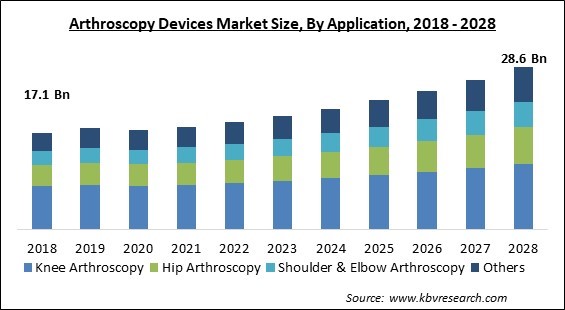

The Global Arthroscopy Devices Market size is expected to reach $28.6 billion by 2028, rising at a market growth of 7.2% CAGR during the forecast period.

An arthroscope is a medical instrument that allows doctors to see within bodily joints such as the shoulder, knee, spine, hip, and elbow to inspect, diagnose, and perform therapeutic procedures. Arthroscopy devices can look for illnesses like osteoarthritis, rheumatoid arthritis, tendonitis, and bone tumors in the joints. Furthermore, the use of arthroscopy devices has increased as the frequency of sports-related injuries and the number of sports tournaments has increased. Furthermore, the need for intrusive therapies is increasing across the world. Also, technological improvements have allowed arthroscopy devices to be used for a wide range of bone and joint disorders, resulting in a significant arthroscopy devices market opportunity.

As per the World Health Organization, there were 1 billion persons aged 60 and more in 2019, with that number predicted to rise to 1.4 billion by 2030 and 2.1 billion by 2050. As a result, the number of patients with musculoskeletal diseases will rise, which will increase the demand for arthroscopy instruments. Furthermore, 1.71 billion individuals will be affected by musculoskeletal diseases by 2021, making it the biggest cause of disability worldwide. As a result, medical gadgets that can efficiently test and treat bone and joint disorders are in high demand.

Moreover, in emerging economies, spending on healthcare facilities is rapidly expanding. According to the India Brand Equity Foundation, India's hospital business is predicted to reach approximately $372 billion in FY22, up from $61.79 billion in FY17, indicating a CAGR of roughly 16–17%. In addition, the use of arthroscopy devices allows patients to recover quickly and with few consequences.

COVID-19 virus quickly spread throughout several countries and regions, wreaking havoc on people's lives and the community as a whole. It started as a human health issue and has since evolved into a major threat to global trade, economics, and finance. The pandemic of COVID-19 raised the relevance of government healthcare facilities, resulting in increased healthcare spending around the world. Furthermore, once the COVID-19 vaccine becomes available, the number of cases is projected to decrease. This has resulted in the reopening of full-scale research labs for arthroscopy devices. This will aid the market get back on the path to recovery by the beginning of 2022. Companies that make medical equipment must concentrate on safeguarding their employees, operations, and supply networks in order to respond to immediate circumstances and build new working practices after a pandemic.

The arthroscopy devices market is growing due to the rising demand for joint replacement surgeries across various regions. Hundreds of thousands of joint replacement surgeries are conducted in developed regions such as North America and Europe. The healthcare segment in these regions is developed and governments in these nations put an emphasis on the adoption of the latest devices, thus pushing the adoption of the latest arthroscopy devices. Growth in the geriatric population is leading to an increase in the cases of the knee and joint-related disorders since the elderly are more vulnerable to these diseases.

The rising demand for arthroscopic gadgets in sports medicine is expected to present significant possibilities for market competitors. Manufacturers are working on arthroscopy equipment with high-definition cameras, improved suturing procedures, and specialized suturing materials to improve visualization. Arthroscopy devices improved the image qualoity from high definition to 4K. Surgical center leaders started to understand the many advantages of the improved image quality provided by 4K imaging. While regular high-definition imaging is undoubtedly good, there is a significant difference when they upgraded to 4K. With the help of 4K, pathology can be identified, exact measurements taken, diseases treated, and arthroscopic surgery performed with improved precision.

Swelling is one of the most common symptoms of joint inflammation before any surgical treatment. Following surgery, knee swelling can sometimes remain and even increase. Swelling can happen as a consequence of prolonged inflammation, hemorrhage, or infection within the joint. Resting the knee joint, applying ice, wearing an elastic bandage, and raising the extremities are all methods for reducing swelling. However, for some patients, swelling persists after arthroscopic surgery, which can be a bothersome cause of discomfort. Swelling that becomes worse can be an indication of something more severe issues. The creation of scar tissue surrounding the knee joint, as well as prolonged inflammation of the knee joint, can cause stiffness in the knee joint.

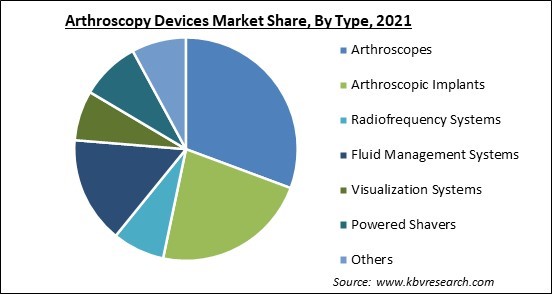

Based on Type, the market is segmented into Arthroscopes, Arthroscopic Implants, Radiofrequency Systems, Fluid Management Systems, Visualization Systems, Powered Shavers, and Others. The arthroscopic implants segment procured a substantial revenue share in the arthroscopy devices market in 2021. It is due to the availability of smart and personalized implants, arthroscopic implants have seen widespread acceptance in arthroscopic surgeries, providing lucrative market growth potential. These implants are effective for diaphyseal/metaphyseal reduction since they are designed to fit nicely and need little or no further bending. The demand for arthroscopic implants in internal tissue repair, bone grafting, joint fixation, and glenoid reconstruction has been boosted by the introduction of biodegradable implants and the demand for arthroscopic implants in internal tissue repair, bone grafting, joint fixation, and glenoid reconstruction.

Based on Application, the market is segmented into Knee Arthroscopy, Hip Arthroscopy, Shoulder & Elbow Arthroscopy, and Others. The knee arthroscopy segment acquired the largest revenue share in the arthroscopy devices market in 2021. This occurred as a result of an increase in the number of patients suffering from bone illnesses like arthritis. The rise in the senior population and the amount of sports-related injuries are driving market expansion. A tiny camera is inserted into the knee joint during knee arthroscopy. The surgeon uses the images from the camera to control microscopic surgical instruments, which are displayed on a television monitor. Degenerative knee disease is a worldwide occurrence among the elderly that is becoming more common as the worldwide geriatric population grows. According to the World Health Organization, roughly 25% of persons over the age of 50 suffer from degenerative knee disease, which causes knee discomfort. The pain is debilitating, and a knee replacement treatment is frequently the last and only option for relief.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 18 Billion |

| Market size forecast in 2028 | USD 28.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.2% from 2022 to 2028 |

| Number of Pages | 196 |

| Number of Tables | 310 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the largest revenue share of the arthroscopy devices market in 2021. Due to the rising frequency of bone-related ailments, which is predicted to raise demand for diagnostic testing devices such as arthroscopes, North America is expected to keep a prominent position in the arthroscopy device market throughout the forecast period. According to data published by the Centers for Disease Control and Prevention (CDC) in 2017, approximately 54.4 million persons in the United States had arthritis or rheumatoid arthritis between 2013 and 2015. By 2040, this population is predicted to rise to roughly 78 million.

Free Valuable Insights: Global Arthroscopy Devices Market size to reach USD 28.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Johnson & Johnson, Smith & Nephew PLC, ConMed Corporation, Stryker Corporation, Zimmer Biomet Holdings, Inc., Karl Storz SE & Co. KG, Arthrex, Inc., Richard Wolf GmbH, and Henke Sass Wolf GmbH.

By Type

By Application

By Geography

The arthroscopy devices market size is projected to reach USD 28.6 billionn by 2028.

High Cases of Joint Replacement Surgery are increasing are driving the market in coming years, however, technological developments in the arthroscopy devices growth of the market.

Medtronic PLC, Johnson & Johnson, Smith & Nephew PLC, ConMed Corporation, Stryker Corporation, Zimmer Biomet Holdings, Inc., Karl Storz SE & Co. KG, Arthrex, Inc., Richard Wolf GmbH, and Henke Sass Wolf GmbH.

The expected CAGR of the arthroscopy devices market is 7.2% from 2022 to 2028.

The Arthroscopes segment acquired maximum revenue share in the Global Arthroscopy Devices Market by Type in 2021, thereby, achieving a market value of $7.9 billionn by 2028.

The North America market dominated the Global Arthroscopy Devices Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.