The Global Car Rental Market size is expected to reach $125.6 billion by 2027, rising at a market growth of 4.1% CAGR during the forecast period.

Car rental or car hire firms are businesses that lend out automobiles for a specific time period for a set price. This service is frequently arranged with multiple local offices, which are typically located around airports or big city areas and are supplemented with a website that allows online bookings. With increased pollution and population, the automobile rental sector has seen a significant shift in recent years, thereby becoming the prominent industry in fleet transportation.

A huge increase in the number of individuals travelling for business and pleasure throughout the world is driving demand for car rental services. Rising internet penetration in both emerging and established nations has further helped market players in capturing a wider client base through the use of dedicated mobile applications for customer convenience.

The COVID-19 pandemic has destroyed economies throughout the world, and the impact is being felt by enterprises across industries, with transportation services bearing the brunt of the damage. In many instances, the challenges resulting from the lockdown are enormous and intractable. In addition, rising fuel and diesel prices in emerging nations are expected to hamper market expansion throughout the forecasting period.

The global financial crisis has only encouraged the use of car rental services. However, in the post-pandemic era, where safety and hygiene are paramount, measures for cleaning the car are strictly adhered to.

Taxis, passenger vehicles, and charter cars with flexibility and other features like real-time feedback, vehicle monitoring, and rating to end consumers are examples of on-demand services. Numerous smartphone applications make it easier to find available cars and compare rates with the respective car rental businesses.

Due to the high expense of employee car maintenance, millennials have a lower rate of car ownership. In addition, the benefits of millennials are oriented toward car rental due to benefits such as cost savings and fuel economy. In industrialized nations, the rise in demand for ride-hailing services and amenities such as car rental, car sharing, and station-based mobility has reduced private car ownership by a significant percentage.

The automobile and transportation industries have a direct influence on crude oil price fluctuations. High gasoline and diesel costs in numerous developing nations function as a major impediment to renting a car since rental pricing cannot be modified regularly based on crude oil prices, causing rental firms' revenues to fluctuate. For example, the per-barrel price of crude oil in 2000 was USD 17, but it has now risen to USD 45 owing to rising worldwide demand. Furthermore, government taxes raise gasoline and diesel costs, having a significant impact on the worldwide sector.

Based on Application, the market is segmented into Airport Transport, Outstation, Local usage and others. The Outstation segment procured a significant revenue share of the overall can rental market in 2020. This is due to the increasing preference among the people to hire can rental services while going outstation.

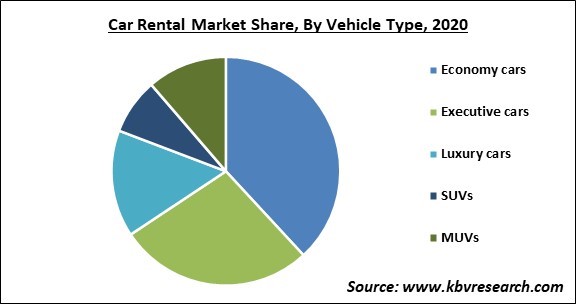

Based on Vehicle Type, the market is segmented into Economy cars, Executive cars, Luxury cars, SUVs and MUVs. The executive cars segment acquired a significant revenue share in the Car Rental Market in 2020. One of the primary causes driving the segment's growth is the growing number of business visitors across the world, particularly in emerging nations.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 97.3 Billion |

| Market size forecast in 2027 | USD 125.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.1% from 2021 to 2027 |

| Number of Pages | 172 |

| Number of Tables | 293 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Vehicle Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The APAC exhibited the promising revenue share of the overall car rental market in 2020. Increased disposable incomes of consumers and continuously developing economies, as well as rising corporate travel spending, are likely to have a positive influence on regional market growth.

Free Valuable Insights: Global Car Rental Market size to reach USD 125.6 Billion by 2027

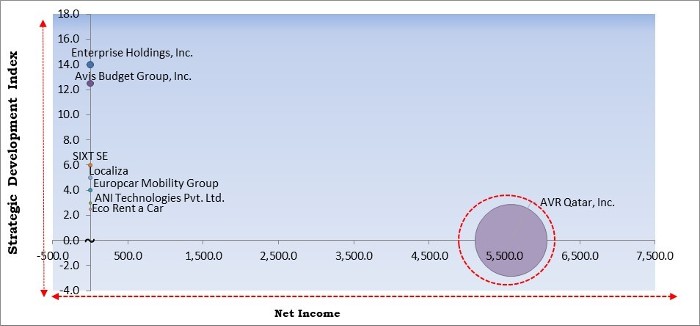

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; AVR Qatar, Inc. is the forerunners in the Car Rental Market. Companies such as Enterprise Holdings, Inc. (The Crawford Group, Inc.), Avis Budget Group, Inc., SIXT SE are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Avis Budget Group, Inc., Europcar Mobility Group, Enterprise Holdings, Inc., Hertz Global Holdings, Inc., Localiza, SIXT SE, Eco Rent a Car, ANI Technologies Pvt. Ltd. (Ola Cabs), and AVR Qatar, Inc.

By Application

By Vehicle Type

By Geography

The global car rental market size is expected to reach $125.6 billion4 billion by 2027.

On-demand transportation services are becoming more popular are driving the market in coming years, however, ever-increasing Crude oil prices and Security & Privacy issues have limited the growth of the market.

Avis Budget Group, Inc., Europcar Mobility Group, Enterprise Holdings, Inc., Hertz Global Holdings, Inc., Localiza, SIXT SE, Eco Rent a Car, ANI Technologies Pvt. Ltd. (Ola Cabs), and AVR Qatar, Inc.

Economy cars segment acquired maximum revenue share in the Global Car Rental Market by Vehicle Type 2020, and would continue to be a dominant market till 2027.

The Airport Transport segment is expected to witness high growth rate in the Global Car Rental Market by Application 2020, and would continue to be a dominant market till 2027.

The North America market region is leading the Global Car Rental Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.