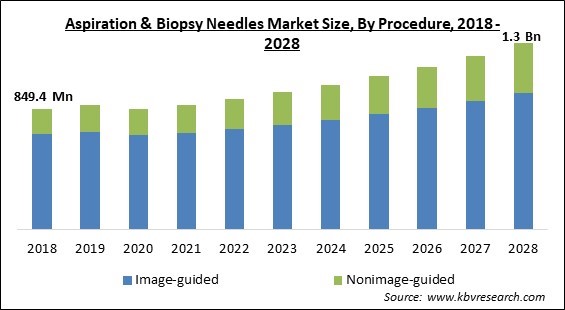

The Global Aspiration & Biopsy Needles Market size is expected to reach $1.3 billion by 2028, rising at a Market growth of 6.1% CAGR during the forecast period.

A biopsy is a surgical operation that involves removing tissue from an organ to detect the existence or degree of a disease, most commonly cancer and inflammatory disorders. Surgeons, radiologists, and interventional cardiologists are the most common practitioners. As a confirmatory test for cancer and celiac disease, biopsies can be conducted on any organ using specialized biopsy instruments. The type of organ under consideration determines how each biopsy equipment is used. Advanced imaging technologies, such as ultrasound-guided biopsy, MRI-guided biopsy, stereotactic-guided biopsy, CT scan, and others, can be used in conjunction with traditional biopsy techniques to perform a biopsy with accuracy and least invasiveness. Biopsies of body organs such as the liver, lungs, and kidneys are performed using these integrated methods.

Needle biopsy is a method of removing a sample of cells from the body by inserting a needle into the appropriate sampling area. The tissue is then examined in a laboratory to discover if it contains any abnormalities. A needle biopsy is used to determine the cause of symptoms such as a tumor, lump, inflammation, or infection. Computed tomography or ultrasound may be utilized in conjunction with a needle biopsy to provide more precise results.

To check anomalies at a specific location, radiologists and surgeons use biopsy needle techniques such as core-needle and fine-needle procedures. Increased demand for minimally invasive procedures, as well as cancer awareness programs run by governments and worldwide health organizations, are expected to drive Market growth throughout the forecast period.

Cancer screening, cancer management visits, and cancer biopsy procedures have all decreased significantly as a result of the COVID-19 outbreak. Cancer screening services were hampered to some extent as a result of the lockdowns, which reduced the demand for biopsy needles. In a study conducted in the United Kingdom and published in Lancet Oncology in March 2021, the consequences of delayed cancer detection due to COVID-19 were studied. Over 90,000 patients with breast, colorectal, esophageal, or lung cancer were included in the study. It was discovered that the COVID-19 pandemic will have a significant impact on 1- and 5-year cancer survival rates because of a decrease in diagnostic biopsies and a lack of screening services.

There has been a spike in the number of people diagnosed with cancer around the world. This can be due to a variety of factors, including changes in lifestyle, bad diets, and increased cigarette use. According to the International Agency for Research on Cancer (IARC), 17.0 million new cancer cases and 9.5 million cancer deaths occurred globally in 2018. The global burden of cancer is anticipated to rise to 27.5 million new cases and 16.3 million deaths by 2040, owing to population expansion and aging.

Disruptive business trends are expected as spanning from shifting supply chains to cost savings, automation, and a focus on customers. Companies that recognize and align their operations with industry trends will gain significant Market share. In the aspiration and biopsy needles Market , emerging Market s such as India, China, Brazil, and Mexico are expected to provide considerable growth potential for competitors. This can be ascribed to increased healthcare expenditures, improved living conditions, a broad target population base, improved and expanded healthcare infrastructure, and modernization of healthcare research and facilities in these countries.

Radiologists and surgeons use biopsy needle procedures such as core-needle and fine-needle procedures to examine anomalies at a specific spot. Patients may, however, get infections as a result of the cuts and incisions used to remove tissue samples. Furthermore, aspiration and biopsy needles are frequently reused, raising the infection risk during these procedures. Despite the fact that the reuse of some needles is discouraged by healthcare authorities and product manufacturers, the practice persists, particularly in developing nations.

Based on Product Type, the Market is segmented into Biopsy Needles and Aspiration Needles. The aspiration needles segment garnered a substantial revenue share in the aspirations and biopsy needles Market in 2021. A fine needle aspiration operation is a sort of biopsy. A thin needle is introduced into a region of abnormal-appearing tissue or bodily fluid in fine needle aspiration. The sample collected during fine needle aspiration, like other forms of biopsies, can help make a diagnosis or rule out illnesses like cancer.

Based on Procedure, the Market is segmented into Image-guided and Nonimage-guided. Based on Image-guided Type, the Market is segmented into Ultrasound-guided, CT-guided, MRI-guided, Stereotactic, and Others. The image-guided segment acquired the largest revenue share in the aspiration and biopsy needles Market in 2021.This occurred due to the increasing demand for minimally invasive biopsy and aspiration procedures. Modern image-guided treatments, also known as image-guided surgical procedures, have been around for almost 30 years, starting with stereotactic brain surgery and gradually expanding to orthopedics, spinal surgery, heart surgery, and abdominal surgery. In order for an image-guided surgical platform to be successful, it must be able to localize and track the position of the surgical instrument or therapeutic device, register a localized volume with preoperative data, and give this information to the surgeon in an intuitive display. Preoperative data is frequently supplemented by intraoperative imaging.

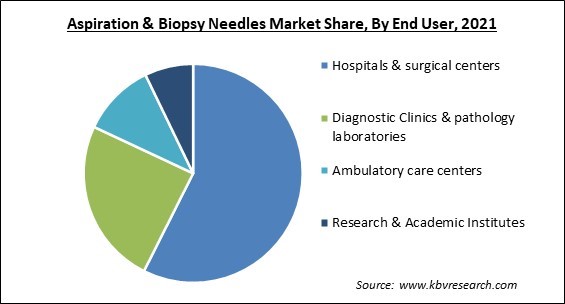

Based on End User, the Market is segmented into Hospitals & surgical centers, Diagnostic Clinics & pathology laboratories, Ambulatory care centers, Research & Academic Institutes. The diagnostic clinics and pathology laboratories garnered a substantial revenue share in the aspiration and biopsy needles Market in 2021. Clinicians use aspiration and biopsy needles to discover malignant growths and cardiac disorders such as atrial fibrillation. These needles can also be used for biopsies and aspirations of bone marrow. It is a diagnostic method in which cells or tissue samples are collected from various parts of the body in order to study them.

Based on Application, the Market is segmented into Tumor/ Cancer Applications, Wound Applications, and Others. Based on Tumor/ Cancer Applications Type, the Market is segmented into Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Kidney Cancer, Bone & Bone Marrow Cancer, and Others. The tumor/cancer segment acquired the largest revenue share in the aspiration and biopsy needles Market in 2021. The rising incidence of breast cancer, greater awareness of the disease, and increased research activity relevant to breast screening and diagnosis are all factors contributing to this segment's substantial proportion.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 877.8 Million |

| Market size forecast in 2028 | USD 1.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.1% from 2022 to 2028 |

| Number of Pages | 380 |

| Number of Tables | 670 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Procedure, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the Market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The North American region acquired the largest revenue share in the aspiration and biopsy needles Market in 2021. According to the American Cancer Society's 2019 estimates for non-Hodgkin lymphoma, it was one of the most frequent malignancies in the United States, accounting for roughly 4% of all cancers. Lymphoma, a prevalent malignancy, raises the demand for biopsy needles as well. EUS biopsy needles have also undergone technological developments, which are expected to drive robust growth in the biopsy needles Market throughout the forecast period.

Free Valuable Insights: Global Aspiration & Biopsy Needles Market size to reach USD 1.3 Billion by 2028

The Market research report covers the analysis of key stake holders of the Market . Key companies profiled in the report include Boston Scientific Corporation, Medtronic PLC, Johnson & Johnson, Merit Medical Systems, Inc., Cardinal Health, Inc., Becton, Dickinson and Company, ConMed Corporation, Olympus Corporation, Argon Medical Devices, Inc., and Cook Medical, Inc.

By Product Type

By Procedure

By End User

By Application

By Geography

The global aspiration & biopsy needles market size is expected to reach $1.3 billionn by 2028.

Rising Incidences of Cancer are increasing are driving the market in coming years, however, reusing aspiration and Biopsy Needles Poses Risk of Infection to Patients growth of the market.

Boston Scientific Corporation, Medtronic PLC, Johnson & Johnson, Merit Medical Systems, Inc., Cardinal Health, Inc., Becton, Dickinson and Company, ConMed Corporation, Olympus Corporation, Argon Medical Devices, Inc., and Cook Medical, Inc.

Yes, It was discovered that the COVID-19 pandemic will have a significant impact on 1- and 5-year cancer survival rates because of a decrease in diagnostic biopsies and a lack of screening services.

The Biopsy Needles segment acquired maximum share in the Global Aspiration & Biopsy Needles Market by Product Type in 2021, thereby, achieving a Market value of $858.5 million by 2028.

The North America is the fastest growing region in the Global Aspiration & Biopsy Needles Market by Region in 2021, and would continue to be a dominant Market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.