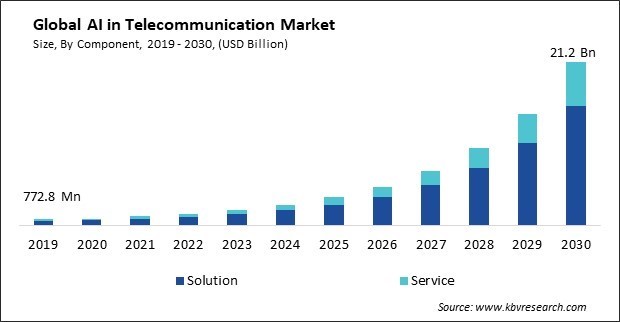

The Global AI in Telecommunication Market size is expected to reach $21.2 billion by 2030, rising at a market growth of 40.4% CAGR during the forecast period.

Network security in the telecommunications sector requires swift responses to emerging threats. Consequently, Network security segment captured $319.4 million revenue in the market in 2022. The AI's ability to analyze data in real time allows for the immediate detection of security incidents. Automated responses, such as isolating compromised devices or blocking malicious traffic, are executed without human intervention, mitigating the impact of security breaches. Thus, these factors will help expand the segment.

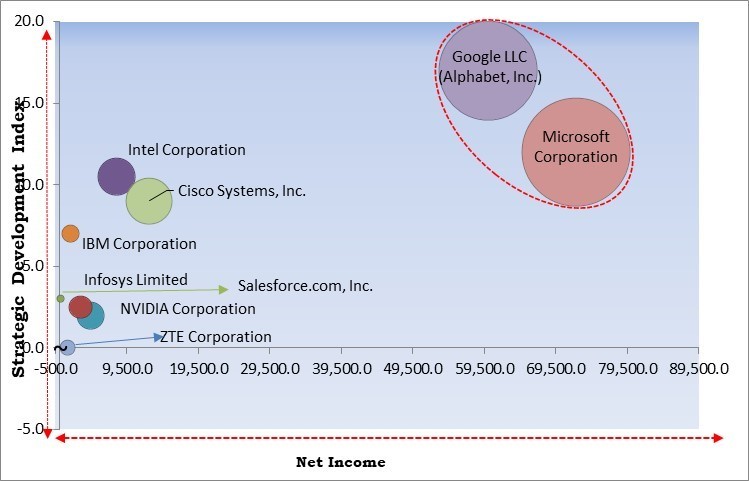

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2024, Microsoft Corporation announced a partnership with Vodafone. The collaboration aimed to enhance Vodafone's customer experience, expand its IoT connectivity, develop digital services for businesses, and revamp global data center cloud strategy, offering a personalized customer experience through advanced AI technology. Additionally, in December, 2023, IBM Corporation announced a definitive agreement with Software AG, to acquire StreamSets and webMethods, Software AG's Super iPaaS enterprise technology platforms. StreamSets added data ingestion capabilities to watsonx, IBM's AI and data platform, while webMethods provided clients and partners with additional integration and API management tools for their hybrid multi-cloud environments.

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC and Microsoft Corporation are the forerunners in the Market. In January, 2023, Microsoft expanded its partnership with OpenAI, an artificial intelligence company, for making the advancement in AI. With this expansion, Microsoft's expertise in providing AI-driven solutions and OpenAI's research on AI Alignment would be combined to build an advanced framework for the secure deployment of Microsoft's AI technologies. Companies such as Intel Corporation, Cisco Systems, Inc., and IBM Corporation are some of the key innovators in Market.

AI algorithms possess the ability to predict prospective equipment failures through the analysis of historical data and patterns. By identifying issues before they lead to downtime, telecom operators can schedule proactive maintenance, reducing service interruptions and optimizing the lifespan of network components. AI enables dynamic and real-time resource allocation based on network demand. AI algorithms continuously monitor and analyze network performance metrics, including latency, packet loss, and jitter. Through the proactive resolution of concerns that impact the quality of service, telecommunications operators can improve the overall experience of users and surpass service level agreements (SLAs). AI can analyze patterns in network traffic, distinguishing between normal and abnormal behaviors. This allows for optimizing data routing and identifying more efficient pathways, reducing latency and improving the overall efficiency of data transmission. Thus, these factors will boost the demand in the market.

Additionally, AI-driven automation streamlines the process of network configuration. To configure network settings, machine learning algorithms can analyze network topology, traffic patterns, and performance metrics, ensuring optimal performance and resource utilization. AI automates the detection of faults and issues within the network. AI algorithms continuously monitor network performance metrics and can automatically optimize settings to enhance overall performance. This includes adjusting configurations for load balancing, traffic routing, and other parameters to meet changing demands and maintain optimal service levels. AI contributes to predictive maintenance by automating the analysis of historical data to forecast potential equipment failures. By generating automated alerts and notifications, the necessity for proactive maintenance can be communicated, thereby minimizing delay and maximizing the lifespan of network components. As a result, there will be increased growth in the market.

However, the telecommunications sector operates within a regulatory tapestry encompassing many local, national, and international directives. Adding complexity is caused by adherence to data protection regulations, such as the CCPA in California or GDPR in Europe. Telecommunications regulations vary globally and contribute to the intricate compliance mosaic. The deployment of AI applications within the telecommunications infrastructure needs to align with these regulations, requiring a nuanced understanding of the industry's specific compliance requirements. Achieving and maintaining compliance with the intricate regulatory framework demands substantial resources. Companies operating in the telecommunications sector need to invest significantly in legal counsel, compliance officers, and technologies that facilitate adherence to evolving regulations. The resource-intensive nature of these efforts is a notable restraint on the rapid deployment of AI solutions. Thus, these factors will lead to decreased demand for AI in telecommunication.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges Based on component, the market is segmented into solution and service. In 2022, the service segment garnered a significant revenue share in the market. Integrating AI into telecommunication networks involves navigating network architecture, data management, and algorithm implementation complexities. Service providers fulfill an essential function by delivering consulting services that evaluate the distinct requirements of telecommunications organizations, develop customized artificial intelligence solutions, and offer counsel on successful implementation tactics. Thus, these factors will help expand the segment.

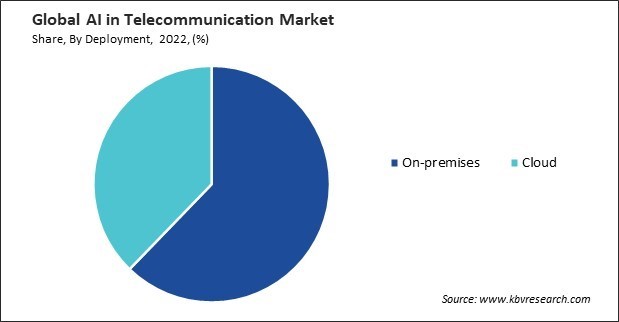

On the basis of deployment, the market is divided into on-premises and cloud. The on-premises segment recorded the maximum revenue share in the market in 2022. Telecommunication operators often deal with sensitive customer data. On-premises solutions provide greater control over data security and privacy compliance. Concerns about data breaches and regulatory requirements may drive telecommunications companies to prefer on-premises AI solutions. As a result, these aspects will lead to increased demand in the coming years.

Based on technology, the market is divided into machine learning, natural language processing (NLP), data analytics, and others. In 2022, the natural language processing (NLP) segment witnessed a substantial revenue share in the market. NLP-powered virtual assistants and chatbots have become integral components of customer interaction in the telecommunications industry. They enable natural and context-aware conversations, providing customers instant support, information, and assistance. Therefore, the segment will grow rapidly in the upcoming years.

Based on application, the market is segmented into network optimization, virtual assistance, customer analytics, self-diagnostics, network security, and others. The network optimization segment held the largest revenue share in the market in 2022. The rollout of 5G networks is a significant driver for the growth of network optimization through AI. The advanced capabilities of 5G, such as ultra-low latency and high bandwidth, necessitate sophisticated optimization techniques. AI plays a pivotal role in managing the intricacies of 5G networks, optimizing resource allocation, and ensuring efficient data transmission. Hence, these factors will drive the demand in the segment.

Free Valuable Insights: Global AI in Telecommunication Market size to reach USD 21.2 Billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the market in 2022. The presence of major technology companies, telecommunications providers, and significant investment in research and development contribute to the growth of AI in telecommunication in North America. Investments from the public and private sectors fuel innovation and deployment of AI technologies. As a result, the segment will witness increased demand in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 772.8 Million |

| Market size forecast in 2030 | USD 21.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 40.4% from 2023 to 2030 |

| Number of Pages | 297 |

| Number of Tables | 464 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Deployment, Technology, Application, Region |

| Country scope |

|

| Companies Included | NVIDIA Corporation, IBM Corporation, Infosys Limited, Intel Corporation, Microsoft Corporation, Salesforce, Inc., Google LLC (Alphabet Inc.), Cisco Systems, Inc, ZTE Corporation and AT&T, Inc |

By Component

By Deployment

By Technology

By Application

By Geography

This Market size is expected to reach $21.2 billion by 2030.

Network optimization and efficiency enhancement are driving the Market in coming years, however, Regulatory challenges and compliance complexities restraints the growth of the Market.

NVIDIA Corporation, IBM Corporation, Infosys Limited, Intel Corporation, Microsoft Corporation, Salesforce, Inc., Google LLC (Alphabet Inc.), Cisco Systems, Inc, ZTE Corporation and AT&T, Inc

The expected CAGR of this Market is 40.4% from 2023 to 2030.

The Machine Learning segment is leading the Market by Technology in 2022; there by, achieving a market value of $8.3 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $7.0 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.