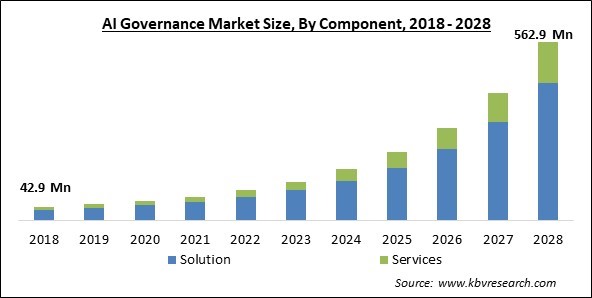

The Global AI Governance Market size is expected to reach $562.9 Million by 2028, rising at a market growth of 34.5% CAGR during the forecast period.

Artificial intelligence (AI) technology has practical uses in modern life. When AI technology is accepted and utilized well, it may benefit economies and society. However, concerns concerning public safety and security have been raised by the growing usage of AI across a range of sectors, including transportation, healthcare, education, and others, necessitating the need for AI governance. Therefore, a legislative framework should exist to ensure that Machine Learning (ML) technologies are correctly examined and systematically developed to support humanity's fair acceptance of AI technology, according to the philosophy underlying AI governance.

In the context of AI (Artificial Intelligence) governance, bias, ROI (return on investment) risk, and algorithm efficacy are assessed and tracked. AI governance's primary goal is to bridge the ethical responsibility and technical progress gaps. The expansion of the AI governance business is driven mainly by the increase in government initiatives to employ Al technology, rapid and simple access to historical datasets, and the convenience of data storage.

Therefore, a legislative framework should exist to ensure that Machine Learning (ML) technologies are adequately examined and systematically developed to support humanity's fair acceptance of AI technology, according to the philosophy underlying AI governance. AI (Artificial Intelligence) governance includes evaluation and monitoring of algorithm performance, ROI risk, and bias. AI governance's primary goal is to bridge the ethical responsibility and technical progress gaps.

The workforce will need a high level of trust in AI governance to close gaps and boost their confidence in automated systems while making routine, life-altering choices. Because of AI's rising advantages, organizations and governments from all over the globe are adopting a range of steps to embrace AI and machine learning technology and position themselves as market leaders. Councils, new norms and legislation, and AI governance solutions are now being developed by governments all around the globe. As a result, a better degree of adherence to technology regulation is anticipated to give profitable chances for the AI governance market projection. AI may also drastically eliminate gender-based discrimination.

Chief risk officers and their teams have had to reevaluate outdated methods and assumptions used to manage and monitor risk due to the present pandemic crisis. The worldwide impact of COVID-19 has shown the significance of interconnection in international collaboration and the challenges posed by antiquated technology for efficient governance. Consequently, many governments have been hurrying to find, assess, and buy trustworthy AI-powered solutions. In addition, the necessity to operationalize ethical AI concepts has increased as a result of COVID-19. Taking all of this into account, the pandemic would have significantly helped the market for AI governance.

An important aspect influencing AI advancement is the accessibility of previous datasets. Healthcare facilities and governmental organizations are creating unstructured data that is available to the research community now that data storage and recovery are more economical. As a result, researchers now have access to enormous databases covering anything from historical rainfall patterns to clinical imaging. By granting access to massive datasets, next-generation computer architectures let academics and information scientists develop more swiftly. These elements have fueled the market for AI governance.

Due to the growing advantages of Al, organizations, and governments throughout the globe are starting initiatives to embrace Al and ML technologies and position themselves as market leaders. Government entities from several countries establish councils, new laws and regulations, and frameworks to adopt Al governance solutions. Increasing public trust in Al technology and protecting civil liberties and private information are the key objectives of governments deploying Al governance solutions. In addition, to identify risk problems for Al technology, several companies have formed committees in collaboration with providers of Al solutions, academic institutions, and research centers.

Over the past few years, numerous principles and guidelines have been established by various governmental agencies, professional organizations, regulatory systems, and AI companies. These guidelines serve as a foundation for developing robust AI regulations and aid in identifying the most important ethical concerns that need to be addressed. However, there are no all-inclusive rules, even if some ideas have been widely accepted. For instance, if laws are created to safeguard one significant value protected by principles, another value may suffer, which might be detrimental to social ethics. Establishing comprehensive ethical standards for AI that consider all ethical principles might thus be a constraining factor for the state of AI governance solutions today.

Based on the component, the AI governance market is divided into solution and service categories. The solution segment dominated the AI governance market share with maximum revenue share in 2021. Many elements, including growing dependency, user desire for AI-based solutions, and others, bring this on. The platform and software tools that would provide end-to-end AI governance solutions to AI developers, business users, data scientists, and IT architects in several sectors are referred to as the AI governance solution. These facilitate the creation, management, and use of AI solutions and enable enterprises to use a variety of AI and associated skills.

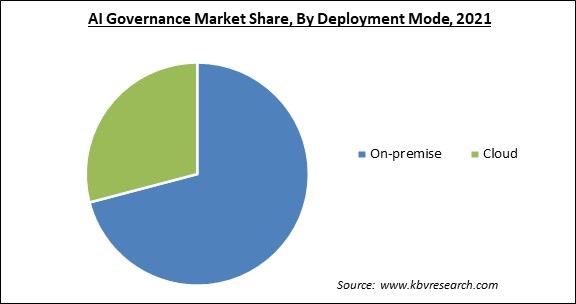

Based on the deployment mode, the AI governance market is divided into on-premise and cloud. In 2021, the cloud segment recorded a remarkable revenue share in the AI governance market. This is because AI services delivered through the cloud are the perfect option for many businesses. To access computation, they don't need to create a vast data center; instead, they may leverage the already established infrastructure. In reality, the availability of several plug-and-play AI cloud services from cloud providers, as well as access to sufficient computational capacity and pre-trained models to start AI applications, is one reason AI has grown so prevalent.

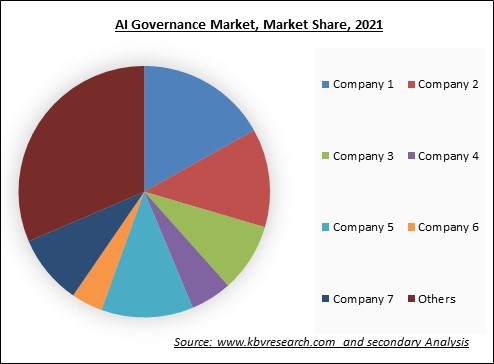

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on the Organization size, the AI governance market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprise segment projected the maximum revenue share in the AI governance market in 2021. As businesses want to ensure that their AI systems safeguard sensitive data, the emphasis on data privacy and security is growing. Furthermore, implementing AI governance to decrease risk is anticipated to increase as big organizations are increasingly vulnerable to cyberattacks and other security challenges. This would encourage market development in this niche.

Based on industry vertical, the AI governance market is divided into the BFSI, government & defense, healthcare & life sciences, media & entertainment, retail, IT & telecom, automotive, and others. The retail segment covered a considerable revenue share in the AI governance market in 2021. The retail industry is going through a substantial shift. Customers' channel choices and purchasing behaviors alter as they grow more digitally literate. Concerns concerning data have arisen as a result of the transition to digital. Proper AI governance is essential to improve overall retail performance, address common issues, and maintain an edge against more potent retail rivals and agile direct-to-consumer businesses.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 75.1 Million |

| Market size forecast in 2028 | USD 562.9 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 34.5% from 2022 to 2028 |

| Number of Pages | 280 |

| Number of Table | 463 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Operation, Railway Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the geography, the AI governance market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the AI governance market by generating maximum revenue share in 2021. This is due to the US having a significant industrial base, government programs to support research, and considerable purchasing power supporting the expansion of the AI governance market. Additionally, several significant AI governance solution vendors are launching new services & solutions.

Free Valuable Insights: Global AI Governance Market size to reach USD 562.9 Million by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, Google LLC (Alphabet Inc.), IBM Corporation, SAP SE, Amazon Web Services, Inc. (Amazon.com, Inc.), Salesforce.com, Inc., Meta Platforms, Inc., SAS Institute, Inc., Tibco Software, Inc. (Vista Equity Partners), and QlikTech International AB.

By Component

By Vertical

By Organization size

By Deployment Mode

By Geography

The global AI Governance Market size is expected to reach $562.9 Million by 2028.

Growing government usage of the Al technology are driving the market in coming years, however, Establishing comprehensive ai ethical standard restraints the growth of the market.

Microsoft Corporation, Google LLC (Alphabet Inc.), IBM Corporation, SAP SE, Amazon Web Services, Inc. (Amazon.com, Inc.), Salesforce.com, Inc., Meta Platforms, Inc., SAS Institute, Inc., Tibco Software, Inc. (Vista Equity Partners), and QlikTech International AB.

The BFSI segment acquired maximum revenue share in the Global AI Governance Market by Vertical in 2021 thereby, achieving a market value of $147.1 Million by 2028.

The On-premise segment is leading the Global AI Governance Market by Deployment Mode in 2021 thereby, achieving a market value of $375.2 Million by 2028.

The North America market dominated the Global AI Governance Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $205.2 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.