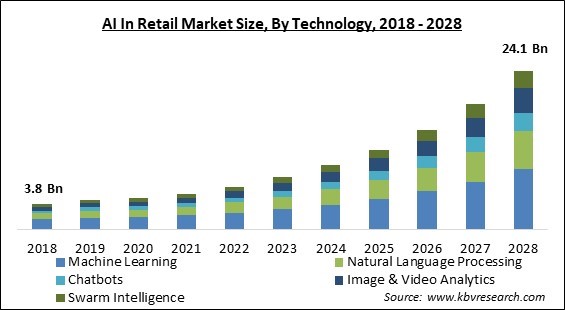

The Global AI In Retail Market size is expected to reach $24.1 billion by 2028, rising at a market growth of 24.4% CAGR during the forecast period.

Automation, data, and technology, like machine learning algorithms, are used in retail AI to give customers highly customized shopping experiences. Consumer experiences within both physical and online retailers can benefit from AI. By employing AI-driven sales and demand forecast accuracy to optimize inventory, for example, merchants may maintain agility while enabling personalization.

Physical stores are still the leader in retail, but they must operate in very competitive markets. Similar to physical stores, digital stores compete in a market where they can easily access their rivals. Retailers can utilize AI to enhance the shopping experience for customers and acquire the competitive edge they need to remain relevant.

For instance, AI-powered virtual personal assistants and chatbots on a website provide customers personalized recommendations or dynamic pricing depending on their usage of the site, past purchases, and other pertinent information. Retail AI application cases exist in actual stores as well, utilizing data sources including in-store customer interactions via mobile devices and through sensors.

Using an algorithm that has been trained with sales data and other pertinent information, retail store owners can even utilize AI to optimize the layout of their stores. This aids in forecasting outcomes, such as a person's propensity to purchase two things simultaneously if they are exhibited near to one another. The retail industry is changing as a result of artificial intelligence (AI). Retailers can use AI to engage with their consumers and run more effectively, from utilizing computer vision to tailor promotions in real time to leveraging machine learning for managing inventory.

Due to the WFH policy brought on by this pandemic, the COVID-19 outbreak is anticipated to accelerate the market growth of next-generation tech fields, including artificial intelligence. In order to increase availability across the globe, tech companies are also increasing the range of products and services they offer. Therefore, the integration of AI significantly increased within the retail industry. Hence, the growth of the market was steadily hampered, however, the increased utilization of AI augmented the growth of AI in the retail industry.

AI comprises the ability to drastically change retailing in coming years, impacting everything from cost structures to the shopping experience. E-commerce and AI go hand in hand, and the coronavirus pandemic's acceleration of e-commerce growth rates makes AI adoption even more imperative. AI advantages will transform the industry. Retailers must therefore start making plans right away. And not just technology should be included in those plans, but also business strategy.

As a whole, one of the main advantages of artificial intelligence is that it can assist people with repetitive, time-consuming jobs. A significant number of workers believe that the increased adoption of AI in the workplace has improved productivity. And when AI is used in retail, the same thing may occur. Drivers in the logistics industry can use AI to discover the best delivery routes. Additionally, robots can assist with choosing and packing orders, freeing up staff members to work on other crucial activities.

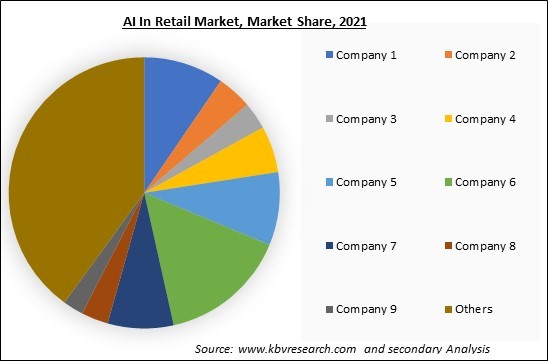

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

It is an impressive achievement when a machine can imitate human intelligence. However, the initial cost of AI is very high in such operations. It can be very expensive and takes a lot of time and resources. AI is highly expensive because it requires the newest software and hardware to function in order to stay updated and meet criteria. Artificial intelligence is a technology that cannot be created by humans since it is pre-programmed with knowledge and experience.

On the basis of Component, the AI in Retail Market is bifurcated into Solutions and Services. In 2021, the solution segment acquired the largest revenue share of The AI in retail market. The management issues facing a number of retail operations are encouraging the development of new automated technology. Retailers can manage warehouse management, supply chain operations, and logistics, and enhance the customer experience with the use of AI-powered solutions.

Based on the Technology, the AI in Retail Market is segregated into Machine Learning, Natural Language Processing, Chatbots, Image and Video Analytics, and Swarm Intelligence. In 2021, the machine learning segment procured the highest revenue share of the AI in retail market. The growth of the segment is rising due to the higher precision and flexibility of this technology. Machine learning is appropriate for providing customers with individualized experiences because it serves data quickly and deeply.

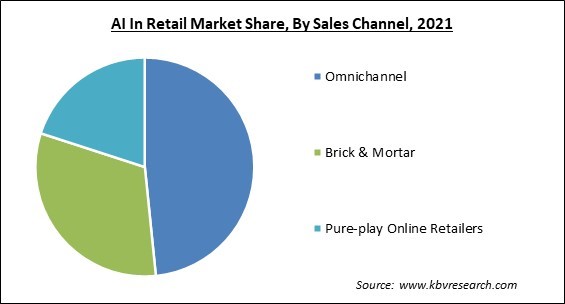

By Sales Channel, the AI in Retail Market is segmented into Omnichannel, Brick and Mortar, and Pure-play Online Retailers. In 2021, the pure-play segment acquired a significant revenue share of the AI in retail market. The growing popularity of online and virtual shopping is expected to accelerate the development of pure-play internet merchants. AI, IoT, and social media would proliferate, which would lead to an expansion of the AI in retail market.

On the basis of Application, the AI in Retail Market is classified into Customer Relationship Management (CRM), Supply Chain and Logistics, Inventory Management, Product Optimization, In-Store Navigation, Payment and Pricing Analytics, and Virtual Assistant. In 2021, the customer relationship management (CRM) segment witnessed the largest revenue share of the Ai in retail market. A strong need to improve customer service and retention would propel the CRM industry to prominence. Retail suppliers may foster consumer loyalty and solid customer connections with the help of AI-powered virtual assistance, search engines, chatbots, and other technologies.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 5.4 Billion |

| Market size forecast in 2028 | USD 24.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 24.4% from 2022 to 2028 |

| Number of Pages | 326 |

| Number of Tables | 493 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Sales Channel, Component, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the AI in Retail Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the largest revenue share of the Ai in retail market. As considerable investments are made in AI projects along with related research and development initiatives, there is potential for industrial expansion. Regional retail suppliers are also focusing on extracting the available data on consumer preferences to increase the effectiveness of their customer care. The market leaders use both organic and inorganic techniques in order to grow.

Free Valuable Insights: Global AI In Retail Market size to reach USD 24.1 Billion by 2028

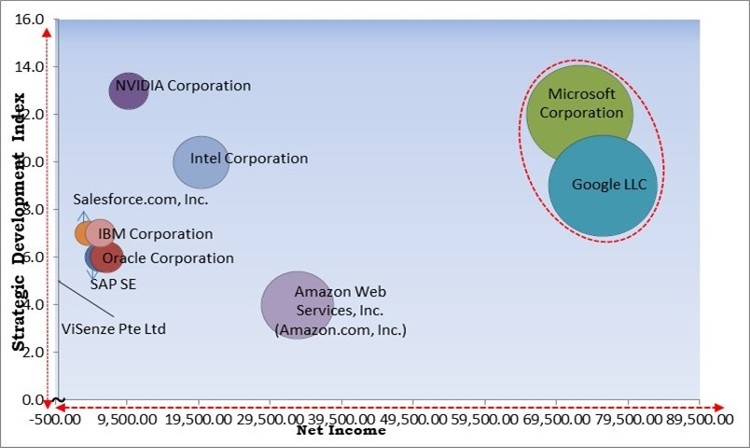

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the AI In Retail Market. Companies such as Amazon Web Services, Inc. (Amazon.com, Inc.), Intel Corporation and NVIDIA Corporation are some of the key innovators in AI In Retail Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Intel Corporation, Salesforce.com, Inc., NVIDIA Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and ViSenze Pte Ltd.

By Technology

By Sales Channel

By Component

By Application

By Geography

The global AI In Retail Market size is expected to reach $24.1 billion by 2028.

Higher Efficiency In Saving Cost And Optimizing The Experience are driving the market in coming years, however, High Costs As Well As Lack Of The Ability To Improve restraints the growth of the market.

Intel Corporation, Salesforce.com, Inc., NVIDIA Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and ViSenze Pte Ltd.

The expected CAGR of the AI In Retail Market is 24.4% from 2022 to 2028.

The Omnichannel segment acquired maximum revenue share in the Global AI In Retail Market by Sales Channel in 2021 thereby, achieving a market value of $11.2 billion by 2028.

The North America market dominated the Global AI In Retail Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $8.9 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.