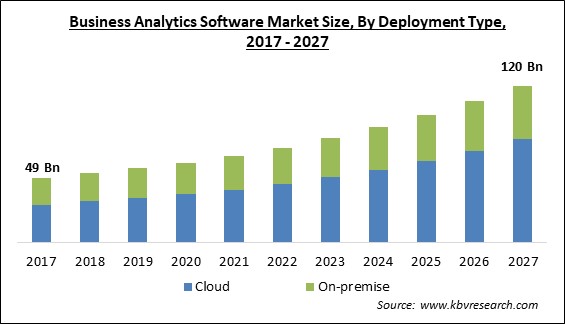

The Global Business Analytics Software Market size is expected to reach $120 billion by 2027, rising at a market growth of 10.5% CAGR during the forecast period.

Business analytics software assist in the interpretation and analysis of business data by permitting ongoing research and investigation of previous business performance in order to obtain actionable insights for business strategy. It facilitates the finding of patterns and connections across data streams, as well as the automation of tasks and processes for real-time decision-making. Small and medium-sized organizations have started implementing cloud-based business analytics in droves in recent times due to its low cost and ease of use. Furthermore, as the popularity of social media marketing develops, demand for social media analytics, which is a subset of business analytics, has expanded significantly, propelling the growth of the market.

The growth in the adoption rate of business analytics software by various firms and the rapid increase in demand for cloud-based analytics software among SMEs have led to the bolstering of the business analytics software market. Moreover, rise in awareness about the various advantages imparted by business analytics solutions and the quickening of digital transformation in companies because of the COVID-19 pandemic have fueled the growth of the market. The emerging trends such as social media analytics and text analytics, as well as an increase in the need for insights for company planning, are likely to fuel the market's growth throughout the forecast period.

There is substantial adoption and use of business intelligence and analytics software in large enterprises. Even, small and medium firms are tempted to invest in this software after observing its associated advantages. The prominence of cloud deployment choices, on the other hand, has provided huge advantages to SMEs and has significantly raised their adoption rate. This trend is expected to continue in the next years, allowing software companies to offer more innovative solutions, such as intelligent and smart dashboards with unique features, to meet the growing need for self-service analytics. Other growth indicators in this industry include customer analytics, social media analytics, predictive analytics, and embedded BI, all of which are driving vendors' interest in meeting these needs. The demand for business intelligence and analytics training will continue to rise.

After the Covid-19 pandemic hit, the business analytics software market witnessed a major contraction. However, the market had experienced a significant growth rate till the pandemic. Lockdowns administered by governments in various regions gave a major shock to the companies operating in these regions. On a positive note, however, the business analytics software market is projected to expand significantly during the forecast period.

Due to the long lockdown periods, many firms put in place a work-from-home system for their employees. This led to the increasing demand for cloud-based big data analytics for the purpose of managing key information, creating a potential market opening in the process. The important factors causing the growth of the business analytics software market are massive quantities of data generated by different industries and consequently the need to manage this data.

Rise in the obtainability of large quantities of data and increase access to low-cost data center services offered by cloud vendors have led to a significantly lower upfront investment costs for small and medium-sized firms, lowering the market entry threshold. As a result, demand for cloud-based business analytics software has surged among small and medium-sized organizations (SMEs). Several organizations are increasingly turning to business analytics to have a better understanding of how to run their businesses more efficiently. For a variety of reasons, companies have invested in cloud-based business analytics software solutions, including enhanced competitive advantage and revenue growth.

Traditional company management methods encourage the use of spreadsheets and static presentations, but current software eliminates endless rows and columns and allows for process automation. The KPI dashboard is automatically updated with real-time data by the tool. The software can help automate the reporting procedure with predetermined time intervals. It also allows its users to drag-and-drop their values and creates an efficient and interactive dashboard that allows them to monitor all their data on one computer screen. Business analytics tools provide speedier planning, analysis, and reporting processes across the board, from sales planning to customer behavior assessment to real-time process monitoring and offer improvement.

Data breaches and the looming risk of leaks are the causes of major concern regarding data analysis systems. Considering some utilize BI software to handle sensitive data, a mistake in the process could reveal it, putting their company, customers, or employees at risk. The largest obstacle facing business analytics market is the security of the data processed through this software. However, because of the widespread nature of the problem, many business analytics software suppliers are taking it seriously and are planning to implement rigorous security measures. Data that is not protected poses a significant risk. Those who use Business Analytics techniques are the most aware of the types of data and where it is kept, but this does not guarantee security.

Based on Component, the market is segmented into Software and Services. The software segment acquired the largest revenue share in business analytics software market in 2020. This is due to a rise in the use of business analytics software by businesses in order to acquire a strategic and competitive advantage over the competitors. Furthermore, it assists them in making rapid and educated judgments by analyzing business data, which fosters market growth.

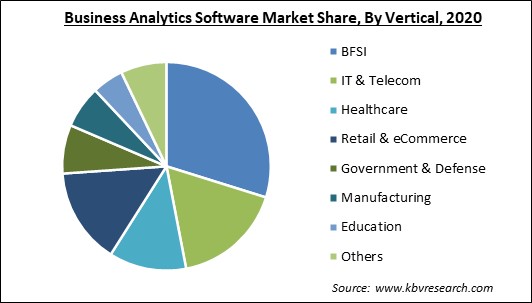

Based on Vertical, the market is segmented into BFSI, IT & Telecom, Healthcare, Retail & eCommerce, Government & Defense, Manufacturing, Education and Others. Telecom segment witnessed a significant share in the business analytics software market in 2020. Given that telecom operators serve millions of consumers, getting individual customer level data is important for providing the individualized services that customers expect. By transforming raw data into usable information, business intelligence may give that intelligence to operators. As a result, telecommunications businesses can conduct focused marketing efforts, fine-tune their pricing strategy, and create or release products derived from empirical consumer knowledge.

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium-sized Enterprises (SMEs). Supply chain analytics observed a substantial revenue share in the business analytics software market in 2020. These analytics can assist a company in making better informed, timely, and efficient decisions. By recognizing trends and patterns throughout the supply chain, it may assist in predicting future hazards and identify known issues. Supply chain analytics can help a company better estimate future demand by studying client data. It assists a company in determining which items can be reduced in price when they become less profitable, as well as determining what client wants will be after the initial order.

Based on Deployment Type, the market is segmented into Cloud and On-premise. The cloud component witnessed the largest revenue share in the business analytics software market in 2020. It is because this deployment mode allows businesses to focus on their core activities rather than managing their IT infrastructure. Furthermore, due to its cost-effectiveness, cloud-based business analytics software is widely used by small and medium businesses, contributing significantly to the global market's growth.

Based on Application, the market is segmented into Customer Analytics, Supply Chain Analytics, Marketing Analytics, Pricing Analytics, and Risk & Credit Analytics. The customer analytics segment of the business analytics software market garnered the largest revenue share in the business analytics software market in 2020. The major factors behind this were the growth in consumer behavior analytics trends and increase in competitiveness of the modern business world.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 60.8 Billion |

| Market size forecast in 2027 | USD 120 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 10.5% from 2021 to 2027 |

| Number of Pages | 367 |

| Number of Tables | 583 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Organization Size, Deployment Type, Application, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the largest revenue share in the business analytics software market. It is owing to the abundant supply of business analytics solutions vendors such as Microsoft Corporation, Oracle Corporation, Salesforce.com, and others that are aiding the regional market's growth.

Free Valuable Insights: Global Business Analytics Software Market size to reach USD 120 Billion by 2027

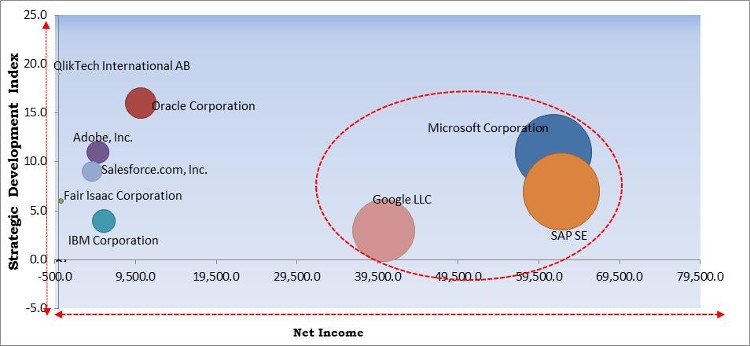

The major strategies followed by the market participants are Partnerships, Collaborations, and Agreements. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation, SAP SE, and Google, Inc. are the forerunners in the Business Analytics Software Market. Companies such as Fair Isaac Corporation, Salesforce.com, Inc., and Adobe, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Adobe, Inc., IBM Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, SAS Institute, Inc., Google LLC, and QlikTech International AB (Thoma Bravo)

By Component

By Vertical

By Organization Size

Deployment Mode

By Application

By Geography

The global business analytics software market size is expected to reach $120 billion by 2027.

High demand for cloud-based business analytics software are driving the market in coming years, however, concerns regarding data breaches limited the growth of the market.

Adobe, Inc., IBM Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, SAS Institute, Inc., Google LLC, and QlikTech International AB (Thoma Bravo)

The expected CAGR of the business analytics software market is 10.5% from 2021 to 2027.

The BFSI segment acquired maximum revenue share in the Global Business Analytics Software Market by Vertical 2020; thereby, achieving a market value of $32.2 billion by 2027.

The North America is the fastest growing region in the Global Business Analytics Software Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.