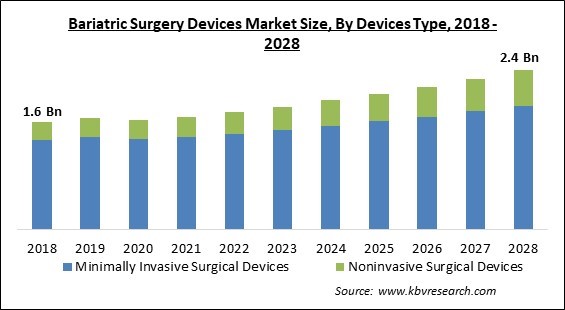

The Global Bariatric Surgery Devices Market size is expected to reach $2.4 billion by 2028, rising at a market growth of 5.3% CAGR during the forecast period.

Bariatric surgery refers to a range of instruments that are used in a bariatric surgery in order to conduct and streamline the operation. A patient who needs bariatric surgery often has obesity and seeks to lose weight surgically by a biliopancreatic diversion with a duodenal switch, gastrectomy, or another technique. Moreover, cannulas, clamps, forceps, dissectors, graspers, needle holders, hooks, retractor arms, Nathanson liver retractors, scissors, and laparoscopic trocar incision closure tools are typical bariatric and laparoscopic instruments. Clip appliers, electrodes, electrosurgical cables, knot pushers, needles, probes, retractors, scopes, suction tubes, and trocar cannulas are additional equipment used in laparoscopic surgeries.

A treatment called bariatric surgery involves operating on the digestive system primarily for weight-loss purposes. By reducing the number of meals that the stomach can consume or limiting the number of nutrients that are absorbed in the intestinal canal, bariatric surgery devices change the gastrointestinal tract. Numerous operations are being carried out for obese patients as a part of bariatric surgery.

The standard of care treatments for long-term weight loss (sleeve gastrectomy, Roux en-Y bypass, and biliopancreatic diversions with duodenal switch) primarily work by changing the levels of the gut hormones that regulate satiety and hunger, creating a new hormonal weight set point. In these operations, bariatric surgery is a hormonal surgery in which the shift in gut hormones occurs as a result of the restriction and malabsorption of the process.

The market for bariatric surgery devices has been severely damaged by the COVID-19 pandemic. Sales of bariatric surgery equipment in the medical equipment market witnessed a substantial decline in the initial stages of the pandemic due to the diffusion of COVID-19 infection. In addition, all elective surgeries were postponed or canceled during the pandemic to make the most of the available hospital space for COVID-19 patients. A large number of patients have been denied access to bariatric surgery due to the novel coronavirus's widespread distribution and the lockdown policies that followed it. With most doctors occupied with the uninterrupted care of corona patients during the ongoing pandemic, the only services available to patients in public hospitals were oncological therapies and surgical emergencies.

Formerly regarded as a last alternative for weight loss, bariatric surgery has gained a lot of popularity over time due to the fact that it is both safer and more efficient than conventional medical techniques, such as prescription drugs and dietary counseling. Bariatric surgery has increased steadily in recent years all over the world. The American Society for Metabolic and Bariatric Surgery (ASMBS) estimates that there were 158,000 bariatric procedures carried out in the US in 2011 as opposed to 198,851 in 2020. The market for bariatric surgery devices is predicted to develop as a consequence of the rising demand for related equipment & devices brought on by the rising number of performed bariatric procedures.

Obesity brings on a number of other diseases with it, including diabetes, liver cirrhosis, and cardiovascular disorders. According to the Cleveland Clinic, type 2 diabetes can go into long-term remission after bariatric surgery. According to the study's findings, the technique is very successful in treating type 2 diabetes in obese people because it almost always leads to a three-year absence from insulin as well as other related medications. A person's risk of coronary heart disease, peripheral heart disorder, and stroke is considerably lowered post weight loss surgery. This factor is stimulating the growth of the bariatric surgery market.

One of the biggest factors, which is restricting the growth of the market is the increasing number of complications in the process of receiving approvals for the clinical use of these devices. Developing markets are working hard to establish a regulatory framework that will discriminate between pharmaceutical products and medicinal devices and equipment. The approval process is currently unstable and causes delays because there is no definite line between pharmaceuticals and devices. Therefore, it is anticipated that unstable regulatory frameworks will lengthen the clearance process for surgical equipment, somewhat restricting the market's expansion.

On the basis of Devices Type, the Bariatric Surgery Devices Market is bifurcated into Minimally Invasive Surgical Devices (Stapling Devices, Energy/Vessel-sealing Devices, Suturing Devices, and Accessories) and Noninvasive Surgical Devices. In 2021, the noninvasive surgical devices segment garnered a substantial revenue share of the bariatric surgery devices market. The major factor that is propelling the growth of this segment of the market is that it does not leave any wounds after the surgery, which is significantly helpful in reducing the hospital stay period.

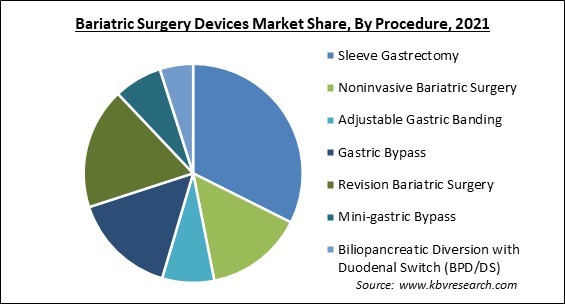

By Procedure, the Bariatric Surgery Devices Market is segregated into Sleeve Gastrectomy, Gastric Bypass, Revision Bariatric Surgery, Noninvasive Bariatric Surgery, Adjustable Gastric Banding, Mini-gastric Bypass, and Biliopancreatic Diversion with Duodenal Switch (BPD/DS). In 2021, the sleeve gastrectomy segment procured the highest revenue share of the bariatric surgery devices market. The growing benefits of sleeve gastrectomy can be ascribed to the significant proportion of this market. Compared to other bariatric operations, benefits include safety, effectiveness, price, and fewer problems.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 2.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.3% from 2022 to 2028 |

| Number of Pages | 253 |

| Number of Tables | 390 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Devices Type, Procedure, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the Bariatric Surgery Devices Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the largest revenue share of the bariatric surgery market. The rapidly increasing growth of the regional market is significantly attributed to factors, like the rising prevalence of chronic diseases, the incidence of obesity and diabetes, the rising number of bariatric surgeries, the rising cost of healthcare, and the rising demand for MIS surgeries.

Free Valuable Insights: Global Bariatric Surgery Devices Market size to reach USD 2.4 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Johnson & Johnson, ReShape Lifesciences, Inc., Apollo Endosurgery, Inc., Medtronic PLC, Olympus Corporation, Intuitive Surgical, Inc., B. Braun Melsungen AG, Spatz FGIA, Inc., Cook Medical, Inc. (Cook Group), and Richard Wolf GmbH.

By Devices Type

By Procedure

By Geography

The global Bariatric Surgery Market size is expected to reach $2.4 billion by 2028.

Rising Prevalence Of Obesity All Over The World are driving the market in coming years, however, Complex Go-To-Market Procedures Along With The Dearth Of Skilled Personnel restraints the growth of the market.

Johnson & Johnson, ReShape Lifesciences, Inc., Apollo Endosurgery, Inc., Medtronic PLC, Olympus Corporation, Intuitive Surgical, Inc., B. Braun Melsungen AG, Spatz FGIA, Inc., Cook Medical, Inc. (Cook Group), and Richard Wolf GmbH.

The expected CAGR of the Bariatric Surgery Market is 5.3% from 2022 to 2028.

The Minimally Invasive Surgical Devices market acquired the maximum revenue share in the Global Bariatric Surgery Devices Market by Devices Type in 2021, thereby, achieving a market value of $1.9 billion by 2028.

The North America market dominated the Global Bariatric Surgery Devices Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $888.2 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.