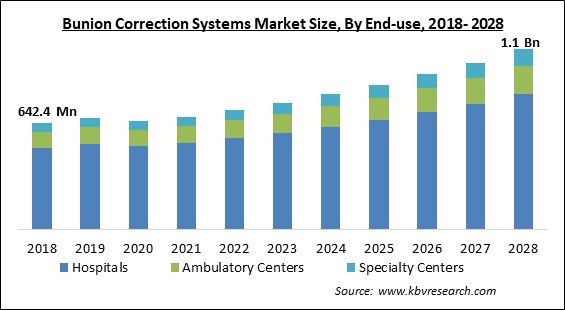

The Global Bunion Correction Systems Market size is expected to reach $1.1 billion by 2028, rising at a market growth of 7.1% CAGR during the forecast period.

Products for bunion correction assist in the treatment of foot deformity, which affects the metatarsophalangeal joint. One in three Americans has bunion or hallux valgus, which is a prevalent foot ailment in the adult population. The condition is most frequently brought on by wearing uncomfortable, narrow shoes for a long period, foot injuries, and genetic foot issues.

According to a study by NCBI (National Center for Biotechnology Information), between 63% and 74% of the participants wore shoes that were either too short or too wide, increasing their chance of developing foot conditions such as bunions, calluses, and deformities. Due to weaker connective fibers and the usage of tight, heeled shoes, the ailment is more prevalent in older people, particularly women.

The American Orthopedic Foot and Ankle Society estimates that roughly one-third of women have bunions. During the forecast period, increasing arthritis prevalence is anticipated to favorably impact market growth. Bunions are more likely to develop in cases of inflammatory arthritis, such as rheumatoid arthritis.

There is a higher chance that people with rheumatoid arthritis will experience foot issues. According to a Vittori article, foot problems affect 90% of rheumatoid arthritis sufferers worldwide. The likelihood of developing a bunion increase as a result of the body incorrectly attacking the big toe linings in rheumatoid arthritis. Additionally, both illnesses' symptoms include swelling and problems with joint movement, which are predicted to boost market growth.

Owing to the cancellation of elective surgeries and the decline in individuals seeking bunion therapy, the COVID-19 pandemic had an adverse effect on the market. The market was also negatively impacted by the lack of healthcare workers and the government-imposed travel restrictions made to stop the virus's spread. The majority of hospitals and outpatient rehabilitation centers operated at decreased capacity, which further hampered market expansion. Numerous hospitals have reduced or delayed non-emergency care. This has both financial and medical repercussions for the hospitals as well as the patients they serve. Nurses and other healthcare professionals had to work longer shifts and even more days as a result of COVID-19.

The demand for these devices has increased throughout several regions, including North America, Asia Pacific, Europe, and LAMEA, as a result of the rise in the number of people with bunions (MEA). This can be linked to the rising incidence of this condition among people of all ages, including teenagers and adults.

Patients are becoming more aware of bunion correction devices, and they are using them more frequently and in more surgical procedures. Bunions can also be brought on by other disorders like arthritis, diabetes, or even pregnancy. They are frequently brought on by wearing tight shoes or overly high heels. There are numerous treatments available today that will help you feel wonderful in your shoes again, no matter what the root of your bunions may be. If it comes to foot care, bunions need to be treated carefully.

A little bony protrusion on the top or side of your big toe joint is the first sign of the bunion toe disease (also known as a bunionette when it affects the pinky toe) (or on the pinky toe for bunionettes). Because bunions are typically not painful at first, so many individuals ignore it till the discomfort and pain start to get more bothersome.

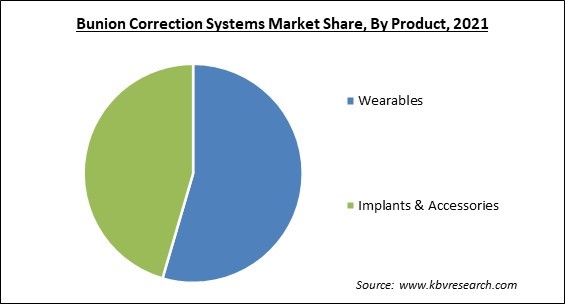

Based on product, the Bunion Correction system market is segmented into Wearables and Implants & Accessories. The wearables segment garnered the highest revenue share among all product categories in 2021. The increasing occurrence of bunions is one of the key influencing factors fuelling the market growth. According to statistics from Disabled Population, approximately 36% of the sample population had the condition.

By end-use, the market is segmented into Hospitals, Ambulatory Centers, and Specialty Centers. The number of patients receiving treatment for the issue at the hospitals is anticipated to increase as a result of factors like the accessibility of different surgical alternatives including Exostectomy, Osteotomy, and Arthrodesis for bunion correction. Additionally, it is anticipated that the hospitals' access to qualified doctors will accelerate category growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 683 Million |

| Market size forecast in 2028 | USD 1.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.1% from 2022 to 2028 |

| Number of Pages | 144 |

| Number of Tables | 248 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Bunion Correction Systems Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2021, North America dominated the global Bunion Correction Systems market with the highest market share worldwide. Some of the major factors that influenced the market growth in the North America market include the higher incidence of the condition there as well as the accessibility of treatment centers for corrective operations.

Free Valuable Insights: Global Bunion Correction Systems Market size to reach USD 1.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Stryker Corporation, Arthrex, Inc., Zimmer Biomet Holdings, Inc., Extremity Medical, LLC., Acumed, LLC., De Puy Synthes (Johnson & Johnson), BioPro, Inc., and Orthofix Medical, Inc.

By Product

By End Use

By Geography

The global Bunion Correction Systems Market size is expected to reach $1.1 billion by 2028.

Growing Prevalence are driving the market in coming years, however, Patient’s Ignorance Towards The Condition restraints the growth of the market.

Stryker Corporation, Arthrex, Inc., Zimmer Biomet Holdings, Inc., Extremity Medical, LLC., Acumed, LLC., De Puy Synthes (Johnson & Johnson), BioPro, Inc., and Orthofix Medical, Inc.

The Hospitals segment is leading the Global Bunion Correction Systems Market by End-use in 2021 thereby, achieving a market value of $819.9 million by 2028.

The North America market dominated the Global Bunion Correction Systems Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $494.3 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.