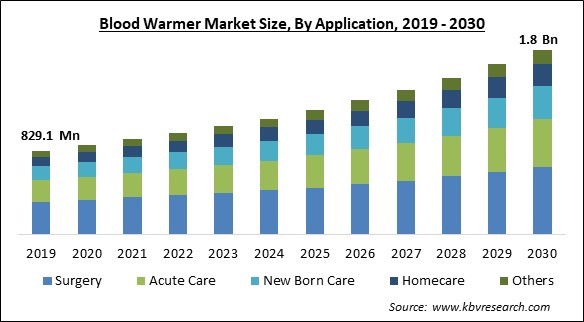

The Global Blood Warmer Market size is expected to reach $1.8 billion by 2030, rising at a market growth of 7.9% CAGR during the forecast period.

The exponential rise in surgical procedures and trauma cases across the globe continues to be a key factor in the market for blood warmers' upward trajectory. Hence, the surgery segment would capture more than 35% share of the market by 2030. Dialysis treatments frequently cause an increase in these surgeries at varying stages of disease complexity. For instance, the American Kidney Fund 2022 report estimates that more than 37 million people in the US have kidney disorders and that as of 2021, 810,000 people have kidney failure. This has led to an increase in dialysis machines' usage, which has increased the demand for blood-warming devices.

Additionally, one of the leading causes of death worldwide is traffic-related injuries. For instance, the World Health Organization (WHO) predicts that road traffic accidents are responsible for the death of about 1.3 million persons globally. This has surged the need for surgical procedures to be conducted. Some of the factors impacting the market are increasing Demand for IV Systems, the Increasing Number of Senior Citizens, and availability of Alternatives, Strict Regulations, and High Device Costs.

The need for intravenous systems is anticipated to grow rapidly, along with using blood warmers for intra-operative infusions. This is mainly attributable to intravenous systems' capacity to lower the likelihood of unwanted peri-operative hypothermia during surgical procedures. Nevertheless, a sizable increase in demand for intravenous blood warmers is anticipated in the upcoming years. The increasing demand has also been significantly influenced by technological developments in the IV system industry. People are now living longer globally; most individuals can expect to live well in their sixties and beyond. In every nation on earth, the proportion of older people is growing. WHO estimates that by 2030, one in six people will be 60 or older. By 2030, there will be 1.4 billion individuals over the age of 60, up from 1 billion in 2020. By 2050, the global population of people aged 60 and older will have more than doubled to 2.1 billion. Additionally, the number of people aged 80 or elderly is projected to triple between 2020 and 2050, reaching 426 million people. Thus, with this rise in the old-age population, the need for blood warmer raises further supporting the market growth.

The COVID-19 pandemic is anticipated to favor the market for IV fluid warmers and blood. As the number of patients with coronavirus disease (COVID-19) rises, the demand for infusion therapy increases. In addition, the global hospital admission rate has dramatically increased due to the COVID-19 pandemic. One of the primary signs of COVID-19 infection in patients is a high fever. Due to the rising patient population in hospitals and clinics, the use of warm blankets and sterile fluids has increased. This is projected to fuel market expansion.

However, the high cost of blood-warming devices may prevent widespread use, especially in nations with constrained healthcare budgets. In addition, these devices are subject to stringent regulatory guidelines and approvals, which can be tedious and time-consuming, not to mention expensive. However, it is predicted that expensive research & development costs and device problems will hamper the market's expansion as it will result in adding up to overall cost of blood warmer.

On the basis of end-use, the blood warmer market is bifurcated into hospitals/clinic, ambulatory services, defense forces and rescue forces. In 2022, the hospitals/clinic segment dominated the blood warmer market with maximum revenue share. Hospitals typically use blood/IV warming systems because they are less expensive, easier to use, and can heat large blood or IV solutions. Hospitals are considered essential purchasers because they have long-term contracts with suppliers of blood and IV fluid warming devices, giving them greater negotiating power and expanding their potential customer base for after-sales services. This will significantly aid hospitals & clinics using blood warmers, resulting in segment expansion.

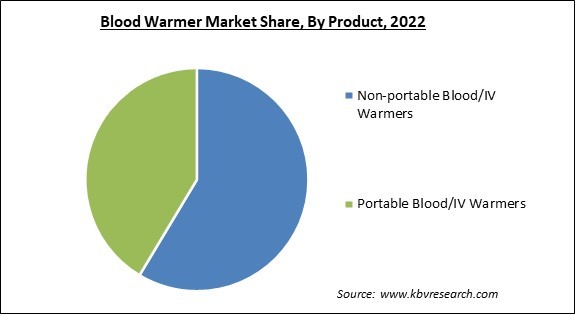

By product, the blood warmer market is classified into portable blood/IV warmers device and non-portable blood/IV warmers. The portable blood/IV warmers segment covered a considerable revenue share in the blood warmer market in 2022. The ambulatory/paramedic services, rescue services, and defense sectors account for most of the demand. The segment is also anticipated to develop due to rising demand from emergency centers and outlying clinics. Additionally, the volume demand for portable blood-IV warmers is slightly higher compared to non-portable blood warmers.

Based on application, the blood warmer market is segmented into surgery, acute care, newborn care, homecare and others. The surgery segment witnessed the largest revenue share in the blood warmer market in 2022. In order to maintain the ideal temperature of the body during surgery, which is essential for patient safety & successful outcomes, blood warmers are utilized during surgical procedures to prevent hypothermia and its related consequences. By enhancing healthcare infrastructure, providing financing for cutting-edge surgical technologies, and establishing programs to improve access to surgical services, government investments have contributed to the expansion of surgical procedures further supporting the segment’s growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1 Billion |

| Market size forecast in 2030 | USD 1.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.9% from 2023 to 2030 |

| Number of Pages | 233 |

| Number of Table | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the blood warmer market is analyzed across North America, Europe, Asia-Pacific and LAMEA. In 2022, North America led the blood warmer market by generating the highest revenue share. The region's market is expanding due to the presence of major market players, significant government investments in developing cutting-edge medical devices, and a favorable reimbursement scenario. Additionally, a rise in the demand for blood warmers is due to increased spending on the defense industry and search & rescue emergency services. The geographical location of this area results in exceptionally cold weather patterns that make the area vulnerable to cyclones, blizzards, and heavy snow. The region's market is expected to be driven by many fatalities associated with severe snow/frost-related incidents.

Free Valuable Insights: Global Blood Warmer Market size to reach USD 1.8 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 3M Company, Stryker Corporation, ICU Medical, Inc., Gentherm Incorporated (Gentherm Medical), Vyaire Medical, Inc. (Apax Partners LLP), Belmont Medical Technologies (Audax Management Company, LLC.), The Surgical Company, Life Warmer, Estill Medical Technologies, Inc., and Smisson-Cartledge Biomedical, LLC.

By Application

By Product

By End-use

By Geography

The Market size is projected to reach USD 1.8 billion by 2030.

The Increasing Number of Senior Citizens are driving the Market in coming years, however, Availability of Alternatives, Strict Regulations, and High Device Costs restraints the growth of the Market.

3M Company, Stryker Corporation, ICU Medical, Inc., Gentherm Incorporated (Gentherm Medical), Vyaire Medical, Inc. (Apax Partners LLP), Belmont Medical Technologies (Audax Management Company, LLC.), The Surgical Company, Life Warmer, Estill Medical Technologies, Inc., and Smisson-Cartledge Biomedical, LLC.

The Non-portable Blood/IV Warmers segment is leading Global Blood Warmer Market by Product in 2022, thereby achieving a market value of $1.1 billion by 2030.

The Ambulatory Services segment has shown the high growth rate of 8.4% during (2023 - 2030).

The North America region dominated the Global Blood Warmer Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $707.8 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.