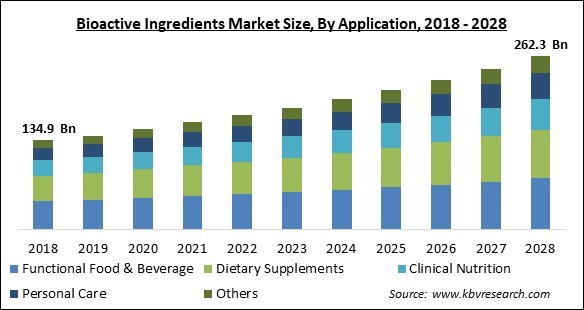

The Global Bioactive Ingredients Market size is expected to reach $262.3 billion by 2028, rising at a market growth of 7.2% CAGR during the forecast period.

Bioactive ingredients are substances utilized in food that have a favorable impact on human and animal health. Examples include prebiotics, amino acids, vitamins, and omega-3 fatty acids. Food components known as bioactive substances affect living tissue biologically. They are a particular class of macromolecules that support the metabolism of beneficial compounds added to food and ingredients. This is essential in addressing the issues of insufficient nutrient intake and difficulty maintaining a balanced diet.

Plants, animals, and microbes are the primary sources of biologically active chemicals. The food and beverage sector, pharmaceuticals, functional foods, personal care items, and animal feed extensively use bioactive compounds. Functional foods containing this substance treat several chronic conditions, including diabetes and arthritis.

In addition, meals often include bioactive components like carotenoids, antioxidants, and essential oils to create nutritional benefits or improve sensory qualities. A correlation between certain bioactive substances and their effects on several chronic diseases, including cancer, heart disease, diabetes, and hypertension, has been demonstrated by several research findings.

The primary sources of bioactive dietary components are primarily plant-based foods such as whole grains, fruits, and vegetables. In addition, animal products, including milk, fermented milk products, and cold-water fish, include similar bioactive components as conjugated linolenic acid, probiotics, omega-3 polyunsaturated fatty acids, and bioactive peptides. The aging populations in Australia and the Asia-Pacific region and the rise of lifestyle-related disorders, including diabetes and bone issues, will fuel market expansion. Accordingly, many customers realize the value of healthier food and improved lifestyle decisions.

The COVID-19 pandemic has given the market for bioactive ingredients a significant boost due to increased research and development efforts for bioactive chemicals for COVID-19 treatment, management, and prevention, as well as an increase in the number of persons afflicted by the disease globally. In addition, natural bioactive substances derived from plants are beneficial against Middle East Respiratory Syndrome (MERS) and severe acute respiratory syndrome (SARS) (MERS). The most promising natural bioactive against the COVID-19 infection include emodin, flavonoids, isoflavones, polysaccharides, lectin, thymoquinone, sterols, saponins, gallic acid, quercitin, and other substances.

The bioactive compounds market is expanding due to rising healthcare spending and consumer health awareness. The demand for bioactive compounds is growing due to consumer awareness of health concerns, increased emphasis on fitness, higher personal incomes, and the urbanization of developing nations. Progressive Consumers interested in health and well-being are looking for alternatives to fear-based information, a trend that has shaped wellness perspectives for decades. According to consumers, honesty, integrity, and awareness are the three pillars of convergence.

The extraction of bioactive compounds is undergoing technical progress on the market. Bioactive compounds are extracted from natural sources using various cutting-edge methods, including pressurized-liquid extraction, subcritical and supercritical extractions, microwave- and ultrasound-assisted extractions, and so on. Traditional solvent extraction method has been superseded with pressurized-liquid extraction. Accelerated and pressured solvent extraction at high temperatures of 50 to 200 C and pressures of 1450 to 2175 psi are examples of pressurized-liquid extraction. It makes it possible to extract bioactive compounds quickly and with fewer solvents.

The functional foods are made from naturally sourced ingredients, which are expensive compared to other food & beverage options. For instance, dry beverage mixes offer high nutrients replacing the requirement of functional drinks, have low transportation costs, and are cost-effective. On the other hand, the manufacturing and commerce factors of functional drinks are very complicated, uncertain, and expensive.

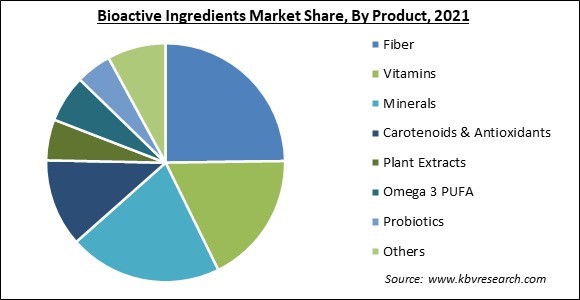

Based on Product, the Bioactive Ingredients Market is divided into fiber, vitamins, omega 3 PUFA, plant extracts, minerals, carotenoids & antioxidants, probiotics, and others. The omega-3 PUFA market accounted for a considerable revenue share of the bioactive ingredients market in 2021. This is because they are loaded in vitamins, minerals, and proteins and are used to cure conditions like cancer, asthma, and depression. Omega-3 fatty acids reduce the chance of arrhythmias, or irregular heartbeats.

Based on application, the bioactive ingredients market is divided into functional food & beverage, dietary supplements, clinical nutrition, personal care, and others. The personal care segment registered the significant revenue share in the bioactive ingredients market in 2021. Cosmetics and personal care products are increasingly using bioactive substances. The expanding population, changing consumer lifestyles, increased interest in health and beauty, and rising popularity of skincare and personal care products all contribute to the expansion of this market.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 162.6 Billion |

| Market size forecast in 2028 | USD 262.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.2% from 2022 to 2028 |

| Number of Pages | 209 |

| Number of Tables | 330 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the bioactive ingredients market is divided into North America, Europe, Asia Pacific, and LAMEA. With the largest revenue share in 2021, the Asia Pacific region dominated the bioactive ingredients market. The existence of several manufacturing firms in nations like China and India is responsible for this. Additionally, it is projected that the region's growing need for functional ingredients will fuel market expansion throughout the projection period. As demand for functional components rises, several producers are expanding their product portfolios.

Free Valuable Insights: Global Bioactive Ingredients Market size to reach USD 262.3 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BASF SE, Archer-Daniels-Midland Company, DuPont de Nemours, Inc., Ajinomoto Co., Inc., Mazza Innovation Ltd (Sensient Technologies Corporation), Ingredion Incorporated, Nuritas Limited, Cargill, Incorporated, Sabinsa Corporation (Sami-Sabinsa Group Ltd.) and Owen Biosciences Inc.

By Product

By Application

By Geography

The global Bioactive Ingredients Market size is expected to reach $262.3 billion by 2028.

Rising healthcare costs and increasing consumer health awareness are driving the market in coming years, however, High cost of functional food and beverages restraints the growth of the market.

BASF SE, Archer-Daniels-Midland Company, DuPont de Nemours, Inc., Ajinomoto Co., Inc., Mazza Innovation Ltd (Sensient Technologies Corporation), Ingredion Incorporated, Nuritas Limited, Cargill, Incorporated, Sabinsa Corporation (Sami-Sabinsa Group Ltd.) and Owen Biosciences Inc.

The expected CAGR of the Bioactive Ingredients Market is 7.2% from 2022 to 2028.

The Fiber market is leading the segment in the Global Bioactive Ingredients Market by Product in 2021; thereby, achieving a market value of $57.3 billion by 2028.

The Asia Pacific market dominated the Global Bioactive Ingredients Market by Region in 2021; thereby, achieving a market value of $105.0 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.