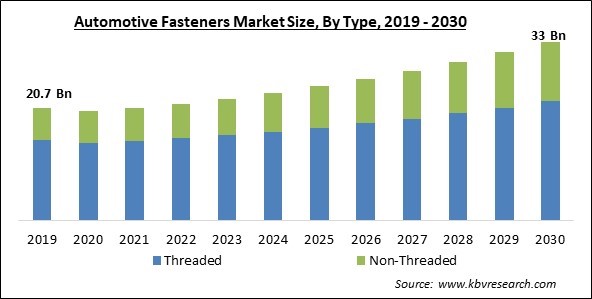

The Global Automotive Fasteners Market size is expected to reach $33 billion by 2030, rising at a market growth of 5.6% CAGR during the forecast period.

Due to the rising requirement for metal-to-metal fastening in automobiles, the demand for detachable fasteners expanded. Also, this has aided automakers with problems with fasteners and bolts fitting in the automobiles due to loosening. Thus, Removable segment will register a 3/4th share in the market by 2030. This is attributable to how simple and adaptable this fastener is to install when joining two metal objects in vehicles. These fasteners allow them to fix and replace the fitting so that the parts or components fit perfectly. Some of the factors impacting the market are high-quality products, the increase in number of electric vehicle sales, and the need of Intensive Capital.

To enhance vehicle performance and increase fuel efficiency, suppliers of high-quality products in the market want to focus their efforts. Because there is no need to preheat the metals, producers can build automobiles faster and more economically using novel friction-based riveting technology like rotating hammer riveting (RHR). Manufacturers of electric vehicles should adhere to all EV regulations, including those controlling battery performance, energy consumption, recycling, reusing, and durability of batteries, as well as onboard and wireless charging. Additionally, the automotive sector is investing a large amount of capital toward the research and development of electric vehicles. Governments from various nations and regulatory organizations globally are promoting using electric vehicles to minimize fuel consumption and conserve foreign exchange reserves. Electric mobility is a great alternative to short- and medium-distance individual transportation because it provides high levels of comfort, is simple to operate, and eliminates away with the need for a conventional vehicle. Therefore, the use of lightweight materials and cutting-edge technology and due to rising demand for electric and hybrid automobiles, is driving the market.

However, automobiles often feature a variety of sophisticated mechanical and electrical subsystems. They have many moving parts, making their development and maintenance difficult and expensive. For better seasonal performance and operation, automotive fasteners ensure the auto vehicle is in a single state without discrepancies in the numerous bound components/parts. Automotive fasteners are expensive, time-consuming, and risky to manufacture because numerous things might go improperly if the component is not designed properly. To maintain market competitiveness and prevent a drop in the market, manufacturers must weigh the potential benefits of these improved fasteners against their production costs.

On the basis of type, the market is segmented into threaded, and non-threaded. The non-threaded segment acquired a substantial revenue share in the market in 2022. Conversely, a non-threaded fastener lacks internal threading to hold it in place with other parts. These fasteners demonstrate several locking techniques for mechanical components. Rings, rivets, pins, and washers are examples of non-threaded fasteners. Non-threaded fasteners are becoming increasingly necessary for minor automotive parts requiring less frequent maintenance.

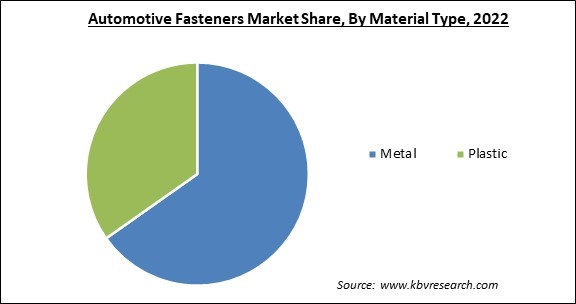

Based on material type, the market is fragmented into metal, and plastic. In 2022, the metal segment held the highest revenue share in the market. Metal fasteners are more durable, mechanically, and practically resistant. Stainless steel fasteners with a high level of corrosion resistance and minimal maintenance are available from manufacturers of metal fasteners. Stainless steel is the material from which automotive fasteners are usually produced, though this varies depending on its intended usage.

By characteristic, the market is classified into removable, and fixed. The fixed segment recorded a remarkable revenue share in the market in 2022. The majority of permanent fasteners are found in non-metallic auto parts. The popularity of permanent fasteners is rising as a wider range of high-tech interiors are being used in cars. These qualities are necessary to guarantee automobile assemblies' lifetime, dependability, and safety.

Based on vehicle type, the market is categorized into passenger cars and commercial vehicle. In 200, the passenger car segment witnessed the largest revenue share in the market. Due to the increased demand for passenger cars worldwide, this segment will grow effectively. The demand for passenger automobiles is expected to see an increase in demand for plastic fasteners due to government limits on lightweight vehicles.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 21.5 Billion |

| Market size forecast in 2030 | USD 33 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.6% from 2023 to 2030 |

| Number of Pages | 241 |

| Number of Table | 400 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Material Type, Characteristic, Vehicle Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. As major automakers have production facilities in China and Japan, the automotive sector in these nations is well-established. Market expansion is anticipated to be fueled by government programs that support the development of automobile manufacturing facilities in developing nations like India. Lightweight automotive fasteners are anticipated to benefit greatly from the region's growing EV demand.

Free Valuable Insights: Global Automotive Fasteners Market size to reach USD 33 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bulten AB, KAMAX Holding GmbH & Co. KG, Stanley Black & Decker, Inc., Berkshire Hathaway, Inc., Illinois Tool Works Inc., SFS Group AG, LISI GROUP, Westfield Fasteners Ltd, Shanghai Prime Machinery Co., Ltd. (Shanghai Electric Group Company Limited) and Sundram Fasteners Limited (TVS Group).

By Type

By Material Type

By Characteristic

By Vehicle Type

By Geography

The Market size is projected to reach USD 33 billion by 2030.

Raising number of electric vehicle sales are driving the Market in coming years, however, Intensive Capital Needs restraints the growth of the Market.

Bulten AB, KAMAX Holding GmbH & Co. KG, Stanley Black & Decker, Inc., Berkshire Hathaway, Inc., Illinois Tool Works Inc., SFS Group AG, LISI GROUP, Westfield Fasteners Ltd, Shanghai Prime Machinery Co., Ltd. (Shanghai Electric Group Company Limited) and Sundram Fasteners Limited (TVS Group).

The Threaded segment is generating maximum revenue in the Market by Type in 2022; thereby, achieving a market value of $22 billion by 2030.

The Removable segment is leading the Market by Characteristic in 2022; thereby, achieving a market value of $21.4 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $13.4 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.