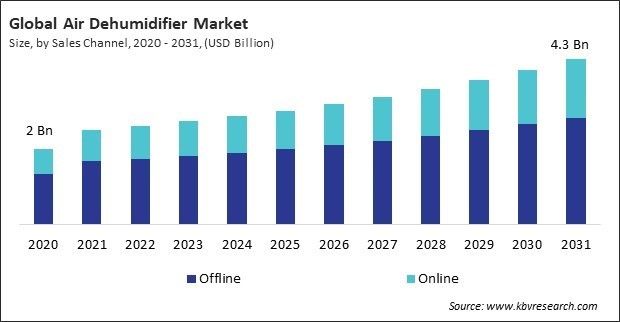

The Global Air Dehumidifier Market size is expected to reach $4.3 billion by 2031, rising at a market growth of 6.2% CAGR during the forecast period. In the year 2023, the market attained a volume of 1,688.19 thousand units, experiencing a growth of 12.9% (2020-2023).

The growing trend of home renovation and improvement projects in North America has led to increased demand for air dehumidifiers. Therefore, the North America region will capture 34.5% revenue share in the market by 2031. Also, the US market would require 749.43 thousand units of Air Dehumidifier by 2031. Whether finishing basements, remodeling bathrooms, or upgrading HVAC systems, homeowners often install these products to address moisture issues and improve indoor air quality during renovation projects in North America.

The travel and hospitality industry invests heavily in property, furnishings, and amenities to provide guests with a high-quality experience. These helps protect these investments by maintaining optimal humidity levels, prolonging the lifespan of furniture, electronics, artwork, and structural materials, and reducing maintenance and replacement costs. Therefore, the market is expanding significantly due to the increasing travel and hospitality industry.

Additionally, smart air dehumidifiers can be controlled remotely via smartphone apps or voice assistants, allowing users to adjust settings, monitor humidity levels, and receive alerts from anywhere with an internet connection. This convenience appeals to busy homeowners who want to manage indoor humidity levels while on the go. Thus, because of the integration of smart home technology, the market is anticipated to increase significantly.

However, the upfront cost of purchasing this product may be prohibitive for some consumers, particularly those with limited disposable income or tight budgets. High initial costs can deter potential buyers from investing in dehumidification solutions, especially if they perceive them as non-essential or too expensive compared to alternative moisture control methods. Thus, high initial costs can slow down the growth of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges Based on sales channel, the market is fragmented into online and offline. In 2023, the offline segment led the market by generating 66.6% revenue share. Offline retail stores provide immediate availability of air dehumidifiers, allowing consumers to purchase and take home their desired product on the same day. In terms of volume, the offline segment registered 1,003.26 thousand units of sales of Air Dehumidifier in 2023.

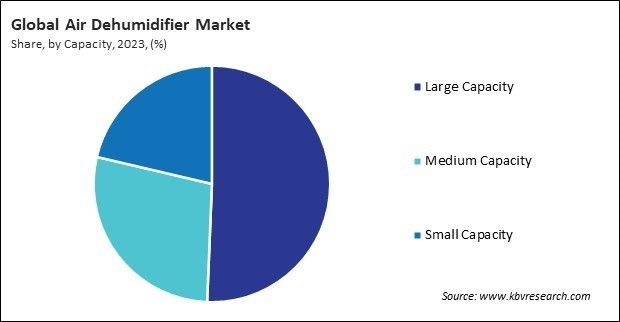

Based on capacity, the market is classified into small capacity, medium capacity, and large capacity. The medium capacity segment acquired 28.0% revenue share in the market in 2023. Medium capacity dehumidifiers typically offer a larger coverage area than small capacity units, making them suitable for medium-sized rooms and spaces. In terms of volume, the demand for medium capacity models would be 731.65 thousand units by 2028.

By type, the market is categorized into mobile dehumidifier, mini dehumidifier, and fixed dehumidifier. In 2023, the fixed dehumidifier segment held 52.4% revenue share in the market. Fixed dehumidifiers are commonly used in residential settings to maintain optimal indoor humidity levels, which helps prevent mold growth, musty odors, and dust mites. In terms of volume, the demand for fixed dehumidifiers would reach 1,004.18 thousand units by 2028.

On the basis of price range, the market is divided into high range, mid-range, and low range. The mid-range segment garnered 34.8% revenue share in the market in 2023. Mid-range dehumidifiers are versatile and suitable for various residential, commercial, and institutional applications. In terms of volume, the mid-range segment attained 568.65 thousand units in 2022.

By application, the market is segmented into residential, commercial, and industrial. In 2023, the industrial segment registered 53.7% revenue share in the market. Industrial air dehumidifiers are designed to be energy-efficient, helping industries reduce energy consumption and operational costs. In terms of volume, the industrial segment showcased 305.41 thousand units in 2022.

Free Valuable Insights: Global Air Dehumidifier Market size to reach USD 4.3 Billion by 2031

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region acquired 25.4% revenue share in the market. The region is undergoing rapid urbanization and construction activity, leading to new residential, commercial, and industrial buildings being constructed. In terms of volume, China registered 112.15 thousand units demand of these products in 2020.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 2.7 Billion |

| Market size forecast in 2031 | USD 4.3 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 6.2% from 2024 to 2031 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 454 |

| Number of Tables | 1030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Capacity, Sales Channel, Price Range, Application, Region |

| Country scope |

|

| Companies Included | Sharp Corporation, AB Electrolux, Whirlpool Corporation, De’Longhi Group, LG Electronics, Inc. (LG Corporation), Honeywell International, Inc., Haier Smart Home Co., Ltd. (Haier Group Corporation), Munters Group AB, Condair Group AG, Midea Group Co., Ltd. |

By Sales Channel (Volume, Thousand Units, USD Billion, 2020-2031)

By Capacity (Volume, Thousand Units, USD Billion, 2020-2031)

By Type (Volume, Thousand Units, USD Billion, 2020-2031)

By Price Range (Volume, Thousand Units, USD Billion, 2020-2031)

By Application (Volume, Thousand Units, USD Billion, 2020-2031)

By Geography (Volume, Thousand Units, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.