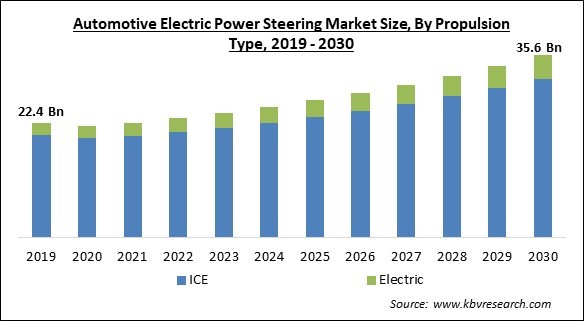

The Global Automotive Electric Power Steering Market size is expected to reach $35.6 billion by 2030, rising at a market growth of 5.6% CAGR during the forecast period.

Dual Pinion EPS enhances the primary pinion for vehicle dynamics and performance, while the secondary pinion is optimized for assistance. Consequently, Pinion Electric Power Steering would acquire approximately 1/4th share of the market by 2030. The Pinion Type offers additional design flexibility to locate the controller, motor, and assist mechanism on the opposite side of the vehicle's engine compartment from the driver. As a result of technological advancements that have made the pinion-type EPS more affordable, the pinion type is anticipated to expand at a constant rate. Some of the factors impacting the market are strict emission and efficiency standards, adoption of Advanced Driver Assistance Systems (ADAS) on the rise, and high initial investment expenditures.

Stringent fuel efficiency and emission standards promote the expansion of the electric power steering (EPS) market for automobiles. EPS systems are more energy-efficient than conventional hydraulic power steering, resulting in better vehicle fuel economy. In addition, EPS systems contribute towards carbon emissions by eliminating the need for power steering fluid, thereby reducing the likelihood of fluid leakage and environmental contamination. Integration with vehicle control systems optimizes energy consumption, further reducing emissions. Moreover, ADAS technologies seek to improve vehicle safety and provide driver assistance in various driving situations; EPS systems play a crucial role in facilitating these systems' functionality. ADAS systems rely on precise and responsive steering control to implement features like lane-keeping assist, lane departure warning, and automated parking. With the implementation of EPS, vehicles reduce their energy consumption and improve their fuel efficiency following the EPA's proposed standards. Consequently, these factors are anticipated to propel the growth of the market.

However, the deployment of electric power steering (EPS) systems in vehicles requires substantial investments in the infrastructure of research, development, and production. To successfully design and optimize the various system components, including the electric motor, control unit, sensors, and software, the advancement of EPS technology requires extensive research and engineering. Significant capital expenditures are required for the purchase of specialized apparatus, tools, and production lines used in the production of EPS systems. Consequently, these factors are anticipated to restrain market expansion.

On the basis of propulsion type, the market is categorized into ICE and electric. In 2022, the electric segment garnered a significant revenue share in the market. The market growth is anticipated to be primarily driven by factors such as the increasing penetration of power-driven vehicles among consumers, the growing emphasis on environmental safety, and the increasing emphasis of government organizations on promoting sustainable development.

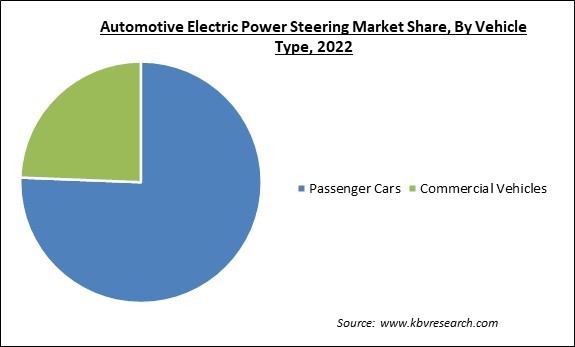

By vehicle type, the market is segmented into passenger cars and commercial vehicles. In 2022, the commercial vehicles segment covered a considerable revenue share in the market. Integrating electric power steering with ADAS technologies, like lane-keeping assist and collision avoidance systems, improves vehicle safety. In order to reduce accidents and enhance overall fleet management, these features are gaining importance in the commercial vehicle sector.

Based on component, the market is bifurcated into electric control units, electric motors, rack-and-pinion, steering columns, and others. In 2022, the steering column segment registered the maximum revenue share in the market. The steering column system is a mechanism that aids in controlling the car's direction. The system consists of the steering wheel, linkage, and connecting shafts for the front axles. The column is mounted to the vehicle's frame and can be altered vertically and laterally to assist drivers in finding a comfortable driving position.

Based on type, the market is divided into column electric power steering, rack electric power steering, and pinion electric power steering. In 2022, the column electric power steering held the highest revenue share in the market. Column EPS offers steering assistance through an electromechanical power unit installed on the steering column. This system was designed specifically for the cockpit's extant installation space.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 23.2 Billion |

| Market size forecast in 2030 | USD 35.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.6% from 2023 to 2030 |

| Number of Pages | 303 |

| Number of Table | 440 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, Propulsion Type, Vehicle Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. This is attributable to the swiftly expanding manufacturing sector and the more substantial development of the automobile industry, in which China leads the world. The Asia-Pacific region is at the vanguard of electric vehicle and component supply. In addition, the consistent increase in EV sales in China, India, and ASEAN is expected to present market participants with lucrative opportunities. Asia-Pacific market growth is likely to be bolstered by the rising demand for advanced safety features and a comfortable driving experience.

Free Valuable Insights: Global Automotive Electric Power Steering Market size to reach USD 35.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include NSK Ltd., Robert Bosch GmbH, HL Mando Corporation, Hitachi, Ltd., JTEKT Corporation, ZF Friedrichshafen AG, Thyssenkrupp AG, BBB Industries (Clearlake Capital Group, L.P.), Nexteer Automotive (Pacific Century Motors) and Zhejiang Shibao Co., Ltd.

By Propulsion Type

By Component

By Vehicle Type

By Type

By Geography

This Market size is expected to reach $35.6 billion by 2030.

Strict emission and efficiency standards are driving the Market in coming years, however, High initial investment expenditures restraints the growth of the Market.

NSK Ltd., Robert Bosch GmbH, HL Mando Corporation, Hitachi, Ltd., JTEKT Corporation, ZF Friedrichshafen AG, Thyssenkrupp AG, BBB Industries (Clearlake Capital Group, L.P.), Nexteer Automotive (Pacific Century Motors) and Zhejiang Shibao Co., Ltd.

The ICE segment is leading the Market by Propulsion Type in 2022; thereby, achieving a market value of $31 billion by 2030.

The Passenger Cars segment is generating the highest revenue in the Market by Vehicle Type in 2022; thereby, achieving a market value of $25.6 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $14.5 billion by 2030, growing at a CAGR of 5.8 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.