The Asia Pacific Mobile Banking Market would witness market growth of 17.3% CAGR during the forecast period (2024-2031).

The China market dominated the Asia Pacific Mobile Banking Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $439.6 Million by 2031. The Japan market is registering a CAGR of 16.6% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 18% during (2024 - 2031).

Higher internet penetration means more individuals have access to the internet, allowing them to use mobile banking services from anywhere with internet connectivity. This increased accessibility expands the potential user base for banking apps, reaching individuals in both urban and rural areas.

Adoption trends in the market reflect consumers’ changing behaviors and preferences as they increasingly embrace digital banking channels. Several factors influence the adoption of this banking, including technological advancements, regulatory initiatives, consumer demographics, and societal trends.

China has rapidly transitioned from cash-based transactions to mobile payments, with platforms like Alipay and China UnionPay leading the way. According to the State Council of the People's Republic of China, approximately 22 million customers in more than 200 foreign nations and regions used China UnionPay's online payment services in 2022. In the same year, approximately 50 billion yuan of transactions were made using consumption vouchers that over 41 million Chinese citizens got through the China UnionPay payment app. The widespread adoption of mobile payments has made smartphones the primary tool for conducting financial transactions, increasing reliance on banking apps for managing funds, transferring money, and accessing financial services. In conclusion, the rising digital payments in the region are propelling the market’s growth.

Free Valuable Insights: The Global Mobile Banking Market is Predict to reach USD 5.7 Billion by 2031, at a CAGR of 16.5%

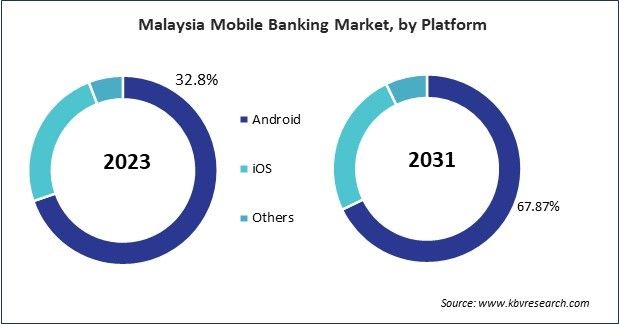

Based on Platform, the market is segmented into Android, iOS, and Others. Based on Transaction, the market is segmented into Consumer-to-business, and Consumer-to-consumer. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

By Platform

By Transaction

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.