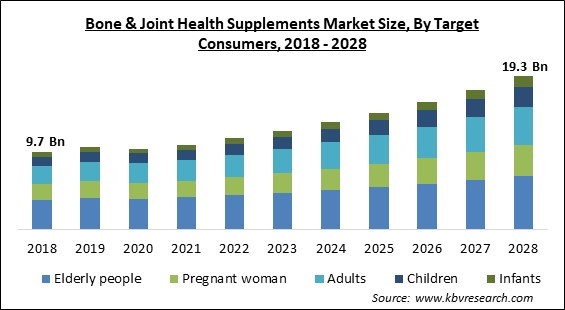

The Global Bone & Joint Health Supplements Market size is expected to reach $19.3 billion by 2028, rising at a market growth of 9.0% CAGR during the forecast period.

Supplements for joint health can improve range of motion, lessen the discomfort of arthritis, speed up the healing process after an injury, and preserve the complete health of human joints. A specially formulated vitamin called Cooper Complete Joint Health helps support and maintain healthy joints. It may not be aware, though, that this vitamin has advantages beyond joint health.

Bone and joint health become more crucial as humans age. It may be seeking to aid in the healing of an injury. Perhaps looking for strategies to stay healthy because everyone is worried about osteoporosis or arthritis. Healthy bones and joints can be maintained with the help of vitamins, minerals, and other dietary supplements. However, make sure they're a part of a comprehensive plan that also incorporates nutrition, exercise, and help from medical professionals. When beginning a new supplement, make sure to discuss it with the doctor.

The nutraceutical sector is undergoing ongoing change, and it plans its R&D operations considering the movement in customer interest toward goods that promote health. As a result, the items being produced in the sector are following customer demand and trends since the industry also places a strong emphasis on the monitoring of new consumer trends and partnerships with mass distributors. These products are also used to promote health, slow down aging, aid in the prevention of diseases, lengthen life expectancy, and support the body's structure and function.

Another typical component that is present in many joint support supplements is gelatin; Cooper Complete Joint Health has 480 mg of gelatin. Gelatin, which comes from animal connective tissues, aids the body in regenerating collagen, cartilage, and connective tissue in the joints. However, gelatin's capacity to stimulate the production of collagen affects more than only joints. Hair, skin, and nails receive structure and moisture from the protein called collagen.

International health organizations like the World Health Organization (WHO) advise people to strengthen their immune systems to prevent COVID-19. Nutraceuticals with immune-boosting properties, like collagen, vitamins, and calcium supplements, are expected to become more popular. The COVID-19 pandemic has caused the population to practice social withdrawal and to follow the trend of working from home or staying in, which has changed consumer behavior by making them more health-conscious and creating an unheard-of degree of demand for supplements. Following the aforementioned considerations, the market is expected to have a large expansion due to an increase in the baby boomer population and the rising prevalence of lifestyle diseases linked to aging

In order to retain their good health and quality of life, the senior population is concentrating on adapting to supplements that are specifically customized to their needs. Individuals experience a variety of changes as they age, including psychological, physiological, and social ones that have an impact on their eating habits. The elderly population increasingly relies on customized nutritional consumption patterns and habitual food choices. Over time, the aging population in various nations has increased the need for age-friendly dietary choices with improved nutritional content to maintain their general health.

Consumer awareness of the prevalence and risks of dietary deficiencies is rising. Additionally, their understanding of how nutritional inadequacies can be improved by supplementation will lead to an increase in the use of bone and joint health supplements, further fueling market expansion. Since nutrition and health are closely related, more people are choosing supplements that are better for them. In some parts of Asia, Latin America, and Africa, middle-class income is rising, allowing consumers to spend more on dietary, nutritional, and food supplements.

Vitamin supplements can meet a variety of needs, but a sizable segment of the public still has misconceptions or misgivings about taking dietary supplements, particularly vitamins. Additionally, the poor awareness of vitamin supplements among rural and semi-urban customers discourages many market players from investing in new goods. The market for vitamin supplements is constrained by this factor. Additionally, a lot of consumers are hesitant to incorporate vitamin supplements into their regular dietary routines since they see them as prescription drugs. Furthermore, the important participants in the market may be seriously threatened by the rise in the accessibility of counterfeit goods.

On the basis of type, the Bone & Joint Health Supplements market is divided into Vitamin D, Vitamin K, Calcium, Collagen, Omega-3 Fatty acids, Glucosamine-Chondroitin, and Others. The Omega-3 Fatty acids segment registered a substantial revenue share in the Bone & Joint Health Supplements market in 2021. Omega-3 fatty acids in pathologic calcification, such as macrocalcification in cancerous tissues and vascular calcification. Additionally, these fatty acids enhance bone mineralization and inhibit bone degradation to increase bone quality.

Based on the Distribution channel, the Bone & Joint Health Supplements market is segmented into Supermarkets/hypermarkets, Pharmacies & drug stores, Health & beauty stores, and Others. The Health, Beauty Stores & Others segment registered a significant revenue share in the Bone & Joint Health Supplements market in 2021. Convenience stores, beauty stores, direct-to-consumer, fitness centers, and online shopping are some more distribution methods. To make it easier for customers to place orders and have them delivered, many businesses and shops use online services. On the internet, many one-stop shops make it easier for customers to make purchases.

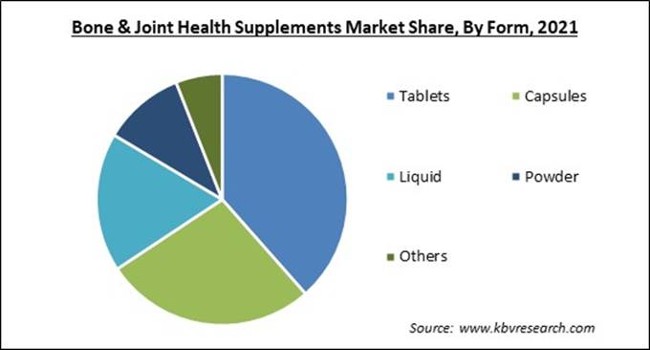

By Form, the Bone & Joint Health Supplements market is classified into Tablets, Capsules, Liquid, Powder, and Others. The capsules segment recorded a substantial revenue share in the Bone & Joint Health Supplements market in 2021. The majority of customers of bone and joint health supplements believe that nutrients in capsules are more readily absorbed than in tablets. Typically, gelatin derived from animal sources is used to make capsules. Vegetarians can also use starch hydrolysate or hydroxypropyl methylcellulose, a derivative of plant fibers.

On the basis of the Target Consumers, the Bone & Joint Health Supplements market is bifurcated into Infants, Children, Adults, Pregnant women, and Elderly people. The elderly people segment acquired the largest revenue share in the Bone & Joint Health Supplements market in 2021. It is due to the linked aging population’s rising trend. Among the main objectives of the majority of the aging population is graceful aging choosing a healthy lifestyle, and maintaining an active lifestyle. It gets more difficult as one page to consume the proper number of vitamins and minerals for the body.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 10.7 Billion |

| Market size forecast in 2028 | USD 19.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9% from 2022 to 2028 |

| Number of Pages | 295 |

| Number of Tables | 520 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Target Consumers, Form, Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the Bone & Joint Health Supplements market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region procured a promising revenue share in the Bone & Joint Health Supplements market in 2021. A growing influence of westernization, a larger number of millennials, and an increased awareness among Asian consumers of the health benefits of functional food products are three of the key factors influencing demand for nutritional supplements for bone and joint health in the region.

Free Valuable Insights: Global Bone & Joint Health Supplements Market size to reach USD 19.3 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Procter and Gamble Company, BASF SE, Amway Corporation, Pfizer, Inc., Glanbia PLC, Bayer AG, Archer Daniels Midland Company, Reckitt Benckiser Group PLC, Nutramax Laboratories, Inc., and NOW Foods, Inc.

By Target Consumers

By Form

By Type

By Distribution Channel

By Geography

The global Bone & Joint Health Supplements Market size is expected to reach $19.3 billion by 2028.

The Aging Population To Fuel Market Expansion are driving the market in coming years, however, Less Knowledge And Accessibility of Fake Goods Vitamin Supplements restraints the growth of the market.

The Procter and Gamble Company, BASF SE, Amway Corporation, Pfizer, Inc., Glanbia PLC, Bayer AG, Archer Daniels Midland Company, Reckitt Benckiser Group PLC, Nutramax Laboratories, Inc., and NOW Foods, Inc.

The Tablets segment acquired maximum revenue share in the Global Bone & Joint Health Supplements Market by Form in 2021 thereby, achieving a market value of $7.1 billion by 2028.

The Supermarkets/hypermarkets segment is leading the Global Bone & Joint Health Supplements Market by Distribution Channel in 2021 thereby, achieving a market value of $8.1 billion by 2028.

The North America market dominated the Global Bone & Joint Health Supplements Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $6.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.