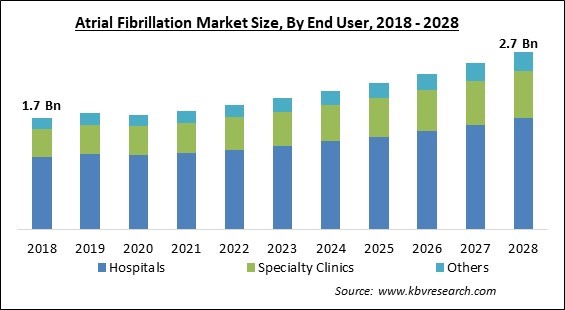

The Global Atrial Fibrillation Market size is expected to reach $2.7 billion by 2028, rising at a market growth of 6.1% CAGR during the forecast period.

A-fib, or atrial fibrillation, is irregular and frequently very fast heart rhythm (arrhythmia) that can cause cardiac blood clots. Stroke, heart failure, and other heart-related issues are all made more likely by A-fib. The heart's top chambers (the atria), which should pulse in unison with the lower chambers (the ventricles), instead beat chaotically and irregularly during atrial fibrillation.

A-fib may not show any symptoms in many people. However, A-fib may result in palpitations, a quick, hammering pulse, shortness of breath, or weakness. Atrial fibrillation episodes can be intermittent or recurrent. Even though A-fib is often not a life-threatening illness, it is a significant medical issue that has to be treated properly to avoid stroke.

Medication, therapy to correct the heart rhythm, and catheter operations to obstruct incorrect cardiac signals are all possible forms of treatment for atrial fibrillation. A person with atrial fibrillation may also experience atrial flutter, a similar heart rhythm issue. Despite being a distinct arrhythmia, atrial flutter can be treated in a manner that is quite similar to that of atrial fibrillation.

An abnormal heart rhythm (arrhythmia) known as atrial fibrillation (AF or A-fib) is defined by the fast and erratic beating of the atrial chambers of the heart. Short bouts of aberrant beating are frequently the first to appear, and over time, they often grow longer or never stop. It could also begin as another type of arrhythmia, such as atrial flutter, before changing into AF. Episodes could not show any symptoms.

Production of various atrial fibrillation products was slowed down by the COVID-19 outbreak. In addition, fewer COVID-19 cases are anticipated in the future with the introduction of the COVID-19 vaccine to the market. As a consequence, atrial fibrillation-specific businesses have reopened and are operating at full capacity. To respond to urgent events and develop new working methods, equipment and machinery producers must concentrate on safeguarding their workers, operations, and supply networks in the wake of the decline in COVID-19 infection cases.

The widespread increase in obesity and cardiac disorders is a major driver of the atrial fibrillation industry. Additionally, cardiac illnesses are one of the leading causes of death worldwide, and their prevalence is increasing quickly as a result of changing lifestyles. Obesity is linked to an elevated likelihood of developing cardiovascular disease (CVD), especially coronary heart disease and heart failure (HF) (CHD). The processes through which obesity raises the risk of CVD include modifications to body composition that may impact hemodynamics and modify the anatomy of the heart.

Globally, the number of elderly people is steadily rising. The number of adults 65 and over in the globe was estimated at 703 million in 2019 by the UN organization. In the world's population, those 65 and older now make up 9% of the total, up from 6% in 1990. That number is predicted to increase to 16% by 2050, which would mean that one in every six people on the planet will be 65 or older.

This technology is undoubtedly assisting in the market's outgrowth, but one aspect that is restricting expansion is the excessively expensive cost of the treatment procedure. Because it is expensive, it is not always appropriate to utilize it extensively. The first year following an atrial fibrillation diagnosis had the greatest expenses. The main cost component was the cost of admission, with the prices of the primary economy and medications only making up modest portions.

By End User, the Atrial Fibrillation Market is classified into Hospital, Specialty Clinics, and Other. The hospital segment garnered the highest revenue share in the atrial fibrillation market in 2021. Growing demand for minimally-invasive surgery, an increase in the number of catheter ablation operations conducted in hospital settings, the availability of cutting-edge medical facilities, and the availability of cutting-edge post-operative care facilities. The majority of patients receive their care in hospitals, and the growing number of skilled experts, including skilled cardiologists, physicians, and medical staff, has made it simple and convenient to perform operations for the treatment and diagnosis of atrial fibrillation.

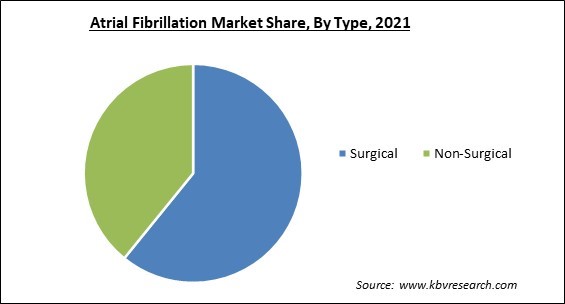

Based on the Type, the Atrial Fibrillation Market is segmented into Surgical and Non-Surgical. The non-surgical segment witnessed a significant revenue share in the atrial fibrillation market in 2021. It is because there are several therapy methods available to restore the heart's normal rhythm, depending on particular circumstances. The goal of treatment is to either manage or cure AFib while lowering the risk of stroke. The intensity of the problems, the likelihood of a specific treatment's effectiveness, and a comparison of the risks and advantages of other treatments all influence the choice of treatment.

On the basis of Technology, the Atrial Fibrillation Market is divided into Radiofrequency, Laser, Cryotherapy, and Others. The radiofrequency segment procured the largest revenue share in the atrial fibrillation market in 2021. It is because radiofrequency ablation employs heat (similar to microwave radiation) to kill the tissue. If medication is unable to control AFib, doctors may advise this therapy. The experts in the electrophysiology program are skilled in a variety of atrial fibrillation ablation techniques and will collaborate to choose the most appropriate course of action for the particular case.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.8 Billion |

| Market size forecast in 2028 | USD 2.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.5% from 2022 to 2028 |

| Number of Pages | 216 |

| Number of Tables | 353 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Technology, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Atrial Fibrillation Market is analysed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired the largest revenue share in the atrial fibrillation market in 2021. The main factor driving the growth of the atrial fibrillation market is the high adoption of technologically improved devices for atrial fibrillation in North American nations. Moreover, one of the biggest problems facing healthcare systems is the sharp rise in heart disorders among the aging population.

Free Valuable Insights: Global Atrial Fibrillation Market to reach USD 2.7 Billion by 2028

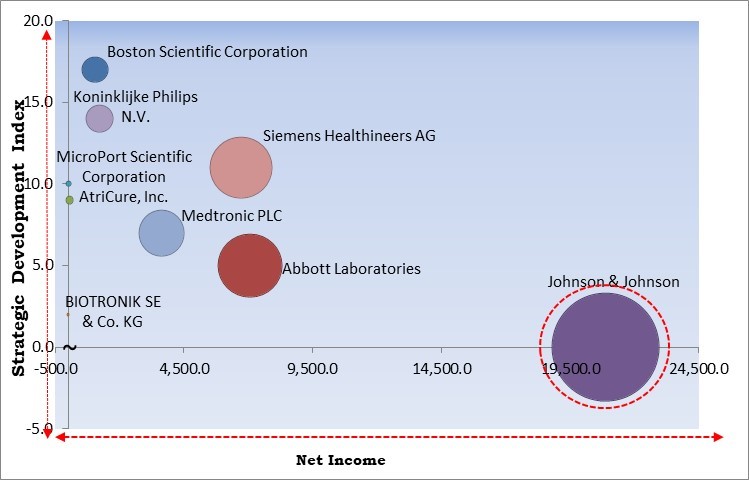

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson is the major forerunner in the Atrial Fibrillation Market. Companies such as Boston Scientific Corporation, Koninklijke Philips N.V. and Siemens Healthineers AG are some of the key innovators in Atrial Fibrillation Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Johnson & Johnson, MicroPort Scientific Corporation, Boston Scientific Corporation, Abbott Laboratories, Medtronic PLC, BIOTRONIK SE & Co. KG, Koninklijke Philips N.V., Siemens Healthineers AG (Siemens AG) and AtriCure, Inc.

By End User

By Type

By Technology

By Geography

The global Atrial Fibrillation Market size is expected to reach $2.7 billion by 2028.

Increasing prevalence of obesity and cardiac disorders are driving the market in coming years, however, Expensive therapy cost of atrial fibrillation restraints the growth of the market.

Johnson & Johnson, MicroPort Scientific Corporation, Boston Scientific Corporation, Abbott Laboratories, Medtronic PLC, BIOTRONIK SE & Co. KG, Koninklijke Philips N.V., Siemens Healthineers AG (Siemens AG) and AtriCure, Inc.

The expected CAGR of the Atrial Fibrillation Market is 6.1% from 2022 to 2028.

The Surgical market segment shows high market share in the Global Atrial Fibrillation Market by Type in 2021; thereby, achieving a market value of $1.6 billion by 2028.

The North America market dominated the Global Atrial Fibrillation Market by Region in 2021; thereby, achieving a market value of $923 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.