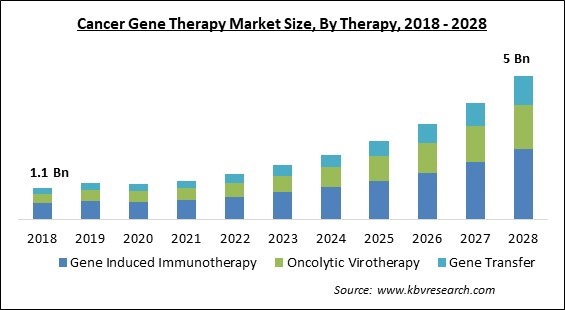

The Global Cancer Gene Therapy Market size is expected to reach $5 billion by 2028, rising at a market growth of 21.2% CAGR during the forecast period.

Gene therapy is the process of replacing faulty or damaged genes at the molecular level. It is a procedure in which viruses are genetically modified before being transmitted to host cells. Viruses are genetically modified to contain a gene that is now frequently used to cure cancer. The pipeline for cancer gene therapy is quite strong, and various industry participants have recently concentrated their efforts on developing a number of successful cancer gene therapies and vectors. Pre-marketing approval is required for the marketing of cancer gene therapy, and it is a lengthy process that is closely reviewed. As a result, there are few cancer gene treatments on the market, and they are still in development. However, vectors, which are essential for gene transfer and are pre-requisites for gene therapy, are increasingly being used in study and treatment.

Cancer is described as uncontrolled cell development in the body that results in organ failure. It can be fatal if left untreated. The body manages uncontrolled cell proliferation in numerous ways, one of which is by deploying white blood cells to detect and kill malignant cells. The immune system has been discovered to be influenced in order to cause malignant cells to self-destruct. The effects of radiation and chemotherapy therapy on malignant cells in the body are constant and dependable. Immunotherapy for hematological tumors has recently gained popularity and is attracting the attention of numerous researchers. Scientists have devised a method for isolating, replicating, and developing cancer-destroying cells from a patient's blood cancer and then injecting those cells back into the patient to eliminate their tumors, resulting in long-term remissions.

Cancer has a strong tendency to spread throughout the body. It is the world's second-leading cause of death. Cancer gene therapy is a strategy for treating cancer that involves inserting therapeutic DNA into the patient's gene. Cancer gene therapy has grown in popularity as a result of its high success rate in preclinical and clinical trials. A treatment in which the mutant gene is replaced with a healthy gene or the deactivation of a gene whose function is improper are examples of cancer gene therapy procedures. A new strategy for combating cancer cells has just been devised, in which new genes are delivered into the body.

The COVID-19 pandemic has hampered the market for cancer gene therapy. Doctors from Dana Farber Cancer Institute discovered that during the COVID-19 pandemic, there was a 46 percent decline in diagnoses of the six most frequent cancer types - breast, pancreatic, colorectal, lung, gastric, and oesophageal cancers, according to research published in Cancer Connect 2020. Furthermore, the Centres for Disease Control and Prevention (CDC) and many medical professional organizations recommended that cancer screening and other health-prevention services, as well as elective surgeries, be postponed unless the risks outweighed the benefits, in order to secure hospital infrastructure for COVID-19 patients' treatment. As a result, the COVID-19 pandemic has had an influence on the market for cancer gene therapy.

In recent years, there has been a rising burden of cancer disease, the expanding focus on research to create an effective cancer treatment, and growing investments in cancer research. According to Globocan 2020, an expected 19,292,789 new cancer cases and 9,958,133 cancer-related deaths were reported worldwide in 2020. Various gene therapy strategies are now being used in the treatment of cancer. Anti-angiogenic gene therapy, pro-drug activating suicide gene therapy, gene therapy-based immune modulation, oncolytic virotherapy, gene correction/compensation, antisense, genetic manipulation of apoptotic and tumor invasion pathways, and RNAi techniques are only a few examples. These medicines have been used to treat cancers such as brain, lung, breast, pancreas, liver, prostate, colorectal, bladder, head & neck, skin, ovarian, and renal cancer.

An improving regulatory landscape would help the industry players to optimize the opportunities. In addition, manufacturers are subject to regulations to secure the admission of defect-free products (vectors) onto the market, as they are associated with people's health. Because any flaws in gene therapy goods could be lethal to patients, laws have been changed to ensure that no products are recalled during post-market surveillance. Better success rates of novel medicines, ethical acceptance of gene therapy for cancer treatment, and enormous unexplored markets in emerging nations are expected to impact the market in the long run.

Gene therapy can be very expensive, thereby discouraging many people from choosing this mode of treatment. In the United States, for example, Zolgensma, gene therapy for spinal muscular atrophy, is the most expensive drug. In many countries, people have low disposable income, so spending high costs on healthcare is still a distant dream for them. Moreover, many governments are reeling from the negative impacts brought by the COVID-19 pandemic on their economy and healthcare infrastructure. The high expense of cancer gene therapy is due to the need for extensive clinical studies; also, unlike other pharmaceuticals, treatment by cancer gene therapy varies from person to person depending on the genetic acceptance of each patient.

Based on Therapy, the market is segmented into Gene Induced Immunotherapy, Oncolytic Virotherapy, and Gene Transfer. In 2021, the Gene Transfer segment held a promising revenue share of the Cancer Gene Therapy Market. Gene transfer is a new treatment method that involves introducing new modified genes into malignant cells or associated tissue in order to kill the cells or restrict their growth. This method is adaptable, as it may be employed with a wide range of vectors and genes in clinical trials with positive results. Gene therapy could be utilized alone or in combination with other treatments to control the condition as technology advances. Naked/plasmid vectors, electroporation, sonoporation, magnetoreception, and gene gun are all used to transfer or replace genes.

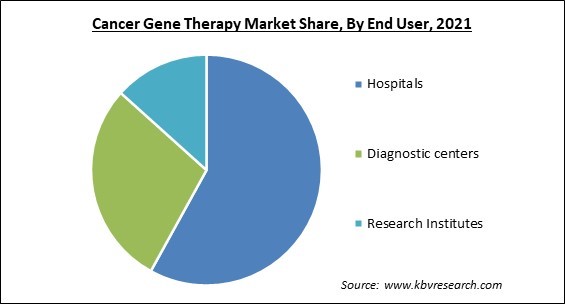

Based on End User, the market is segmented into Hospitals, Diagnostic centers and Research Institutes. In 2021, the hospital segment collected the maximum revenue share of the Cancer Gene Therapy Market. This is owing to rising healthcare awareness, an increase in the number of hospitals, and an increase in the geriatric and bariatric populations. Therefore, these factors would continue to boost the growth of the segment even during the forecasting period.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.4 Billion |

| Market size forecast in 2028 | USD 5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 21.2% from 2022 to 2028 |

| Number of Pages | 154 |

| Number of Tables | 259 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Therapy, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, the North America emerged as the leading region in the overall Cancer Gene Therapy Market by procuring the highest revenue share of the market. The growth of the regional market is owing to the huge investments in research and technological breakthroughs. The region's viral vectors and plasmid DNA market is boosted by the presence of a huge population base, government measures to develop healthcare facilities, and a rise in healthcare expenditure.

Free Valuable Insights: Global Cancer Gene Therapy Market size to reach USD 5 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Novartis AG, GlaxoSmithKline PLC (GSK), Amgen, Inc., Bristol Myers, Squibb Company, Karyopharm Therapeutics, Inc., Gilead Sciences, Inc., Adaptimmune Limited, Genelux Corporation, and Sarepta Therapeutics, Inc

By Therapy

By End User

By Geography

The cancer gene therapy market size is projected to reach USD 5 billion by 2028.

Growing cases of cancer are driving the market in coming years, however, high cost of cancer gene therapy growth of the market.

Novartis AG, GlaxoSmithKline PLC (GSK), Amgen, Inc., Bristol Myers, Squibb Company, Karyopharm Therapeutics, Inc., Gilead Sciences, Inc., Adaptimmune Limited, Genelux Corporation, and Sarepta Therapeutics, Inc

The expected CAGR of the cancer gene therapy market is 21.2% from 2022 to 2028.

The Gene Induced Immunotherapy segment acquired maximum revenue share in the Global Cancer Gene Therapy Market by Therapy in 2021, thereby, achieving a market value of $2,459.2 million by 2028.

The North America market is the fastest growing region in the Global Cancer Gene Therapy Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.