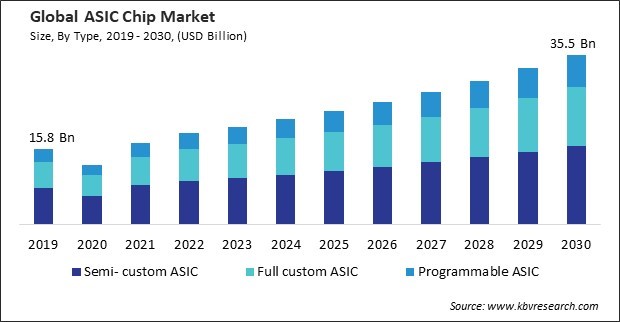

The Global ASIC Chip Market size is expected to reach $35.5 billion by 2030, rising at a market growth of 8.2% CAGR during the forecast period.

The ever-growing demand for smartphones and tablets is a key driver for the consumer electronics segment. Thus, the consumer electronics segment acquired $2,683.1 million in 2022. ASICs are used in these devices for various functions, including signal processing, graphics rendering, and power management, contributing to enhanced performance and efficiency.

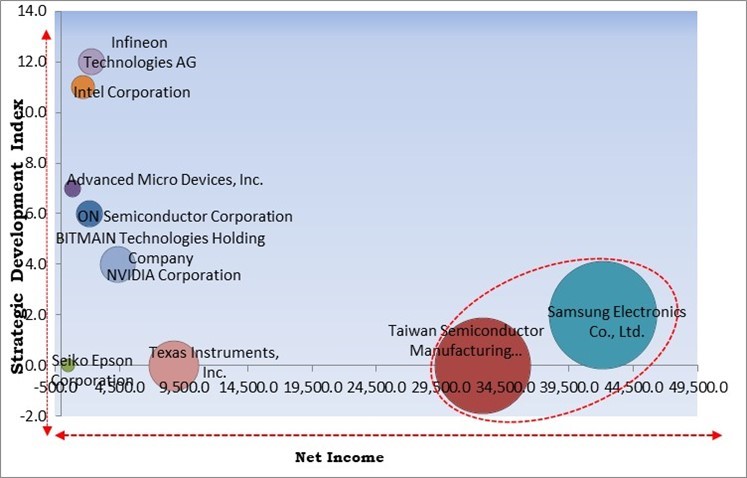

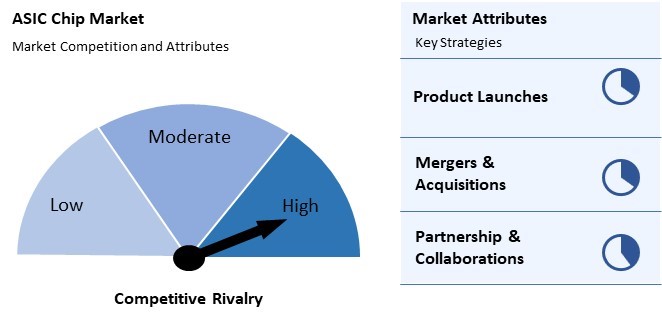

The major strategies followed by the market participants are Partnerships & Collaborations as the key developmental strategy to keep pace with the changing demands of end users. For instance, In Feb 2024, Intel Corporation signed a collaboration with Wipro to accelerate the development of advanced and innovative chip designs. Additionally, In, Jul 2022, Intel Corporation came into partnership with MediaTek to manufacture chips, leveraging the advanced process technologies offered by Intel Foundry Services (IFS).

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. and Taiwan Semiconductor Manufacturing Company Limited are the forerunners in the ASIC Chip Market. In Mar 2021, Samsung Electronics Co., Ltd. and Marvell Technology, Inc to accelerate the advancement of high-impact 5G solutions that provide a competitive advantage to their operators. Companies such as Texas Instruments, Inc., NVIDIA Corporation, and Infineon Technologies AG are some of the key innovators in Market.

ASICs are known for their high performance and efficiency in specific applications. As industries demand faster and more specialized processing capabilities, ASICs are preferred to meet these performance requirements. Thus, these factors can assist in the growth of the market.

Additionally, ASICs can be designed to accelerate the computations commonly involved in AI and ML tasks, such as matrix multiplications and convolutions. This targeted optimization results in significantly higher performance than general-purpose processors that may not be as well-suited for these specific workloads. Therefore, these factors can assist in the growth of the market.

The substantial upfront costs associated with ASIC (application-specific integrated circuit) design and development can be a significant barrier for smaller companies or projects with limited budgets. Thus, owing to these factors, there will be reduced demand for ASIC chips in the coming years.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

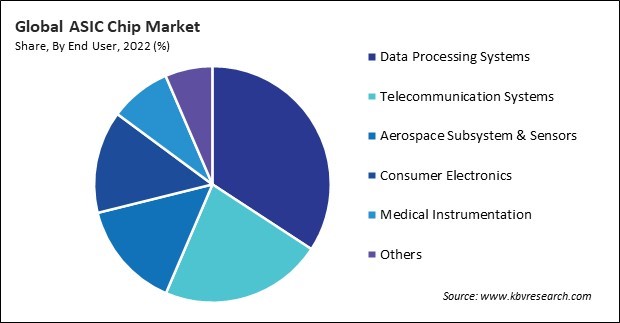

Challenges On the basis of end user, the market is divided into data processing systems, consumer electronics, telecommunication systems, aerospace subsystem & sensors, medical instrumentation, and others. The data processing systems segment recorded 34.2% revenue share in the market in 2022.

Based on type, the market is segmented into semi-custom ASIC, programmable ASIC, and full custom ASIC. In 2022, the programmable ASIC segment garnered 18% revenue share in the market. Programmable logic devices, especially FPGAs, provide great flexibility and customization.

Free Valuable Insights: Global ASIC Chip Market size to reach USD 35.5 Billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific segment acquired 39% revenue share in the market. The Asia Pacific region, particularly countries like China, Japan, South Korea, and Taiwan, has been at the forefront of technology adoption and innovation.

The ASIC chip market is fiercely competitive across multiple sectors, including cryptocurrency mining, artificial intelligence, networking, and emerging technologies. Companies like BITMAIN Technologies Holding Company and Taiwan Semiconductor Manufacturing Company Limited vie for dominance in cryptocurrency mining, while tech giants such as NVIDIA, Intel, and Samsung Electronics Co., Ltd. compete vigorously in AI, networking, and telecommunications.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 19.2 Billion |

| Market size forecast in 2030 | USD 35.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 8.2% from 2023 to 2030 |

| Number of Pages | 212 |

| Number of Tables | 293 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market share analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, End User, Region |

| Country scope |

|

| Companies Included | Advanced Micro Devices, Inc., Samsung Electronics Co., Ltd. (Samsung Group), ON Semiconductor Corporation, Taiwan Semiconductor Manufacturing Company Limited, NVIDIA Corporation, Intel Corporation, Infineon Technologies AG, Texas Instruments, Inc., Seiko Epson Corporation, BITMAIN Technologies Holding Company |

By Type

By End User

By Geography

This Market size is expected to reach $35.5 billion by 2030.

Increased demand for customization across industries are driving the Market in coming years, however, High Initial Costs of ASIC ChipIncreased demand for customization across industries restraints the growth of the Market.

Advanced Micro Devices, Inc., Samsung Electronics Co., Ltd. (Samsung Group), ON Semiconductor Corporation, Taiwan Semiconductor Manufacturing Company Limited, NVIDIA Corporation, Intel Corporation, Infineon Technologies AG, Texas Instruments, Inc., Seiko Epson Corporation, BITMAIN Technologies Holding Company

The expected CAGR of this Market is 8.2% from 2023 to 2030.

The Semi- custom ASIC segment is leading the Market by Type in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $16.4 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $14.1 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.