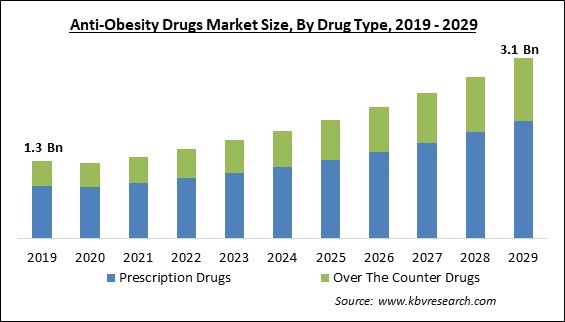

The Global Anti-Obesity Drugs Market size is expected to reach $3.1 billion by 2029, rising at a market growth of 10.6% CAGR during the forecast period.

Obesity is a medical disease in which the body's extra body fat has built up to the point that it could be harmful to one's health. Carrying a body mass index (BMI) of 30 or more is the standard definition. It is largely acknowledged as the most significant and rapidly expanding public health issue in both industrialized and developing nations. Anti-obesity medications are ones that doctors prescribe to help the overweight. These medications reduce hunger, boost metabolism, or prevent the absorption of fat from meals.

Phentermine, liraglutide, sibutramine, and orlistat, are a few of the anti-obesity medications that are frequently recommended. The significant increase in the prevalence rate of obesity, the rise in the health risks associated with being overweight or obese, and the rise in the volume of research and development operations for multiple potential drug molecules to combat both obesity and type 2 diabetes mellitus by key market players are the main factors driving the growth of the anti-obesity drugs market share.

The expansion of clinical studies for the treatment of obesity is anticipated to fuel demand for anti-obesity medications. For instance, large corporations are creating prospective medicine substitutes to enhance the scenario for treating obesity. One of the main reasons projected to promote the growth of the anti-obesity drug market share is the increase in R&D activity among key players for the creation of anti-obesity treatments with fewer adverse effects.

As the obesity rate rises, the market's leading companies are also creating new products and gaining market acceptance. Due to the rising demand for long-lasting medications, it is anticipated that the opportunities for market vendors to create new products will increase significantly. Numerous industry experts and suppliers have been conducting research on medications that can treat both type II diabetes and obesity as a result of the increased prevalence of the disease. This aspect is anticipated to support market expansion eventually.

The negative effects on the market have been reduced by the rising use of telemedicine in place of "in-person" hospital visits and the use of internet pharmacies to buy repeat prescription drugs. Additionally, pharmaceutical firms put a lot of effort into keeping the pandemic's supply and demand in check to sustain their profits. Due to the rapid weight gain people experience when sitting at home or working from home, the sudden development of the COVID-19 virus has later raised the need for anti-obesity treatments. In addition, it is anticipated that forthcoming product launches, major pipeline opportunities at well-known companies, and a continuing rise in obesity will all contribute to the market's significant growth potential in the post COVID-19 period, after facing a decline in the starting phase.

The fast-food industry has experienced a significant increase in consumption. Frequent consumption of fast food has been associated with obesity and allergies. Consuming fast food can increase the risk of health issues such as bloating, stomach ulcers, and potentially even stomach cancer due to the presence of harmful substances, chemicals, and excessive salt. Increased salt intake from fast food can lead to water retention in the body, potentially causing discomforts such as stomach pain and abdominal bloating. The correlation between fast food consumption among adults and wealth is positive, while it is negative with age. This is expected to increase the demand for anti-obesity drugs, surging the market growth.

The success of a new pharmaceutical product in generating long-term profits is contingent upon the pricing strategy implemented by companies across various regions, the projected sales volume at those prices, and the probability of a successful drug development process, which significantly impacts research and development expenses. In addition, government programs and policies significantly influence the pharmaceutical industry's private spending for research and development. This impact is achieved through diverse methods, including boosting the need for prescribed medications, financing fundamental research, overseeing clinical trials, and issuing vaccine guidance that impacts both supply and demand.

The fitness industry is rapidly evolving with a growing ecosystem comprising customers, equipment and service suppliers, complementary sectors, and public programs. There is a growing trend among individuals to prioritize fitness and monitor their daily routines and habits. The fitness industry is evolving and becoming more dynamic due to globalization and the easy accessibility of knowledge. This enhances and reinforces traditional practices and exercises. Also, gyms and other natural ways are being preferred to lose weight by the general population as there is a lack of awareness regarding anti-obesity drugs, which is expected to hinder the anti-obesity drugs market growth during the projected period.

Based on drug type, the anti-obesity drugs market is segmented into prescription drugs and over the counter drugs. The prescription drugs segment dominated the anti-obesity drugs market with maximum revenue share in 2022. The growth is attributed due to the presence of established players who have obtained regulatory approval for their products. These enterprises are promoting the acceptance for such commodities by enhancing their investment in research and development programs and forming strategic alliances to launch efficient remedies.

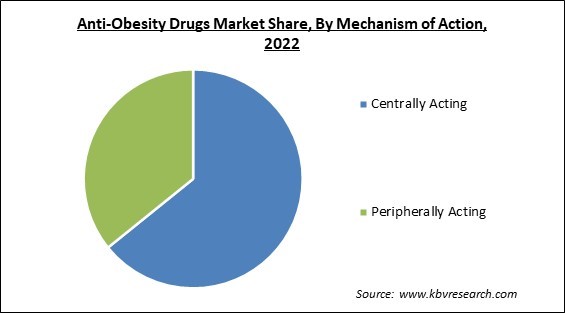

On the basis of mechanism of action, the anti-obesity drugs market is divided into centrally acting anti-obesity drugs and peripherally acting anti-obesity drugs. The peripherally acting segment procured a substantial revenue share in the anti-obesity drugs market in 2022. This is because peripherally acting anti-obesity agents refer to pharmaceuticals that aid in weight reduction without impacting the brain or appetite suppression. This product functions as a pancreatic lipase inhibitor, effectively impeding the breakdown of fat in the gastrointestinal tract and ultimately leading to a reduction in the absorption of fat in the intestines.

By route of administration, the anti-obesity drugs market is classified into oral route and subcutaneous route. The oral route segment witnessed the largest revenue share in the anti-obesity drugs market in 2022. This is because oral drug delivery is a highly preferred administration route for the anti-obesity drug due to its noninvasive nature, high patient compliance, ease of handling, and lack of requirement for specific sterile conditions. Various types of nanoparticles (NPs), hydrogels, microparticles, or combinations of them have been employed to enhance bioavailability or target specificity in the gut.

Based on the distribution channel, the anti-obesity drugs market is bifurcated into hospital pharmacies, retail pharmacies and online pharmacies. The online pharmacies segment recorded a significant revenue share in the anti-obesity drugs market in 2022. This is due to the rise in e-pharmacy usage, which has led to greater accessibility of anti-obesity medication for patients, streamlining the drug procurement process. In addition, the chronic condition of obesity requires the patient to obtain a refill in order to maintain the long-term treatment plan. This can lead to increased utilization of anti-obesity medications through online pharmacy distribution channels, driving the segment's growth during the projected period.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.5 Billion |

| Market size forecast in 2029 | USD 3.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 10.6% from 2023 to 2029 |

| Number of Pages | 220 |

| Number of Table | 410 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Drug Type, Mechanism of Action, Route of Administration, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the anti-obesity drugs market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the anti-obesity drugs market by generating the maximum revenue share in 2022. The growth of the anti-obesity drugs market in the region is primarily fueled by the rise in the number of individuals who are obese and the significant healthcare spending on anti-obesity drugs. Moreover, the market growth is anticipated to be driven by the heightened awareness among the populace regarding the grave chronic ailments associated with obesity and the surge in clinical trials due to increased investment by major industry players in research and development endeavors.

Free Valuable Insights: Global Anti-Obesity Drugs Market size to reach USD 3.1 Billion by 2029

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Pfizer, Inc., Boehringer Ingelheim International GmbH, GlaxoSmithKline PLC, Novo Nordisk A/S, Rhythm Pharmaceuticals, Inc., Gelesis Holdings Inc. (PureTech Health), Currax Pharmaceuticals LLC (Currax Holdings USA LLC), Vivus LLC, CHEPLAPHARM Arzneimittel GmbH (Braun Beteiligungs GmbH) and KVK Tech, Inc.

By Drug Type

By Mechanism of Action

By Route Of Administration

By Distribution Channel

By Geography

This Market size is expected to reach $3.1 billion by 2029.

The growth of fast-food industry and increasing consumption of unhealthy food are driving the market in coming years, however, Lack of awareness and adoption of medication restraints the growth of the market.

Pfizer, Inc., Boehringer Ingelheim International GmbH, GlaxoSmithKline PLC, Novo Nordisk A/S, Rhythm Pharmaceuticals, Inc., Gelesis Holdings Inc. (PureTech Health), Currax Pharmaceuticals LLC (Currax Holdings USA LLC), Vivus LLC, CHEPLAPHARM Arzneimittel GmbH (Braun Beteiligungs GmbH) and KVK Tech, Inc.

The Centrally Acting segment acquired maximum revenue share in the Global Anti-Obesity Drugs Market by Mechanism of Action in 2022 thereby, achieving a market value of $1.9 billion by 2029.

The Hospital Pharmacies segment is leading the Market by Distribution Channel in 2022 thereby, achieving a market value of $1.4 billion by 2029.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $1.1 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.