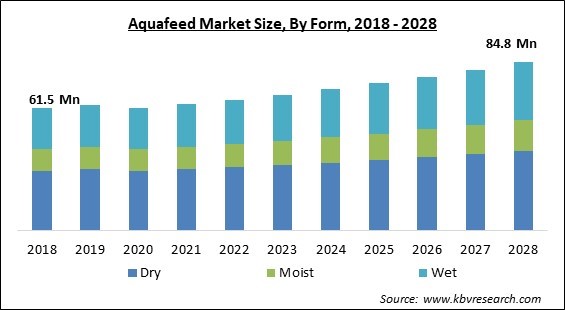

The Global Aquafeed Market size is expected to reach $84.8 million by 2028, rising at a market growth of 4.4% CAGR during the forecast period.

The advancements in aquafeed processing and formulation, farm-raised species that are generally carnivores in the wild are becoming more and more omnivorous, and in some cases, herbivores. The effective trophic level basically, their position in the food chain of many farmed fish has decreased and resource use efficiency has increased as researchers work to make feed more nutritious and sustainable. Aquafeeds allow for the use of a wider variety of ingredients. This boosts input diversity and resilience, ultimately acting as a buffer against sudden changes in availability brought on by the climate, markets, and technology.

Aquatic animal culture, particularly fish culture, has experienced a dramatic expansion in recent years. About half of all fish eaten by humans comes from aquaculture. Animal productivity can be increased through proper nutrition. As the aquaculture business has grown, knowledge of the nutritional needs and fish feed production is crucial to its success and sustainability.

Diets that are prepared or manufactured might be either full or supplemental. For the fish to grow and stay healthy, complete meals provide all the ingredients such as protein, fat, carbohydrate, ash, phosphorus water, and small traces of vitamins and minerals. When fish are raised in high-density urban systems or cages and are unable to forage freely on natural foods, natural foods are lacking, or natural foods only contribute minimally to nutrition, nutritionally complete diets should be employed. Supplemental feeds only serve to help reinforce the natural foods in the culture systems with more protein, carbohydrate, and fat when massive quantities of natural productivity are available. They are not required to provide all-important nutrients.

Finding boats or airplanes for the shipment of raw materials has been difficult due to the pandemic, which has caused supply chain disruption. Even though truck availability and other logistical measures are generally getting better, some places still have comparatively few of these resources compared to before COVID-19. As a result, businesses are anticipated to rapidly increase the number of retailers they work with through various digital platforms that provide advertising and sales services. Additionally, the length of the lockdown period and how quickly the COVID-19 pandemic is contained would affect how long it takes for the world to recover.

Direct and indirect economic activities are generated by aquariums. Direct economic activity includes the money aquariums spend on the products and services they utilize. Indirect economic activity refers to the positive effect’s aquariums have on nearby companies like hotels, restaurants, and shops. Increased economic activity results in higher taxes for cities and governments. It is impossible to overestimate the importance of the amateur fishing market. In contrast to the Philippines, where collectors have few employment opportunities, this industry makes up 60% of the local economy in Amazonas, Brazil. However, these financial advantages are now provided by the capture industry.

Aquaculture feeds have a limited shelf life and unique handling requirements, so it is imperative to store and handle them correctly to maximize their nutritional and economic value. It is possible to reduce feed quality degradation during storage by rotating the inventory and maintaining hygienic conditions that prevent mold and mildew, insect infestation, and rodent infestation. Proper handling procedures can decrease nutrient loss as well as pellet breakage soon before feeding. It is crucial to pay close attention to the particular guidelines for the safe handling and storage of aquaculture feeds.

The spread of illness in natural habitats can be accelerated by breeding animals. Salmon farming is one of the most prevalent examples of this phenomenon. Salmon anemia was first documented in Chile in the 1990s, and it has since spread to other countries. The disease spread from one nation to another and even continent to another because of poor biosecurity and the international movement of salmon larvae. A common negative effect of aquaculture is sea lice, which are typically of the genera Lepeophtheirus and Caligus. Sea lice attach themselves to the epidermis of their chosen victim and feed on the host's body. This can be extremely harmful to salmon juveniles.

Based on Form, the market is segmented into Dry, Moist and Wet. The moist segment witnessed a substantial revenue share in the Aquafeed market in 2021. It is damp to varying degrees, ranging from 45% to 70%. They are manufactured from components with high moisture content, such as fishing waste, undried fodder, and slaughterhouse waste. These wet feeds are regularly manufactured in farm sheds and mostly fed to predatory fishes including sea bream, sea bass, and eels.

Based on Application, the market is segmented into Carp, Catfish, Salmon & Sea Bass, Rainbow Trout, Grouper, Crustaceans, Tilapia and Others. The carp segment procured the largest revenue share in the Aquafeed market in 2021. Due to the related health benefits, including immune booster, improved heart health, management of chronic diseases, and protection of gastrointestinal functions, this species is increasingly consumed, which accounts for high production rate. It typically spawns in the spring, when the female lays a large number of eggs on vegetation or other debris, typically in shallow water.

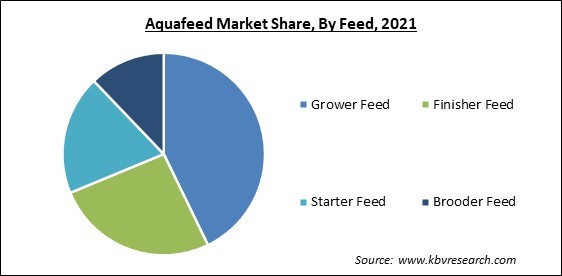

Based on Feed, the market is segmented into Grower Feed, Finisher Feed, Starter Feed and Brooder Feed. The finisher feed segment witnessed a substantial revenue share in the Aquafeed market in 2021. Adult fish and other animals that are older than 20 weeks are typically fed finisher feeds. The essential nutritional requirements of the animal are met by it. It has a high energy content and 21% protein to support life. The feed supplies a lot of energy to enable the seamless performance of routine chores.

Based on Additives, the market is segmented into Amino Acids, Anti-parasitic, Enzymes, Probiotics & Prebiotics, Vitamins, Minerals & Feed Acidifiers, Antibiotics & Antioxidants and Others. The Amino acid segment procured the highest revenue share in the Aquafeed market in 2021. This high share is credited to its benefits, which include boosting immunity, improving larval performance, increasing fishes' patience with environmental stresses, improving metabolic transformation efficiency in fishes, regulating spawning efficiency and timing, and enhancing fillet flavor and texture when added to aquafeed.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 63.4 Million |

| Market size forecast in 2028 | USD 84.8 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.4% from 2022 to 2028 |

| Number of Pages | 304 |

| Number of Tables | 532 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Form, Application, Feed, Additives, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific region garnered the largest revenue share in the Aquafeed market in 2021. It is due to the regional aquaculture sector's rapid expansion. India is one of the nations included in this range. However, to meet their dietary protein needs, individuals have tended to favor fish and other seafood. Increased demand for aquafeed products in India is a result of increased awareness. Although most farmers still feed aquatic species with conventional feeds like groundnut cake, rice/wheat bran, and other agricultural products, the shift to commercial feed would ultimately change.

Free Valuable Insights: Global Aquafeed Market size to reach USD 84.8 Million by 2028

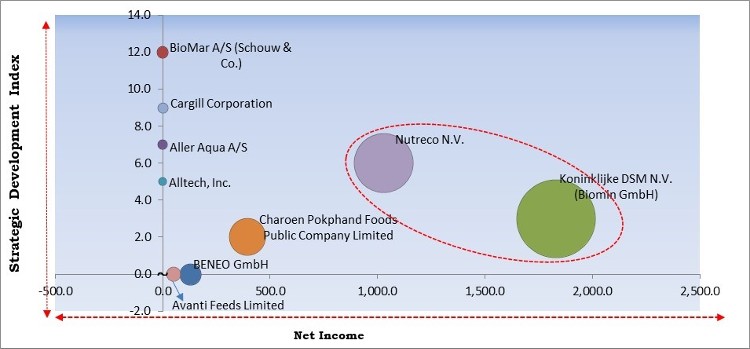

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Koninklijke DSM N.V. (Biomin GmbH) and Nutreco N.V. are the forerunners in the Aquafeed Market. Companies such as BioMar A/S, Cargill Corporation, Aller Aqua A/S are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Nutreco N.V., Koninklijke DSM N.V. (Biomin GmbH), Charoen Pokphand Foods Public Company Limited, BENEO GmbH (Südzucker AG), Avanti feeds Limited, Cargill Corporation, Aller Aqua A/S, Alltech, Inc., and BioMar A/S (Schouw & Co.)

By Form

By Application

By Feed

By Additives

By Geography

The global aquafeed protein market size is expected to reach $4 billion by 2028.

Activities involving fish commerce and habitat are driving the market in coming years, however, Diseases and Environmental issues of the aquaculture limited the growth of the market.

Nutreco N.V., Koninklijke DSM N.V. (Biomin GmbH), Charoen Pokphand Foods Public Company Limited, BENEO GmbH (Südzucker AG), Avanti feeds Limited, Cargill Corporation, Aller Aqua A/S, Alltech, Inc., and BioMar A/S (Schouw & Co.)

The expected CAGR of the aquafeed protein market is 4.4% from 2022 to 2028.

The Dry segment acquired maximum revenue share in the Global Aquafeed Market by Form in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $39.9 Million by 2028.

The Asia Pacific market dominated the Global Aquafeed Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $35.6 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.