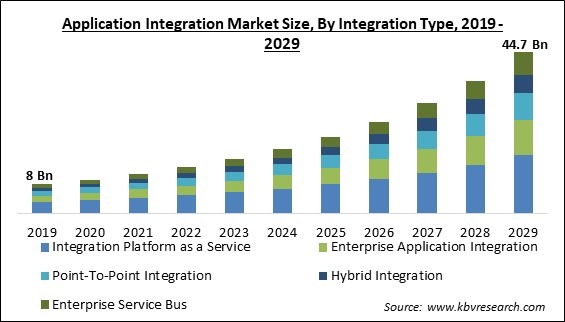

The Global Application Integration Market size is expected to reach $44.7 billion by 2029, rising at a market growth of 19.9% CAGR during the forecast period.

Point-to-point integration is one of the major integration types of the market and businesses are adopting this type of integration because it can be a cost-effective solution, especially for small to medium-sized organizations with limited integration requirements. Hence, it captured $2,057.4 million revenue in the market in 2022. Each connection the user makes is intended to help them with a specific business issue. It eliminates the need for investing in expensive integration middleware or platforms, reducing both upfront and ongoing costs.

Moreover, application integration is a beneficial application for Human resources, as it can help to streamline HR processes by eliminating manual data entry and reducing the number of disparate systems that HR professionals have to navigate. Integrating HR applications can help to increase efficiency by automating routine tasks and allowing HR professionals to focus on more strategic initiatives. Thereby, the Human Resources Management System is anticipated to generate approximately 1/5th share of the market by 2029.

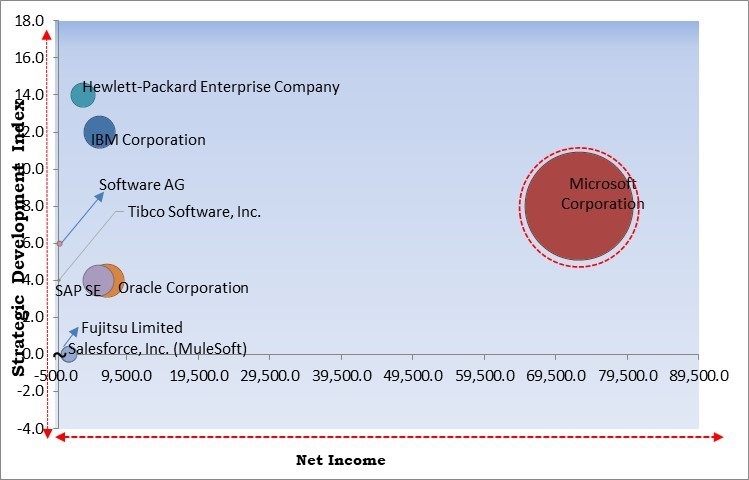

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2023, Oracle joined hands with Zoom and focuses on expanding access to virtual care, and delivering streamlined telehealth services, through integrating Oracle Cerner Millennium and Zoom. Additionally, Hewlett Packard Enterprise (HPE) came into partnership with VAST Data in April, 2023, to handle unstructured data in a more efficient manner.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Market. In April, 2023, Microsoft extended its collaboration with Epic Systems, a US-based developer of healthcare software. The collaboration involves designing and integrating generative AI into healthcare by uniting Azure's OpenAi service 1 and Epic's electronic health record software. Through this collaboration agreement, the companies intend to support providers in delivering noteworthy business and clinical results. Companies such as Hewlett-Packard Enterprise Company, IBM Corporation, and Oracle Corporation Amazon.com, Inc. Samsung Electronics Co., Ltd., Sony Corporation are some of the key innovators in Market.

A data silo is a group of data that is inaccessible to all levels of a company's structure. Data silos are a costly and time-consuming issue for businesses. They must therefore be resolved. Application integration services enable effective data utilization by removing data silos and the costs that go along with them. In addition, cost-cutting initiatives may encourage businesses to use their data more to obtain a competitive advantage, improve operational efficiencies, and create new business prospects. Access to information throughout the entire company is essential in achieving this. Therefore, the demand is anticipated to increase as a result, which in turn, is accelerating the growth of the market.

Digital evolution is a non-linear process that transitions between phases of quick change and slower consolidation dependent on external and internal needs. To maintain pace throughout this transformation, however, the adaptability of digital operations is essential. Most firms have made direct or indirect investments in B2B connectivity driven by Electronic Data Interchange (EDI). In a similar vein, a lot of people have invested in application integration. As more businesses adopt digital transformation strategies, businesses are expected to continuously adapt their practices to increase productivity, quality, and customer satisfaction. Therefore, as the pace of digitalization increases, it will propel the demand.

The two main alternatives for integrating enterprise applications are open-source and proprietary software. However, applying application integration could be expensive and a long-term strategic decision. An API Manager, an ESB, a portal, and a data management platform are just a few integration platform stack solutions businesses may need to purchase. The recent growth of cloud computing coincides with the advent of open-source groups and approaches for developing new technology. Therefore, the market growth is anticipated to be hampered by such elements.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on vertical, the market is segmented into BFSI, retail & eCommerce, manufacturing, healthcare & life sciences, energy & utilities, automotive, transportation & logistics, government & public sector, and others. The retail and eCommerce segment procured a considerable growth rate in the market in 2022. Application integration can help businesses provide a better customer experience by enabling them to offer personalized and seamless interactions across different channels.

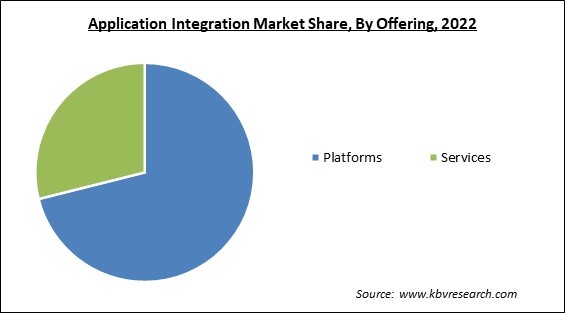

Based on offering, the market is characterized into platforms and services. The platforms segment garnered the highest revenue share in the market in 2022. Integration platforms can help ensure that data is accurately and consistently integrated across different systems. This has the potential to increase the quality of the data that is utilized in decision-making while also reducing the number of errors. Integration platforms can provide organizations with greater visibility into their data and processes.

On the basis of integration type, the market is classified into point-to-point integration, enterprise application integration, enterprise service bus, integration platform as a service, and hybrid integration. The integration platform as a service segment witnessed the maximum revenue share in the market in 2022. Building and deploying connections between on-premise and cloud apps and data is made possible by iPaaS. It doesn't require installing or administering any hardware or middleware and instead takes an API-led approach.

By application, the market is divided into customer relationship management, enterprise resource planning, human resource management system, supply chain management & business intelligence, electronic health record management, and others. The customer relationship management segment recorded a substantial revenue share in the market in 2022. By integrating various applications within a CRM system, customer data can be consolidated, providing a comprehensive view of customer interactions and preferences. This can help organizations tailor their offerings and improve the overall customer experience.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 12.7 Billion |

| Market size forecast in 2029 | USD 44.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 19.9% from 2023 to 2029 |

| Number of Pages | 360 |

| Number of Table | 532 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Integration Type, Offering, Application, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed the maximum revenue share in the market in 2022. The market is dominated by the US. The diversification of services offered and the shift from SaaS to cloud-based services for platforms and infrastructure are two factors influencing the widespread use of application integration in this region.

Free Valuable Insights: Global Application Integration Market size to reach USD 44.7 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Fujitsu Limited, Hewlett-Packard Enterprise Company, IBM Corporation, Microsoft Corporation, Salesforce, Inc. (MuleSoft), Oracle Corporation, SAP SE, Software AG, Tibco Software, Inc. (Vista Equity Partners) and Itransition Group.

By Integration Type

By Application

By Offering

By Vertical

By Geography

The Market size is projected to reach USD 44.7 billion by 2029.

Growing need to break down data silos and boost productivity are driving the Market in coming years, however, High cost of investments and availability of open-source software restraints the growth of the Market.

Fujitsu Limited, Hewlett-Packard Enterprise Company, IBM Corporation, Microsoft Corporation, Salesforce, Inc. (MuleSoft), Oracle Corporation, SAP SE, Software AG, Tibco Software, Inc. (Vista Equity Partners) and Itransition Group.

The BFSI segment is generating the highest revenue share in the Global Application Integration Market by Vertical in 2022 thereby, achieving a market value of $11 billion by 2029.

The Enterprise Resource Planning segment is leading the Market by Application in 2022 thereby, achieving a market value of $15.4 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $15.3 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.