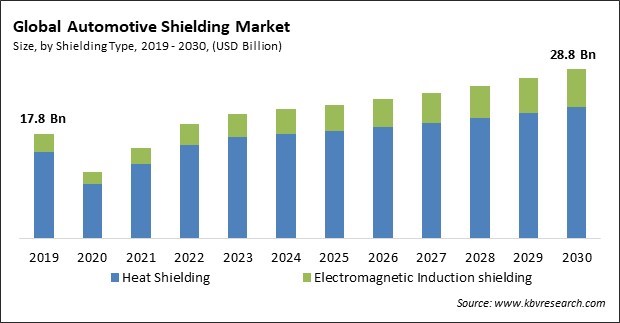

The Global Automotive Shielding Market size is expected to reach $28.8 billion by 2030, rising at a market growth of 4.4% CAGR during the forecast period.

Plastics contribute to the ongoing trend of lightweighting in the automotive industry, addressing the challenges posed by the electromagnetic fields generated by electric propulsion systems. Consequently, the Plastic segment captured $3,969.9 million revenue in the market in 2022. Plastics are generally lighter than metals like aluminum. With automotive manufacturers emphasizing fuel efficiency and reducing vehicle weight to meet environmental standards, using lightweight plastics for shielding contributes to overall weight reduction, improving fuel economy. Moreover, certain types of plastics exhibit excellent resistance to corrosion and chemicals. This corrosion resistance can be beneficial in automotive applications, especially in areas prone to exposure to moisture, road salts, and other corrosive elements.

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2023, Autoneum Holding AG acquired Borgers' automotive business, strengthened its leadership in sustainable vehicle acoustic and thermal management. Shareholders approved a capital band for the planned CHF 100 million capital increase to finance the acquisition. Additionally, March, 2021, Dana Incorporated acquired Pi Innovo LLC, aimed to enhance Dana's ability to deliver value to customers in electric vehicle development.

Based on the Analysis presented in the KBV Cardinal matrix; 3M Company is the forerunners in the Market. Companies such as Henkel AG & Company, KGaA, Parker Hannifin Corporation, RTP Company, Inc. are some of the key innovators in Market. For Instance, In, May, 2019, RTP Company, Inc. acquired the Zeotherm TPV product line from Zeon Chemicals, expanding its product portfolio, which already included compounds based on SEBS, TPV, TPU, POE, COPE, and COPA. This acquisition strengthened RTP Company's position with one of the industry's most extensive TPE product portfolios.

Electric and hybrid vehicles rely heavily on electronic components for various functions, including power electronics, battery management systems, electric motors, and advanced driver assistance systems (ADAS). The intricate electronic architecture makes these vehicles more susceptible to electromagnetic interference. The powertrain of electric vehicles involves high-voltage systems, inverters, and electric motors. These components can generate electromagnetic fields that may interfere with sensitive electronic systems within the vehicle. Electric vehicles frequently integrate advanced infotainment systems, navigation, and connectivity features. The coexistence of these consumer electronics with critical vehicle control systems requires thorough EMI shielding to prevent interference that might impact safety and user experience. The reliability and durability of electronic components in electric vehicles are paramount. EMI can lead to malfunctions, system failures, or accelerated wear and tear. Robust EMI shielding helps ensure the longevity and dependability of the electronic systems in these vehicles. These factors will boost the demand in the market.

Advanced driver assistance systems (ADAS) rely on various electronic components, including sensors, cameras, radar systems, lidar, and processing units. These components function in unison to assist with tasks such as avoiding collisions, adaptive cruise control, and lane departure warning. Sensors, especially those used for collision detection and avoidance, require precise and real-time data. ADAS features are often integrated with the broader vehicle control systems. Unwanted electromagnetic interference can affect the ADAS components and other critical systems, potentially impacting overall vehicle performance and safety. Regulatory bodies and safety standards organizations are increasingly focusing on the performance and safety of ADAS features. Compliance with electromagnetic compatibility (EMC) standards is essential for manufacturers to ensure that ADAS functionalities operate reliably in various electromagnetic conditions. Owing to these factors, there will be an increased demand in the market.

However, Governments worldwide impose stringent safety standards for vehicles to protect occupants and pedestrians. These standards often require specific materials for various safety features, like airbags, crumple zones, and structural reinforcements. Incorporating these safety features might necessitate supplementary shielding to safeguard delicate electronic components in the event of a collision. Emissions standards have become more stringent with an increasing focus on environmental sustainability. Performance standards set by regulatory bodies often push automakers to develop advanced technologies, such as electric and hybrid powertrains, sophisticated infotainment systems, and autonomous driving features. These technologies introduce new challenges related to electromagnetic compatibility (EMC) and require shielding to prevent unwanted interference that could affect the performance of these systems. EMC standards aim to minimize electromagnetic interference between various electronic components within the vehicle. This requires shielding materials and technologies to isolate and protect sensitive electronics from interference. These aspects will limit the growth of the market.

Based on shielding type, the market is segmented into electromagnetic induction shielding and heat shielding. In 2022, the electromagnetic induction shielding segment witnessed a substantial revenue share in the market. The trend toward vehicle electrification, including electric vehicles (EVs) and hybrid vehicles, has substantially increased electronic components. In proportion to the increasing prevalence of electronic systems in various facets of automotive design, the demand for effective EMI shielding has increased. These aspects will help in the growth of the segment in the future.

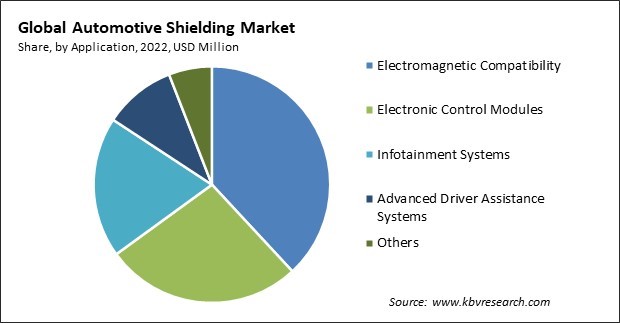

On the basis of application, the market is segmented into electromagnetic compatibility, electronic control modules, infotainment systems, advanced driver assistance systems, and others. The electromagnetic compatibility segment procured the highest revenue share in the market in 2022. With the integration of advanced communication technologies like vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, as well as emerging trends in autonomous driving, vehicles require reliable and uninterrupted communication. Effective EMC solutions are crucial to prevent interference that could disrupt communication signals, ensuring the safety and efficiency of connected vehicle systems. Moreover, modern vehicles are equipped with a growing number of electronic systems and components, which creates a need for robust EMC solutions to prevent electromagnetic interference (EMI) between these systems, ensuring their proper functionality and reliability.

By vehicle, the market is divided into passenger and commercial. In 2022, the commercial segment garnered a significant revenue share in the market. Light commercial vehicles are often customized to meet specific business needs, leading to a diverse range of applications. These applications may include refrigerated vans, service vehicles, and utility trucks. The varied nature of light commercial vehicle applications creates a demand for flexible and adaptable shielding solutions. Owing to these factors there will be increased demand in the segment.

Based on material, the market is divided into copper, plastics, aluminum, foam, nickel, stainless steel, and others. The copper segment recorded the maximum revenue share in the market in 2022. Copper possesses high thermal conductivity, allowing it to efficiently dissipate heat. In automotive applications, copper shielding helps manage heat generated by various vehicle components, such as engine compartments, transmission systems, or electrical systems. The use of copper in automotive shielding aligns with sustainability efforts as it supports eco-friendly practices by promoting the recycling and reusability of materials, reducing environmental impact. Owing to these benefits, the segment will witness increased demand in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 19.5 Billion |

| Market size forecast in 2030 | USD 28.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 4.4% from 2023 to 2030 |

| Number of Pages | 324 |

| Number of Table | 484 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Shielding Type, Material, Vehicle, Application, Region |

| Country scope |

|

| Companies Included | Dana Incorporated, Tenneco, Inc., Henkel AG & Company, KGaA, Morgan Advanced Materials plc, 3M Company, Parker Hannifin Corporation, RTP Company, Inc., Autoneum Holding AG, Tech Etch, Inc. and Marian, Inc. |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a considerable revenue share in the market. Europe prioritizes vehicle safety, and electromagnetic shielding is crucial in ensuring the proper functioning of safety-critical systems such as airbags, collision avoidance radars, and electronic stability control. The commitment to enhancing vehicle safety may drive the adoption of advanced shielding technologies. These aspects will pose lucrative growth prospects for the Europe segment.

Free Valuable Insights: The Global Automotive Shielding Market size to reach USD 28.8 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Dana Incorporated, Tenneco, Inc., Henkel AG & Company, KGaA, Morgan Advanced Materials plc, 3M Company, Parker Hannifin Corporation, RTP Company, Inc., Autoneum Holding AG, Tech Etch, Inc. and Marian, Inc.

By Shielding Type

By Application

By Vehicle

By Material

By Geography

The Market size is projected to reach USD 28.8 billion by 2030.

Shift toward electric and hybrid vehicles are driving the Market in coming years, however, Stringent regulatory measures regarding automotive shielding restraints the growth of the Market.

Dana Incorporated, Tenneco, Inc., Henkel AG & Company, KGaA, Morgan Advanced Materials plc, 3M Company, Parker Hannifin Corporation, RTP Company, Inc., Autoneum Holding AG, Tech Etch, Inc. and Marian, Inc.

The Heat Shielding segment is generating the maximum revenue in the Market by Shielding Type in 2022; thereby, achieving a market value of $22.5 billion by 2030.

The Passenger segment is leading the Market by Vehicle in 2022; thereby, achieving a market value of $22.1 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $14.1 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.