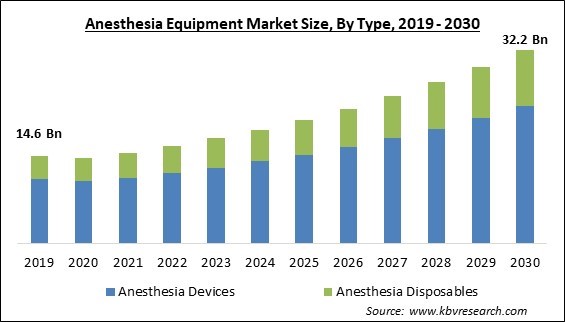

The Global Anesthesia Equipment Market size is expected to reach $32.2 billion by 2030, rising at a market growth of 9.2% CAGR during the forecast period.

The usage of Anesthesia Equipment in Urology is increasing due to the introduction of new and advanced equipment, technological developments, and the rising prevalence of urological disorders. Hence, Urology is expected to capture approximately 1/5th share of the market by 2030. There are pathology laboratories affiliated with medical care centers. Hospitals, ASCs, and clinics offer urological diagnostic and therapeutic services and have significant infrastructure to perform invasive and noninvasive treatments that may not be available otherwise.

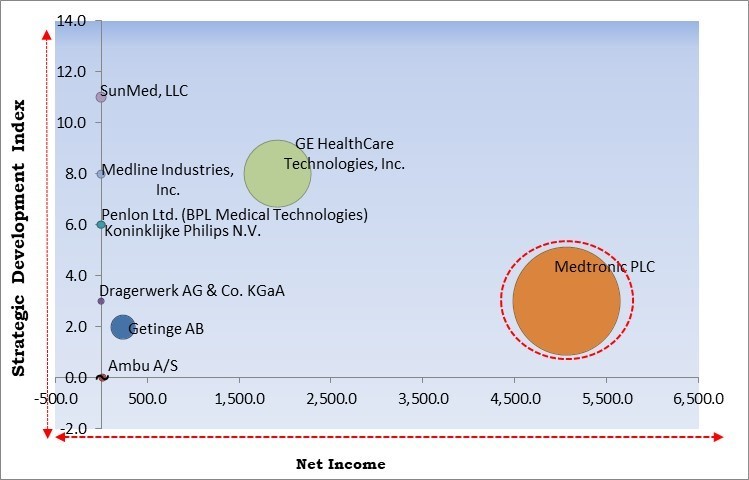

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance In March, 2023, GE HealthCare came into collaboration with LeQuest to make digital simulation training for GE HealthCare’s Anesthesia and Respiratory devices. Additionally, In June, 2021, Royal Philips signed an agreement with Elekta to advance complete and customized cancer care via precision oncology solutions.

Based on the Analysis presented in the KBV Cardinal matrix; Medtronic PLC is the major forerunner in the Market. In October, 2022, Medtronic introduced the Neurovascular Co-Lab Platform, the platform designed for transforming ideas and technologies. This launch would propel collaboration and connections among physicians, start-ups, and institutions. Companies such as GE HealthCare Technologies, Inc., SunMed, LLC and Medline Industries, Inc. are some of the key innovators in the Market.

The COVID-19 pandemic's emergence had a major impact on the international economy and healthcare system. In the early phases of the pandemic, healthcare facilities globally halted all elective surgeries due to the escalating number of COVID-19 cases. As a result of the pandemic, patient monitoring and chronic disease care were severely disrupted, numerous individuals were unwilling to visit hospitals, and surgeries were postponed. The number of unnecessary procedures has decreased, which has slowed the market's expansion. The manufacturing & supply chain faced difficulties in the anesthesia equipment market, such as meeting uneven product demand and timely delivery of devices to end users.

By 2030, 1 in 6 persons worldwide will be 60 years of age or older, according to the WHO's most recent statistics. At this point, there will be 1.4 billion people, up from 1 billion in 2020, who are 60 years of age or older. The number of individuals 60 and older worldwide will double (to 2.1 billion) by the year 2050. Between 2020 and 2050, there will be 426 million more people who are 80 or older than there are today. 80% of the world's elderly population will reside in low- and middle-income nations by 2050. In light of this, it is anticipated that an aging population and measures to address the issue would increase healthcare financing and investment, leading to market growth.

Accident rates are rising globally due to quick modernization, the usage of fast automobiles, and an increase in "drink & drive" incidents. The primary factor of death for children & young adults aged 5 to 29 is road traffic injuries, as reported by the WHO. Road traffic accidents claim the lives of almost 1.3 million individuals annually. Despite having about 60% of the world's vehicles, low- and middle-income countries account for 93% of the world's road deaths. Between 20 and 50 million additional people have non-fatal injuries, with a majority of them becoming disabled. Along with the increased sports participation, sports injuries are also rising globally. This would greatly increase the demand for tools including anesthetic delivery devices, anesthetic mentors, and others, driving the market's expansion.

Numerous national and international vendors make the market competitive. Leading suppliers offer a broad spectrum of products, who also have the requisite technical, financial, and marketing resources, a large geographic footprint, and substantial R&D expenditures. Small & medium-sized suppliers, on the other hand, have constrained financial & technical resources in addition to constrained product offerings. As a result, these providers cannot compete with well-known vendors regarding quality, dependability, and R&D. These factors will therefore limit market growth during the projection period.

By type, the market is segmented into anesthesia devices, and anesthesia disposables. The anesthesia disposables segment generated a significant revenue share in the market in 2022. The segment is anticipated to expand steadily as a result of important variables like the steadily expanding prevalence of chronic disorders that require surgical treatment and the increasing usage of endoscopy or laryngoscopy surgeries. Additionally, it is anticipated that the rising population of elderly people in developing countries will increase market growth potential throughout the course of the projection period.

Based on Application, the market is categorized into orthopedics, neurology, cardiology, respiratory care, urology, general surgery, dental, ophthalmology, and others. In 2022, the orthopedic segment witnessed the largest revenue share in the market. This is a result of an increase in cases of bone or muscle-related issues, a growing geriatric population, growing public awareness of muscular medical procedures, and ongoing developments that are enabling an expansion in the use of muscular medical procedures, all of which will aid in promoting the development of anesthesia devices.

Under anesthesia devices type, the market is classified into anesthesia workstation, anesthesia delivery machines, anesthesia ventilators, anesthesia monitors, and other devices. The anesthesia workstation segment generated the highest revenue share in the market in 2022. The demand for anesthesia workstations has expanded due to the widespread use of these devices in industrialized nations due to their advantages. Anesthetic workstations are equipped with various tools, such as anesthetic machines, physiological monitoring, and add-ons like active suction equipment and supplementary bag-valve-mask devices. In addition to administering volatile anesthetics, they also offer breathing and oxygenation. The workstations are favored by medical experts around the world for surgical procedures because of their versatility.

Under anesthesia disposables type, the market is divided into anesthesia circuits (breathing circuits), anesthesia masks, endotracheal tubes (ETTS), laryngeal mask airways (LMAS), and other accessories. In 2022, the anesthesia circuits segment registered the maximum revenue share in the market. The demand for anesthetic circuits is rising because of the frequency of respiratory ailments, including pulmonary embolism, chronic obstructive pulmonary disease, sleep disorders like obstructive sleep apnea, and increased surgeries. Governments and commercial organizations are expected to enhance their healthcare sector spending, stimulating market expansion.

On the basis of end user, the market is bifurcated into hospitals, clinics, ambulatory surgical centers and others. In 2022, the clinics segment acquired a substantial revenue share in the market. This is because the emergency clinic systems have the best repayment policies, and there are mechanically advanced devices to serve the clinics' high patient base. Both small & large clinics use cutting-edge technology to manage routine surgery. Top anesthetic machine manufacturers are concentrating on medical clinics to sell their devices due to the growing popularity of laryngeal veil aviation routes, endotracheal tubes, and compact devices and machines for various surgeries.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 16.1 Billion |

| Market size forecast in 2030 | USD 32.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 9.2% from 2023 to 2030 |

| Number of Pages | 402 |

| Number of Table | 634 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. This is due to the rapidly rising incidence of diseases including obesity, cardiovascular problems, and various types of malignant growths, that have also contributed to the rise in the number of open intrusive medical operations. Further, the increase in the number of minimally invasive medical methods for persistent infections has aided the market rise in this region.

Free Valuable Insights: Global Anesthesia Equipment Market size to reach USD 32.2 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, GE HealthCare Technologies, Inc., Koninklijke Philips N.V., Dragerwerk AG & Co. KGaA, Getinge AB, Ambu A/S, SunMed, LLC, Medline Industries, Inc., Penlon Ltd. (BPL Medical Technologies) and Heyer Medical AG (AEONMED Group).

By Type

By Application

By End User

By Geography

The Market size is projected to reach USD 32.2 billion by 2030.

Increased elderly population are driving the Market in coming years, however, High competition among leading players restraints the growth of the Market.

Medtronic PLC, GE HealthCare Technologies, Inc., Koninklijke Philips N.V., Dragerwerk AG & Co. KGaA, Getinge AB, Ambu A/S, SunMed, LLC, Medline Industries, Inc., Penlon Ltd. (BPL Medical Technologies) and Heyer Medical AG (AEONMED Group).

The Hospitals segment is generating the highest revenue share in the Global Anesthesia Equipment Market by End User in 2022 thereby, achieving a market value of $11.9 billion by 2030.

The Anesthesia Devices segment is leading the Market by Type in 2022 thereby, achieving a market value of $22.8 billion by 2030.

The North America market dominated the Global Anesthesia Equipment Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $11.1 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.