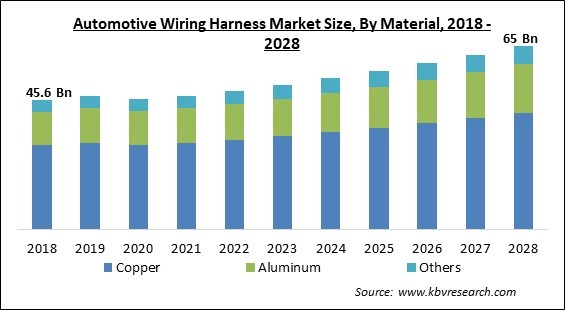

The Global Automotive Wiring Harness Market size is expected to reach $65 billion by 2028, rising at a market growth of 4.8% CAGR during the forecast period.

An assembly of wires, terminals, and connections known as an "automotive wiring harness" runs throughout the vehicle to transport data and electrical power. The automotive wire harness is integrated to connect various vehicle parts, including the body, engine, chassis, dashboard, and others. It is developed to meet the electrical and dimensional requirements of automobiles. To ensure fundamental operation and improved safety, an automotive wire harness facilitates the transfer of control signals and electrical power to electronic and electrical devices.

Today's automobiles come with electrical components that not only allow them to move, turn, and stop, but also carry out several additional tasks. To operate these electronic components and send power and messages to every section of the car, wiring harnesses are essential. They are essential parts similar to the blood veins and nerves in the human body, consisting of connectors, terminals, clamps, sheaths, and other components surrounding a core of electrical wires.

Since 1987, the wiring harness has been the foundation of the company. For the automotive industry, Sumitomo Electric Wiring Systems creates and produces wiring harness components of the highest caliber and greatest dependability. A wiring harness is a logical arrangement of wires, terminals, and connectors that runs throughout the entire vehicle and transmits data and electrical power, effectively "connecting" several different components. Similar to how the circulatory and central nervous systems of the human body transmit energy and information, this network does the same.

The COVID-19 pandemic has caused supply-chain interruptions that have delayed the production of automobiles. A number of automakers had a scarcity of wire harness components, which further delayed the production of vehicles. For instance, Hyundai in South Korea ceased operations at the Ulsan complex in 2020 owing to a part shortage. Auto sales suffered a dramatic decline as a result of the COVID-19 pandemic and related lockdowns. The sale of electric vehicles did, however, enjoy growth. Due to greater German purchase incentives, ongoing battery cost drops, and a shift in technology driven by fleet operators to meet 2020 emissions limits, the sale of electric vehicles grew in Europe.

The desires for driver assistance technology to combine cutting-edge features in automobiles have been spurred by increased awareness about safety and security. Additionally, automakers must adhere to safety regulations and include features like airbags. To increase the comfort of the driving experience, comfort features include voice recognition systems, ambient lighting systems, heated seats, and steering wheels, improved infotainment capabilities, digital IP displays, cooled cupholders, and more power steering functions that have gained popularity.

The conventional copper wiring harness weighs a lot and takes up a lot of room inside the car. After the engine and chassis, the wiring harness is the third-heaviest component, weighing 50-70 kg. Every day, more wiring harnesses are created as a result of the growing number of features in automobiles. Compared to an internal combustion engine powertrain, the development of the electric powertrain alone adds around 30% extra weight. These elements affect the vehicle's performance and fuel efficiency while also adding to the weight of the wire harness and the overall vehicle.

The car has several electrical issues, including non-working front and rear lights, a dead battery, dim lights, a failing alternator, and ignition problems that can result from faulty wire harnesses. Due to quickly varying surroundings, such as sudden temperature changes from extremely hot to extremely cold, the wiring harness might occasionally bend. These issues could cause the wiring harness to deteriorate, shortening its lifespan. For instance, Sumitomo created the aluminum wiring harness, which joins copper-based connectors with aluminum wires. Galvanic corrosion will occur if this mixture of aluminum and copper is exposed to saltwater or another electrolyte solution.

Based on the Material, the Automotive Wiring Harness Market is divided into Copper, Aluminum, and Others. The copper segment acquired the highest revenue share in the automotive wiring harness market in 2021. It is due to the electrification of vehicles and the rise in demand for larger vehicles, such as SUVs and full-size vans, which are the main factors driving the high need for copper-based wire harnesses. In this case, copper or copper braiding materials with a tin coating would be employed.

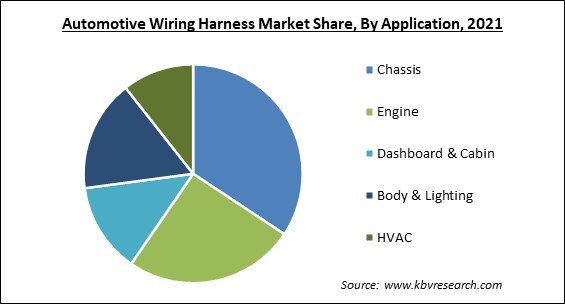

On the basis of Application, the Automotive Wiring Harness Market is divided into Body & Lighting, Engine, HVAC, Chassis, Dashboard & Cabin, and Others. The dashboard & cabin segment recorded a significant revenue share in the automotive wiring harness market in 2021. Due to the increasing use of entertainment systems and dashboard displays in various types of vehicles, the dashboard/cabin harness sector now holds a monopoly on the automotive wiring harness market. Utilization of the wiring harness in the vehicle's seat is increased by the integration of devices like active health monitoring and heated seats.

On the basis of propulsion, the Automotive Wiring Harness Market is classified into ICE Vehicles, Electric Vehicles, and Hybrid Vehicles. The ICE vehicles segment procured the largest revenue share in the automotive wiring harness market in 2021. It is due to the fact that more ICE-based cars are produced than electric vehicles (EVs). They are also being swiftly combined with self-driving capabilities as well as vehicle-to-vehicle (V2V) and vehicle-to-vehicle (V2V) communication. Wire harnesses are so crucial in ICE vehicles for transporting power and data among a wide variety of electrical sensors and systems.

Based on the Voltage, the Automotive Wiring Harness Market is bifurcated into Low Voltage and High Voltage. The high voltage segment witnessed a substantial revenue share in the automotive wiring harness market in 2021. Wires and plastic covers make up the standard high-voltage wiring harness for HEVs. Because the plastic shield doesn't transfer heat well, a larger-sized wire is required for high-voltage wiring harnesses to minimize Joule-heat loss. Making the molds for new or modified protection also requires a hefty design cost and a longer lead time. To solve these issues, created the pipe shield electrical harness.

By Vehicle Type, Automotive Wiring Harness Market is segmented into Two Wheeler, Passenger Cars, and Commercial Vehicles. The passenger cars segment garnered the highest revenue share in the automotive wiring harness market in 2021. A four-wheeled vehicle having at least two axles and its driver is referred to as a passenger vehicle. Passenger transportation is its primary objective. Public transit uses a large percentage of passenger cars. Due to their current potential to offer significant environmental, societal, and health benefits, BEVs have become increasingly popular.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 47.2 Billion |

| Market size forecast in 2028 | USD 65 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.8% from 2022 to 2028 |

| Number of Pages | 304 |

| Number of Tables | 550 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Material, Propulsion, Voltage, Vehicle Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Automotive Wiring Harness Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region segment garnered the largest revenue share in the automotive wiring harness market in 2021. It is because of rising premium car demand, rising disposable income in China and India, and rising use of electric vehicles in the region. Government programs to provide benefits for the purchase of electric vehicles are assisting in the spike in the adoption of electric vehicles. Additionally, the wire harness is needed for the integration of sophisticated technologies in automobiles, which is anticipated to boost market expansion.

Free Valuable Insights: Global Automotive Wiring Harness Market size to reach USD 65 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Lear Corporation, Aptiv PLC, Sumitomo Electric Industries, Ltd., Fujikura Ltd., Nexans SA, Furukawa Electric Co., Ltd., Samvardhana Motherson International Ltd, Leoni AG, Yazaki Corporation and Yura Corporation

By Material

By Application

By Propulsion

By Voltage

By Vehicle Type

By Geography

The Automotive Wiring Harness Market size is projected to reach USD 65 billion by 2028.

Vehicle Features that are Becoming More Advanced are driving the market in coming years, however, Concerns about the Wiring Harness's Lifespan restraints the growth of the market.

Lear Corporation, Aptiv PLC, Sumitomo Electric Industries, Ltd., Fujikura Ltd., Nexans SA, Furukawa Electric Co., Ltd., Samvardhana Motherson International Ltd, Leoni AG, Yazaki Corporation and Yura Corporation

The Low market has acquired the highest market share in Global Automotive Wiring Harness Market by Voltage in 2021; thereby, achieving a market value of $43.9 billion by 2028.

The Chassis market is leading the Global Automotive Wiring Harness Market by Application in 2021; thereby, achieving a market value of $18.7 billion by 2028.

The Asia Pacific market dominated the Global Automotive Wiring Harness Market by Region in 2021; thereby, achieving a market value of $23.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.