommerce platforms.

Customers' usage of mobile applications, social media, and digital channels has expanded as a result of the high penetration of mobile devices throughout the world, boosting their participation in retail and e-commerce through such channels. Customer happiness has become a top priority for businesses. As a result, they're planning consumer engagement channels. SMBs and major corporations are using cutting-edge software and a service to handle offers/discounts, product data, payment systems, and inventories from a central location.

All product information is created, managed, and maintained in a single central repository with catalogue management systems. Catalog management software/platforms and services give a consolidated view of product data needed for search engine optimization and supply chain optimization, which promotes their adoption across a wide range of sectors. Latest technologies like artificial intelligence (AI) are likely to improve catalogue management solution capabilities, giving the catalogue management market tremendous development potential.

Data collection and transfer from one channel to the next is part of catalogue management. Catalog management systems are also engaged in data synchronization and publication across channels. Many firms believe catalogue management systems would result to data breaches in its highly abstracted data sets due to a lack of sufficient information about security standards and their implementation. The main reason for the slow adoption of catalogue management solutions is concerns regarding data security. Users are hesitant to use these solutions because they are afraid of losing their critical master and reference data owing to data mistakes that occur during compilation or upgrade. Users believe that their data privacy is at danger, and that there will be no responsibility for data losses or thefts, and that no mitigation would be offered.

Based on Component, the market is segmented into Solution and Services. Over the projected period, the service category is expected to grow at the fast rate. The managed and professional services provided by various catalogue management system vendors will drive substantial growth in this industry. The growing demand for cloud-based managed services, as well as companies' increased reliance on IT assets to boost their company efficiency, are driving the managed services market forward.

Based on Services Type, the market is segmented into Professional Services and Managed Services. In 2020, professional services held the largest market share. Professional services assist businesses in identifying security flaws and developing security measures in order to deploy catalogue management systems effectively. Professional services provide advantages such as higher profitability, lower administrative costs, and better resource use. Professional services also aid workforce management by enhancing efficiency via greater planning, cooperation, and comprehensive knowledge management.

Based on Type, the market is segmented into Product Catalog and Service Catalog. In the year 2020, the product catalogue category dominated the market. The rising prevalence of e-commerce websites and online retail storefronts, where consumers may shop for their preferred items in one application, might be credited to the segment's rise.

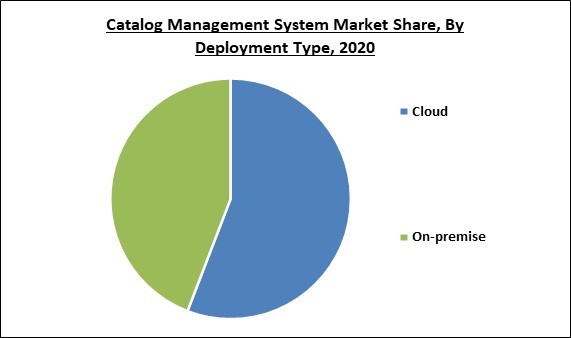

Based on Deployment Type, the market is segmented into Cloud and On-Premise. From 2021 to 2027, the on-premise category is expected to grow at a considerable CAGR. Due to the security benefits provided by this deployment type, such as data security and transparency, the market is predicted to increase significantly throughout the projection period.

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises. In 2020, the large enterprise sector held the largest market share. Large businesses have a broad business network and a variety of income streams. As a result, to extend their company operations, huge corporations turn to creative and new technology and solutions. Moreover, the growing involvement of government agencies in providing finance to major businesses to help them adopt digitalization is expected to drive this segment's growth.

Based on Vertical, the market is segmented into Retail & eCommerce, BFSI, IT & Telecom, Media & Entertainment, Travel & Hospitality and Others. During the predicted period, the BFSI industry will see considerable expansion. BFSI firms are modernising their data platforms and related toolkits to meet the evolving needs of reporting analysts, data analysts, business intelligence, data scientists, and enterprises and employees adopting self-service technologies. The need for catalogue management systems is likely to rise throughout the forecast period as BFSI organisations provide more data, goods, and services.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.5 Billion |

| Market size forecast in 2027 | USD 7.9 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 12.4% from 2021 to 2027 |

| Number of Pages | 333 |

| Number of Tables | 603 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, Deployment Type, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. From 2021 to 2027, the Asia Pacific market for catalogue management systems is expected to grow at a promising CAGR. The rising inclination for technologically superior solutions among various firms in Asia Pacific nations such as India and China may be ascribed to regional market expansion. Furthermore, increased IT investment in the area is likely to contribute to an increase in the implementation of catalogue management systems, boosting regional market growth.

Free Valuable Insights: Global Catalog Management System Market size to reach USD 7.9 Billion by 2027

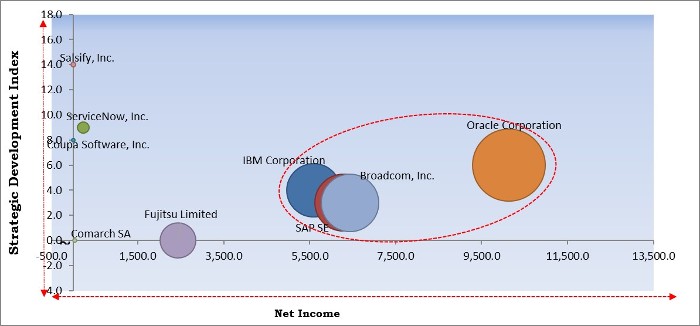

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; IBM Corporation, SAP SE, Broadcom, Inc., and Oracle Corporation are the forerunners in the Catalog Management System Market. Companies such as Fujitsu Limited, Salsify, Inc., ServiceNow, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Proactis Holdings Limited (Café Bidco Limited), Coupa Software, Inc., IBM Corporation, SAP SE, Broadcom, Inc., Oracle Corporation, Fujitsu Limited, Salsify, Inc., ServiceNow, Inc., and Comarch SA.

By Component

By Type

By Deployment Type

By Organization Size

By Vertical

By Geography

The global catalog management system market size is expected to reach $7.9 billion by 2027.

Increasing adoption of Smartphones are driving the market in coming years, however, misconceptions about data security and privacy threats limited the growth of the market.

Proactis Holdings Limited (Café Bidco Limited), Coupa Software, Inc., IBM Corporation, SAP SE, Broadcom, Inc., Oracle Corporation, Fujitsu Limited, Salsify, Inc., ServiceNow, Inc., and Comarch SA.

The Solution segment is generating high revenue in the Global Catalog Management System Market by Component in 2020; thereby, achieving a market value of $4.9 billion by 2027.

The Service Catalog segment has high growth rate of 13.8% during (2021 - 2027).

The North America is fastest growing region in the Global Catalog Management System Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.